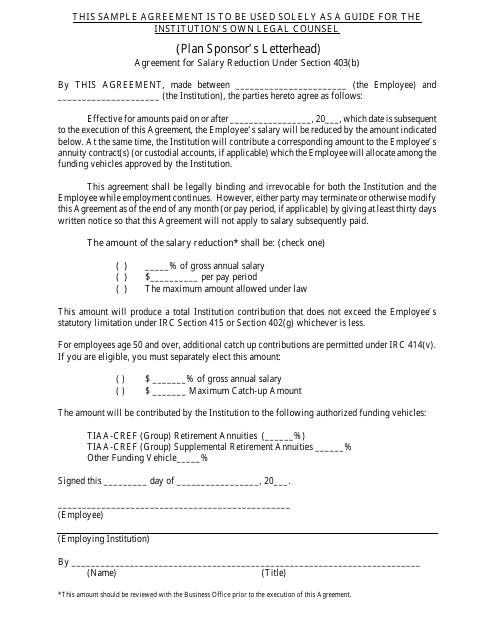

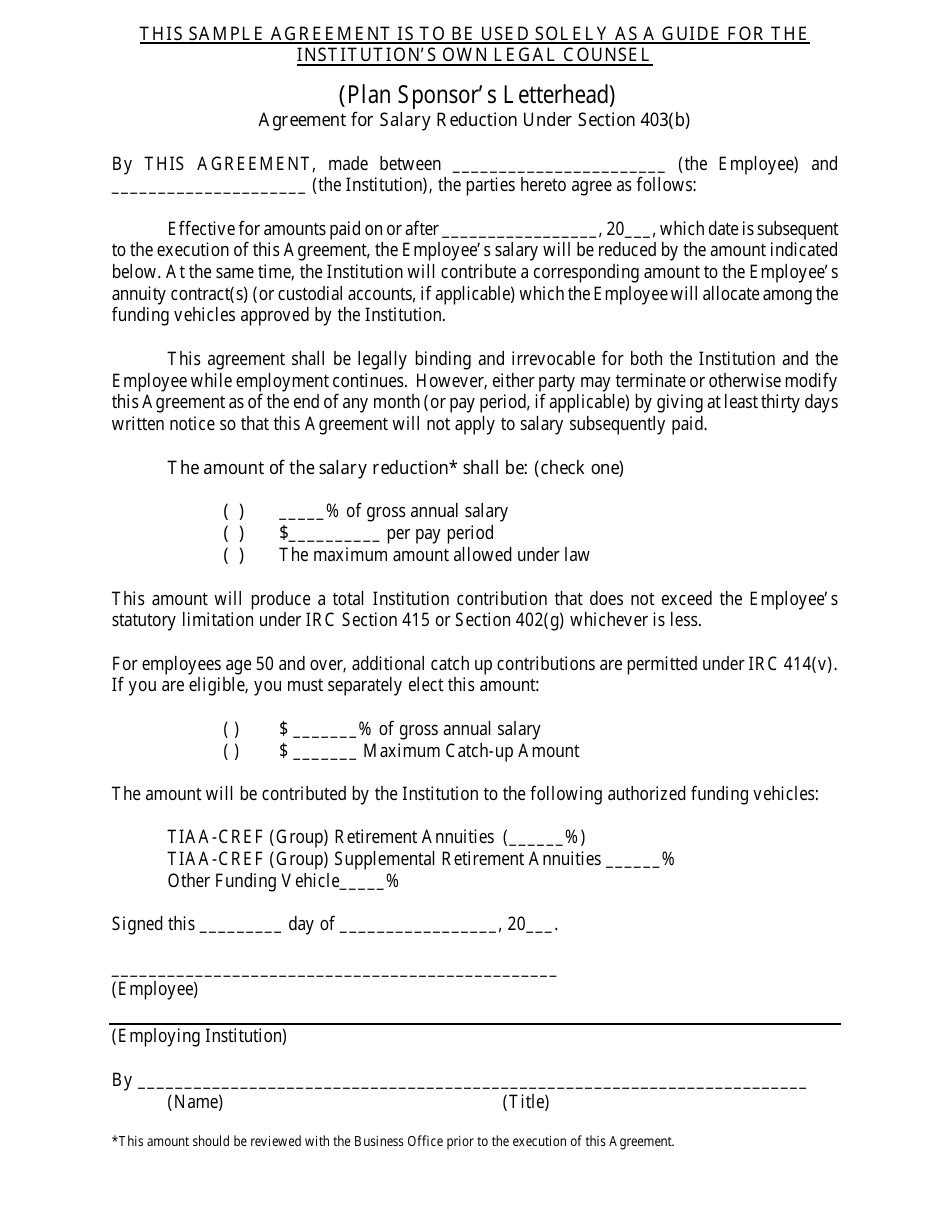

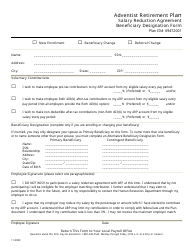

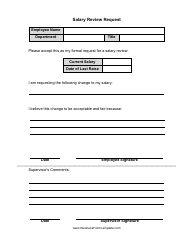

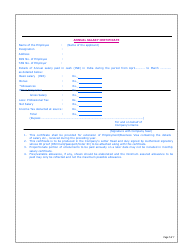

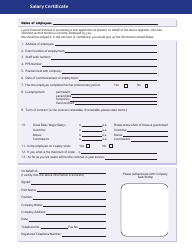

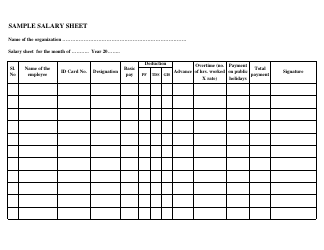

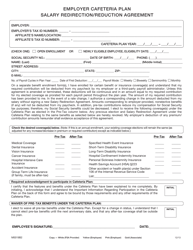

Agreement for Salary Reduction Under Section 403(B) - Tiaa-Cref - Sample

The Agreement for Salary Reduction Under Section 403(b) - TIAA-CREF - Sample is a document used for employees who wish to reduce their salary contribution to their retirement plan, specifically a 403(b) plan, offered by TIAA-CREF.

The employee typically files the agreement for salary reduction under Section 403(b) with TIAA-CREF.

FAQ

Q: What is the Agreement for Salary Reduction Under Section 403(B)?

A: The Agreement for Salary Reduction Under Section 403(B) is a document that allows employees to voluntarily reduce their salary in order to contribute to a retirement plan.

Q: What is a Section 403(B) retirement plan?

A: A Section 403(B) retirement plan is a tax-advantaged retirement savings plan available to employees of certain nonprofit organizations, public schools, and other tax-exempt organizations.

Q: Who is TIAA-CREF?

A: TIAA-CREF is a financial services organization that provides retirement and investment products and services to individuals and institutions.

Q: What does it mean to voluntarily reduce salary?

A: Voluntarily reducing salary means that an employee chooses to have a portion of their salary withheld and contributed to a retirement plan instead of receiving it as cash.

Q: Why would someone choose to reduce their salary?

A: Someone may choose to reduce their salary in order to save for retirement and take advantage of the tax benefits offered by a 403(B) plan.

Q: Are there any tax advantages to contributing to a 403(B) plan?

A: Yes, contributions to a 403(B) plan are typically made on a pre-tax basis, meaning that they are not subject to federal income tax until withdrawn in retirement.

Q: What should I consider before entering into an Agreement for Salary Reduction Under Section 403(B)?

A: You should consider your budget and financial goals before deciding to reduce your salary. It's also important to understand the terms and conditions of the agreement, including any restrictions or penalties for early withdrawal.

Q: Can I change or stop my salary reduction contributions?

A: Yes, you can typically change or stop your salary reduction contributions by submitting a new agreement or form to your employer.

Q: What happens to the money in a 403(B) plan if I change jobs?

A: You generally have several options, including leaving the money in your current 403(B) plan, rolling it into a new employer's retirement plan, rolling it into an Individual Retirement Account (IRA), or cashing it out (which may incur taxes and penalties).

Q: Is a 403(B) retirement plan the same as a 401(K) retirement plan?

A: No, a 403(B) retirement plan is specifically for employees of certain nonprofit organizations, public schools, and tax-exempt organizations, while a 401(K) retirement plan is for employees of private sector employers.