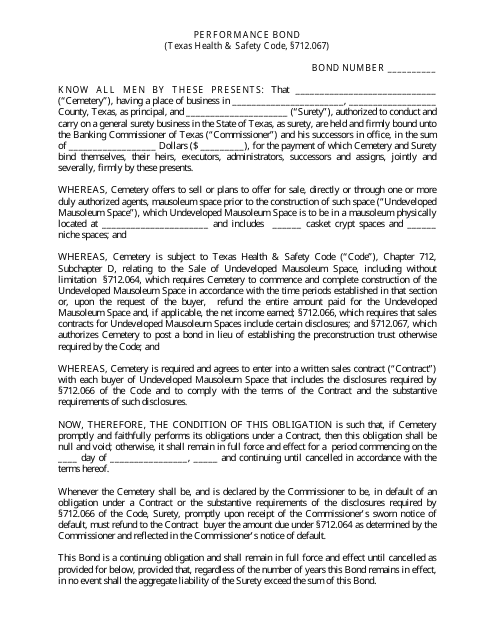

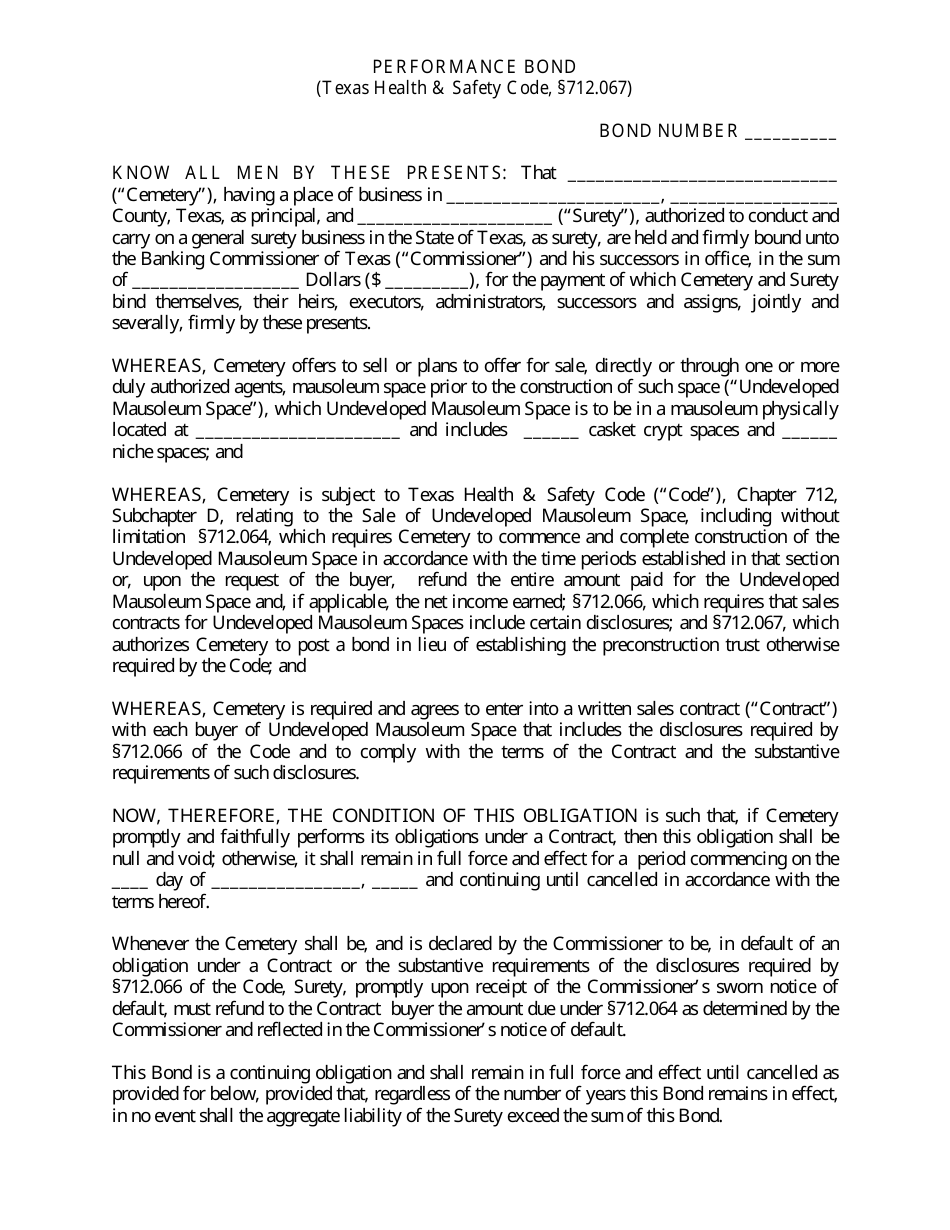

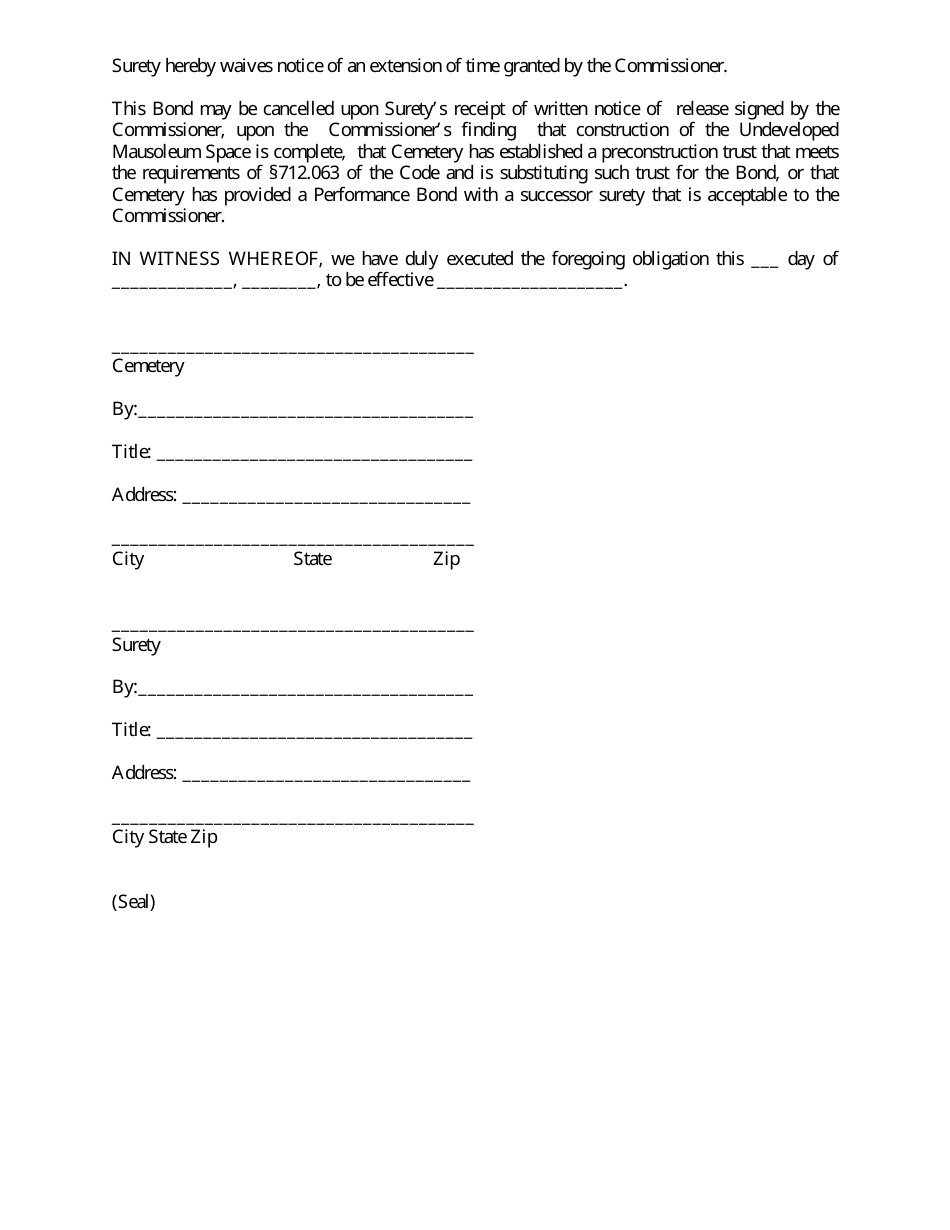

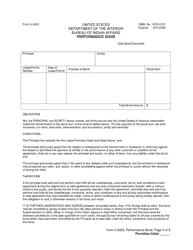

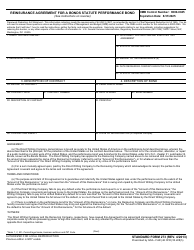

Performance Bond - Texas

Performance Bond is a legal document that was released by the Texas Department of Banking - a government authority operating within Texas.

FAQ

Q: What is a performance bond?

A: A performance bond is a type of surety bond that guarantees the completion of a project or contract according to its terms.

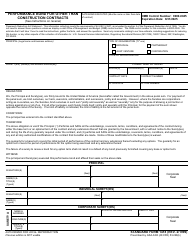

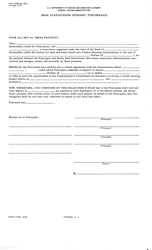

Q: Who is involved in a performance bond in Texas?

A: The parties involved in a performance bond in Texas typically include the principal (contractor or project owner), the obligee (project owner or the party requiring the bond), and the surety company.

Q: Why is a performance bond required in Texas?

A: A performance bond is required in Texas to protect the project owner or obligee from financial loss in case the contractor fails to fulfill their obligations under the contract.

Q: How does a performance bond work in Texas?

A: If the contractor fails to perform their duties according to the contract, the project owner or obligee can make a claim on the performance bond. The surety company will then compensate the obligee up to the bond amount.

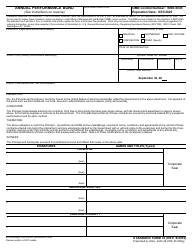

Q: How much does a performance bond cost in Texas?

A: The cost of a performance bond in Texas depends on various factors, including the bond amount, the contractor's qualifications, project scope, and the surety company's evaluation of the contractor's risk.

Q: Are there alternatives to a performance bond in Texas?

A: Yes, there are alternatives to a performance bond in Texas, such as letters of credit or cash retentions, but they may not provide the same level of protection as a performance bond.

Q: Can a performance bond be cancelled in Texas?

A: A performance bond can be cancelled in Texas if both parties agree to the cancellation or if the contract is completed successfully. However, cancellation may require the consent of the obligee and the surety company.

Q: What happens if a performance bond is not obtained in Texas?

A: If a performance bond is not obtained in Texas when required, the project owner or obligee may be at risk of financial loss if the contractor fails to complete the project or fulfill their contractual obligations.

Form Details:

- The latest edition currently provided by the Texas Department of Banking;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Texas Department of Banking.