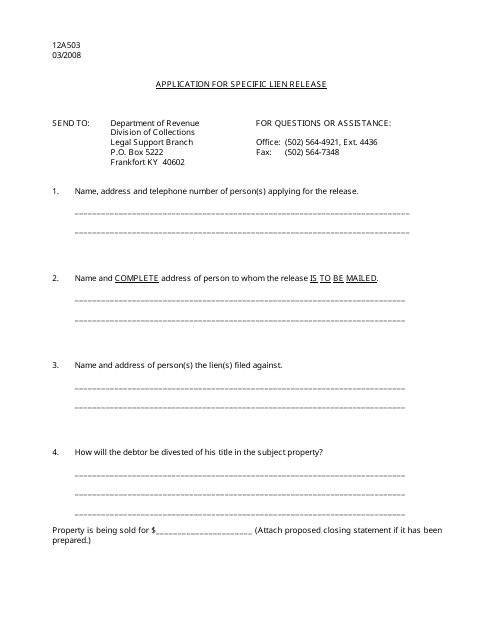

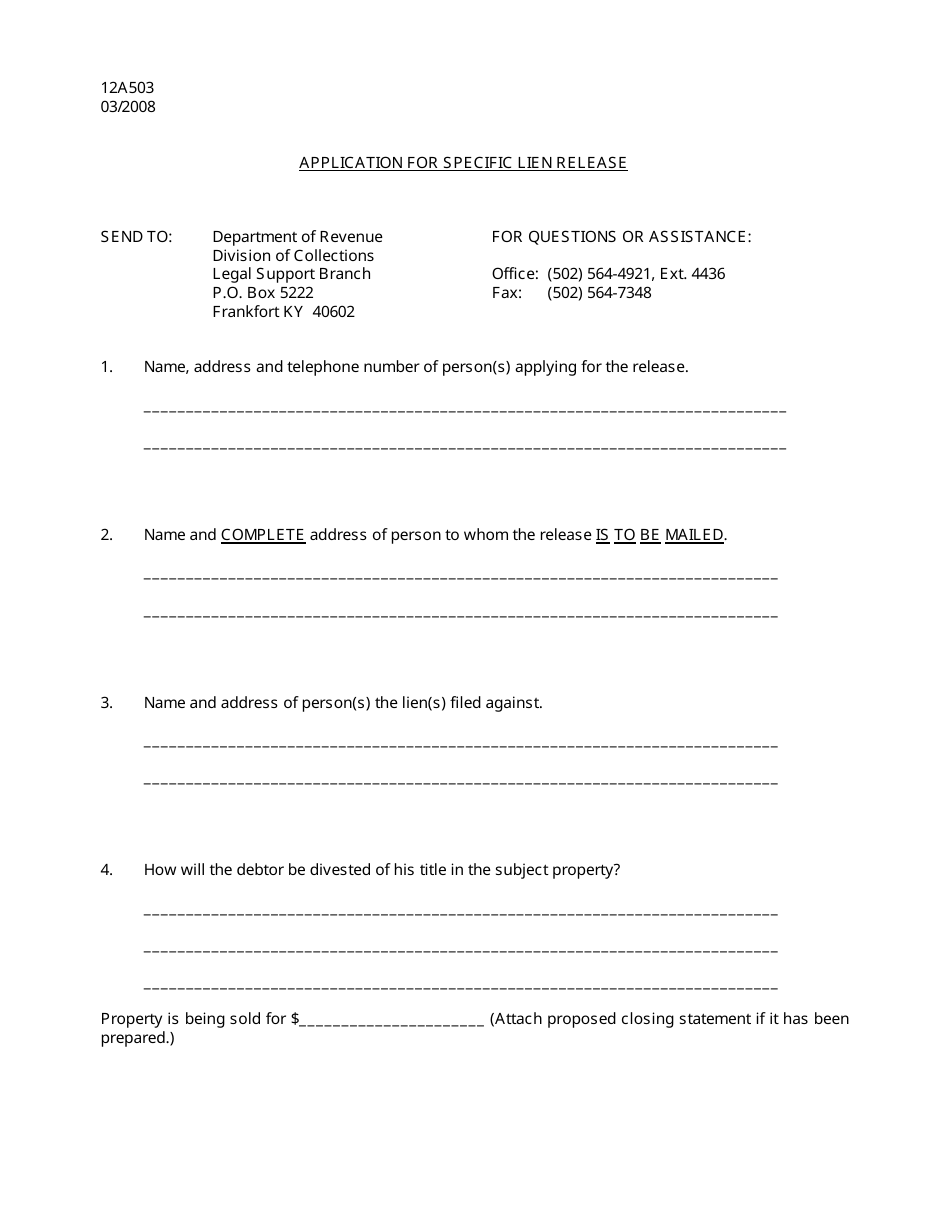

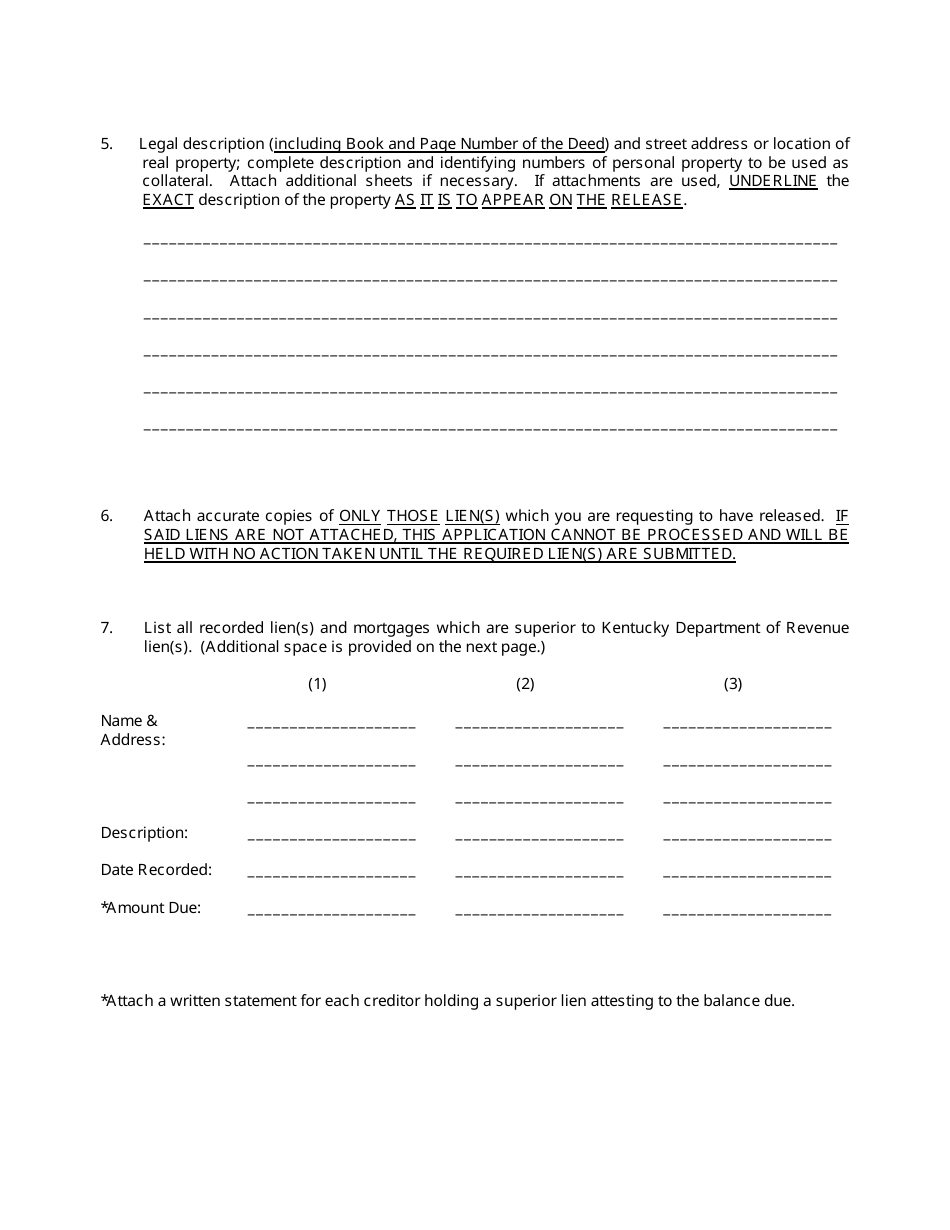

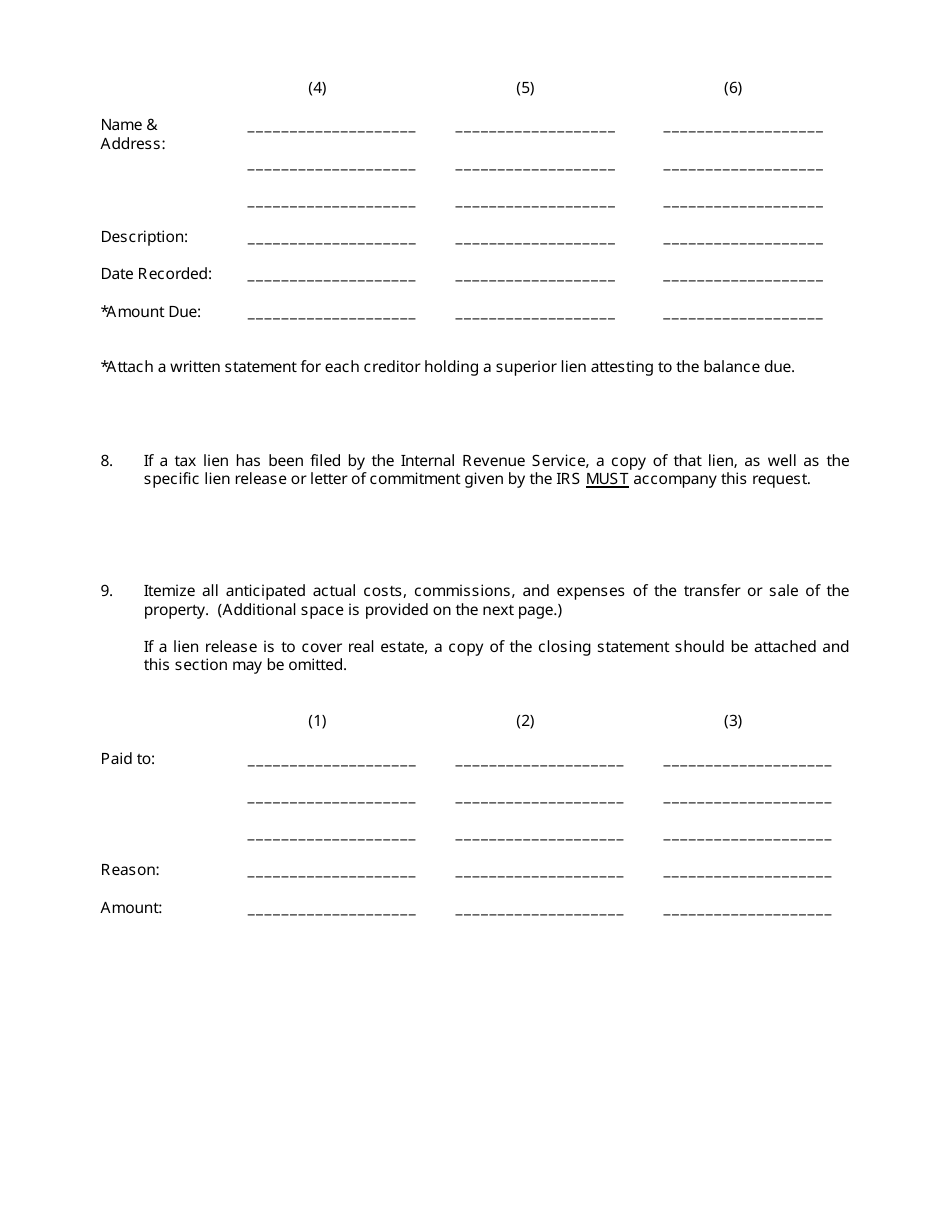

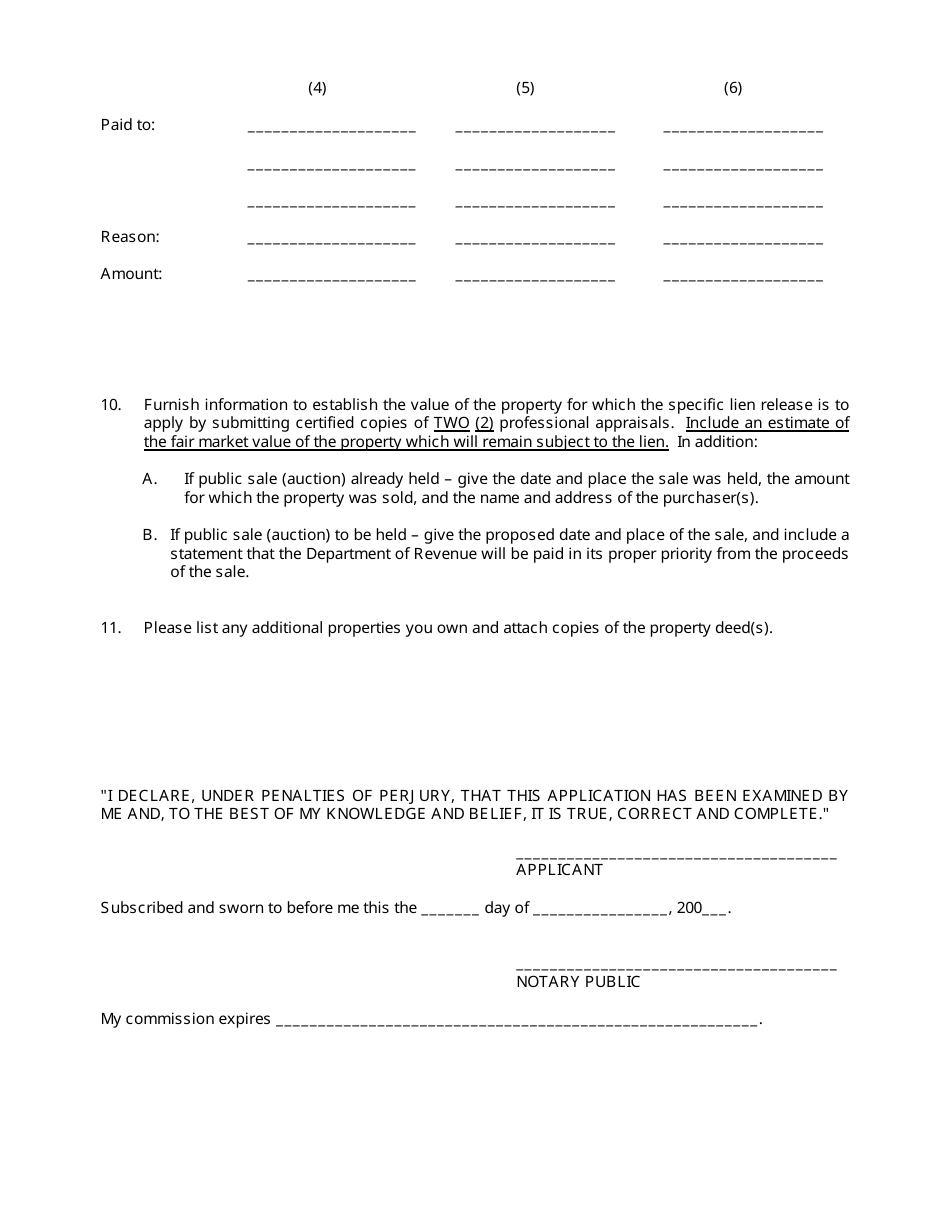

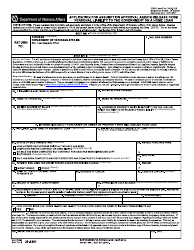

Form 12A503 Application for Specific Lien Release - Kentucky

What Is Form 12A503?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 12A503?

A: Form 12A503 is an application for specific lien release in Kentucky.

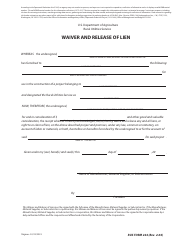

Q: What is a specific lien release?

A: A specific lien release is a legal document that releases a particular lien on property.

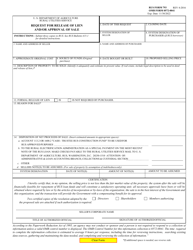

Q: How do I use Form 12A503?

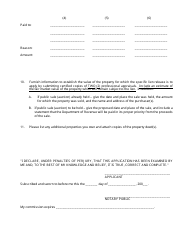

A: To use Form 12A503, you need to provide the necessary information about the lien and the property, and submit the form to the appropriate authority.

Q: What happens after I submit Form 12A503?

A: After you submit Form 12A503, the authority will review the application and determine whether to grant the specific lien release.

Q: How long does it take to process Form 12A503?

A: The processing time for Form 12A503 may vary. You should check with the authority for an estimate of the processing time.

Q: What should I do if my application for specific lien release is denied?

A: If your application is denied, you may have the option to appeal the decision or take other legal actions. It is recommended to consult with a legal professional.

Q: Is Form 12A503 applicable only in Kentucky?

A: Yes, Form 12A503 is specific to lien releases in Kentucky.

Form Details:

- Released on March 1, 2008;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 12A503 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.