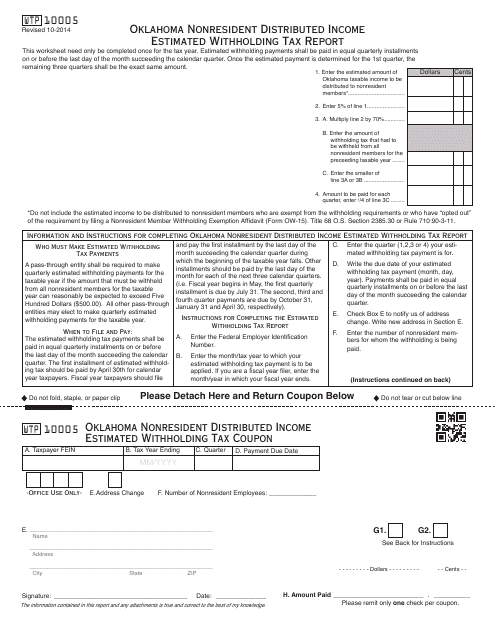

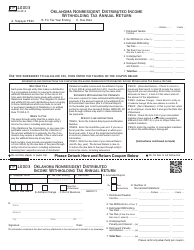

Form WTP10005 Oklahoma Nonresident Distributed Income Estimated Withholding Tax Report - Oklahoma

What Is Form WTP10005?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WTP10005?

A: Form WTP10005 is the Oklahoma Nonresident Distributed Income Estimated Withholding Tax Report.

Q: Who needs to file Form WTP10005?

A: Nonresident individuals who receive distributed income from Oklahoma sources and have Oklahoma withholding tax obligations need to file Form WTP10005.

Q: What is considered distributed income?

A: Distributed income includes income from pass-through entities, such as partnerships, S corporations, and trusts.

Q: What is the purpose of Form WTP10005?

A: The purpose of Form WTP10005 is to report estimated withholding tax payments on distributed income to the Oklahoma Tax Commission.

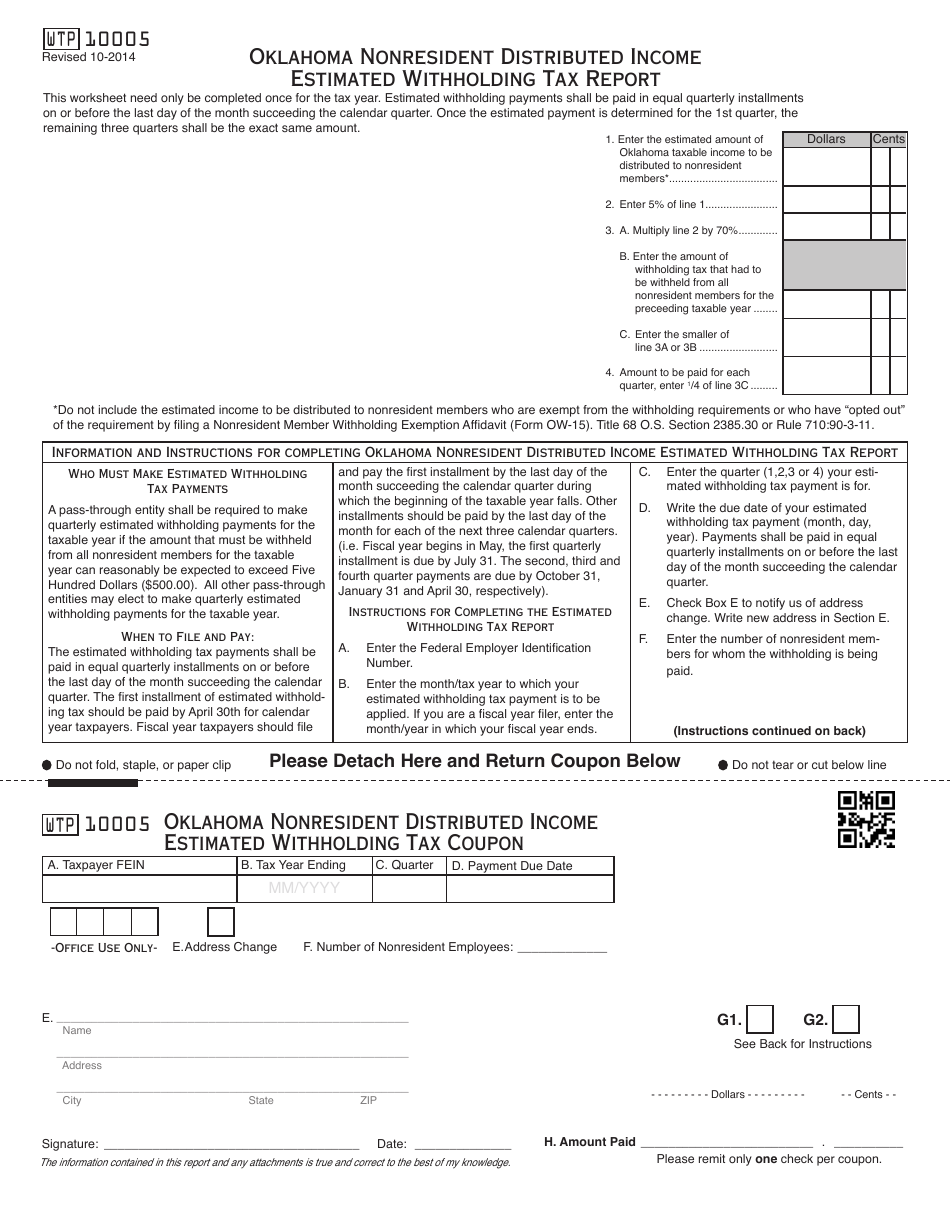

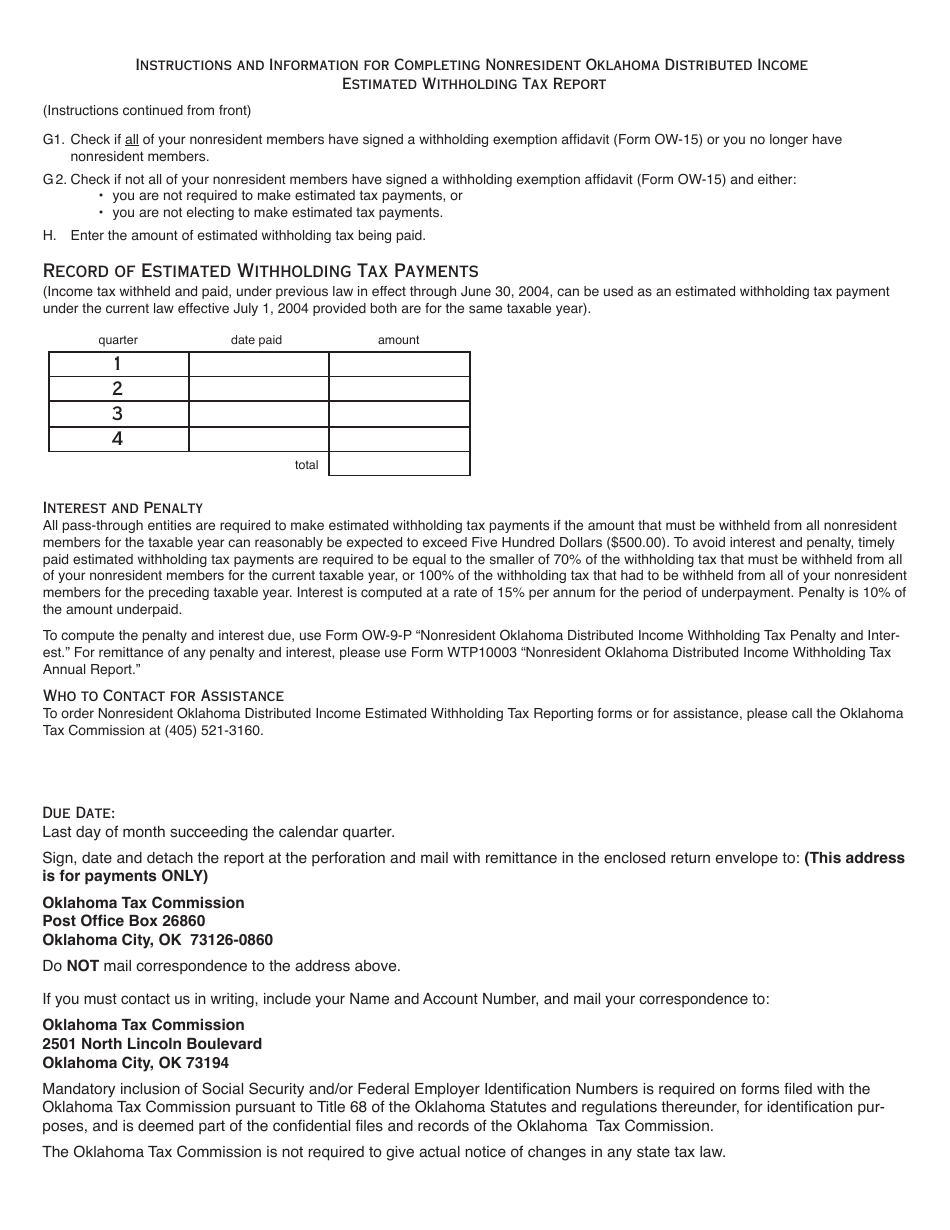

Q: How often should Form WTP10005 be filed?

A: Form WTP10005 should be filed quarterly, with the due dates being April 15, July 15, October 15, and January 15.

Q: Is Form WTP10005 the only tax form that needs to be filed for nonresident distributed income in Oklahoma?

A: No, individuals may also need to file other Oklahoma tax forms, such as Form 511NR or Form 512NR, depending on their specific circumstances.

Q: What happens if I fail to file Form WTP10005?

A: Failure to file Form WTP10005 or pay the required estimated withholding tax may result in penalties and interest charges.

Q: Is Form WTP10005 specific to nonresidents of Oklahoma?

A: Yes, Form WTP10005 is specifically for nonresidents who receive distributed income from Oklahoma sources.

Form Details:

- Released on October 1, 2014;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form WTP10005 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.