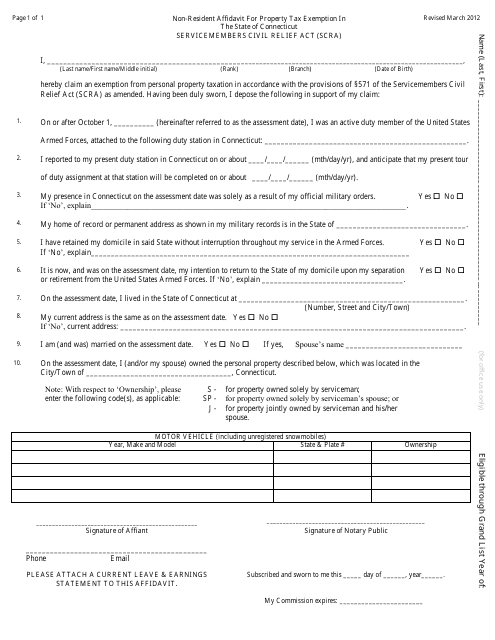

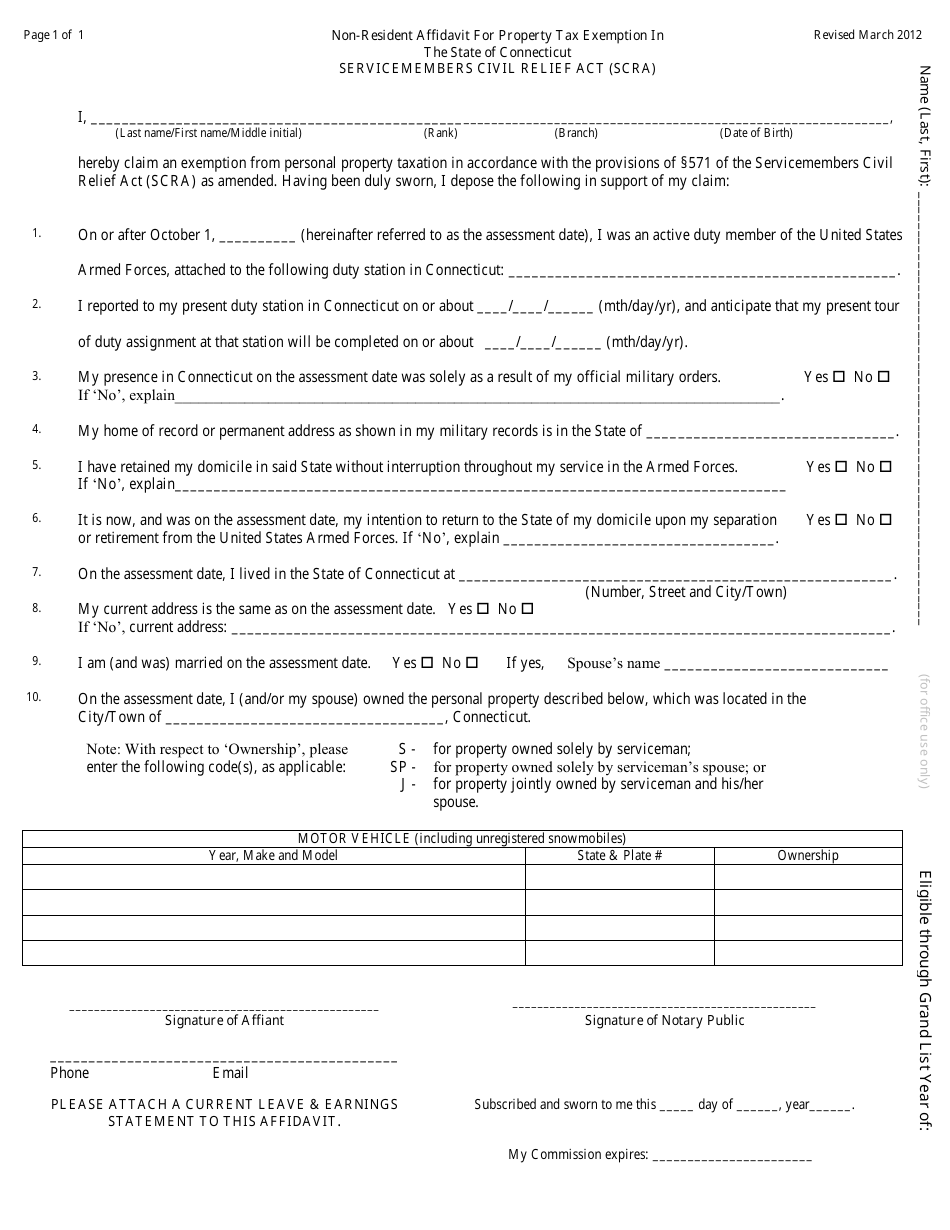

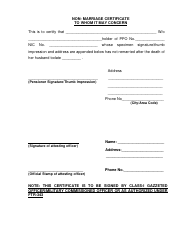

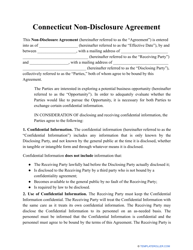

Non-resident Affidavit Template for Property Tax Exemption in the State of Connecticut - Service Members Civil Relief Act (Scra) - Connecticut

Non-resident Affidavit Template for Property Tax Exemption in the State of Connecticut - Civil Relief Act (Scra) is a legal document that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut.

FAQ

Q: What is a non-resident affidavit?

A: A non-resident affidavit is a document used to request property tax exemption in the State of Connecticut for service members under the Service Members Civil Relief Act (SCRA).

Q: Who is eligible to use the non-resident affidavit for property tax exemption in Connecticut?

A: Service members who are residents of another state but are stationed in Connecticut are eligible to use the non-resident affidavit for property tax exemption.

Q: What is the Service Members Civil Relief Act (SCRA)?

A: The Service Members Civil Relief Act (SCRA) is a federal law that provides certain protections and benefits to active duty service members.

Q: How does the non-resident affidavit help service members in Connecticut?

A: The non-resident affidavit allows eligible service members to request property tax exemption in Connecticut, reducing their tax liability.

Form Details:

- Released on March 1, 2012;

- The latest edition currently provided by the Connecticut Department of Revenue Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.