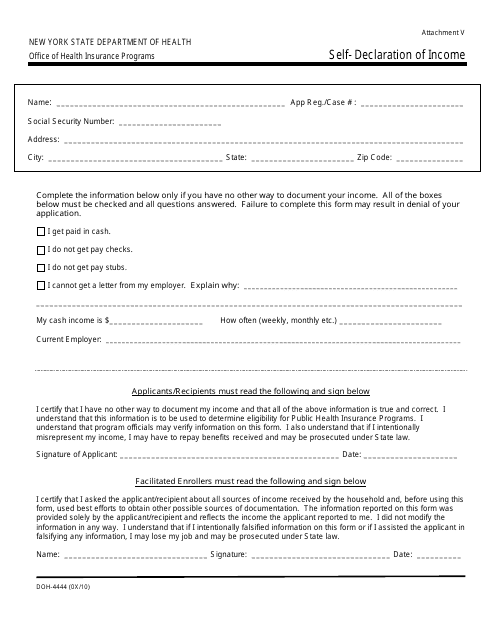

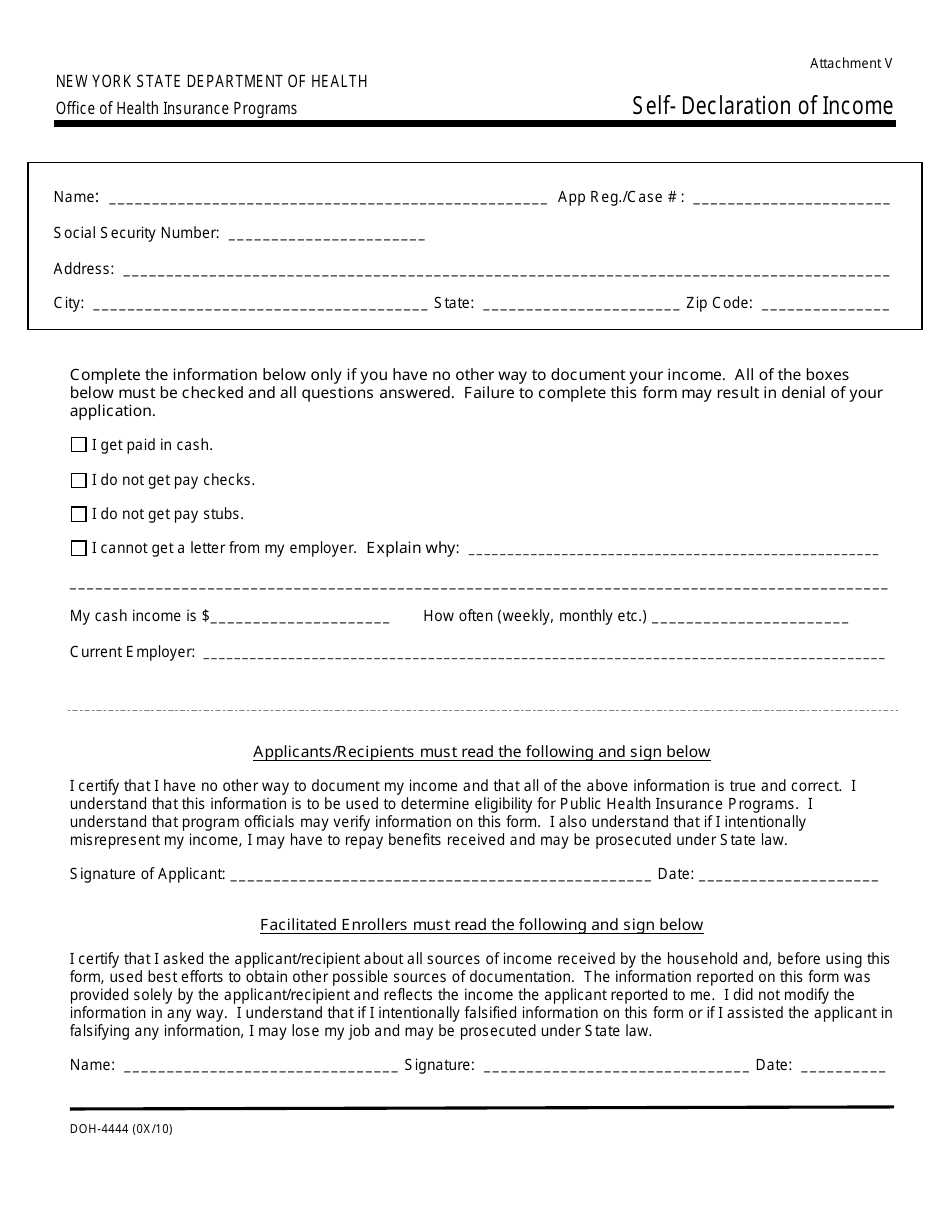

Form DOH-4444 Self-declaration of Income - New York

What Is DOH Form 4444?

Form DOH-4444, Self-Declaration of Income , is one of the documents you need to fill out when applying for Public Health Insurance Programs. Since your enrollment in these programs and further coverage depends on your age, financial circumstances, family situation, and living arrangements, you will be asked to provide personal information with the insurance claim. The enrollment cannot be completed until you have submitted all the items required by the authorities. You will have to submit proof of date of birth and residence and proof of current income.

Alternate Name:

- DOH Self-Declaration of Income Letter.

When it comes to proving income, traditionally, a person files a letter, written statement, or copy of stubs or check from the employer, agency, or another individual who provides income. It is also possible to submit a copy of the current income tax return. You may receive income from rent, military pay, or child support. However, if you cannot provide these documents, you are allowed to use Form DOH-4444.

Form DOH-4444 was released by the New York State Department of Health (DOH) . The latest version of the form was issued on January 1, 2010 , with all previous editions obsolete. You can download a fillable version of the DOH Self-Declaration of Income Form through the link below.

DOH Self-Declaration of Income Instructions

Provide the following details in the DOH Self-Declaration of Income Letter:

- State your full name and mailing address. Indicate the number of your registration application or case.

- Document your income. Check all the boxes and answer all questions. Confirm that you get paid in cash, you do not get paychecks or pay stubs, and you cannot get a letter from your employer. You are required to explain the reason for the absence of the letter. Indicate your cash income, its frequency (whether you are paid weekly, monthly, etc.), and provide the employer information - the name and address.

- Certify you do not have any other way to document your income and all the statements in the form are true and correct. You must understand that the information you provided might be verified by officials who will determine your eligibility for various Public Health Insurance Programs. If you intentionally misrepresented your income, you will have to repay the benefits received and may be prosecuted under state law. Sign and date the form.

Once you fill out the form, you must give it to the facilitated enroller - the DOH employee who assists applicants in the completion of the form and collection of other necessary items, as well as submitting the documentation and enrollment form to the local district. The facilitated enroller will review the DOH Self-Declaration of Income Form to make sure you have added all the required information - for instance, you might be asked to obtain other possible sources of documentation. After that, the enroller will sign and date the form.