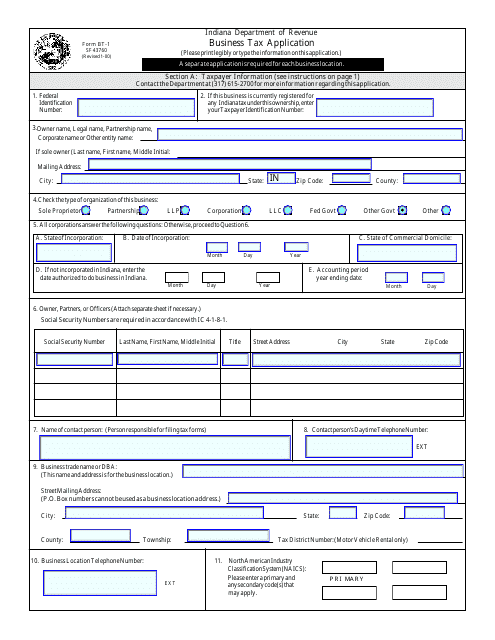

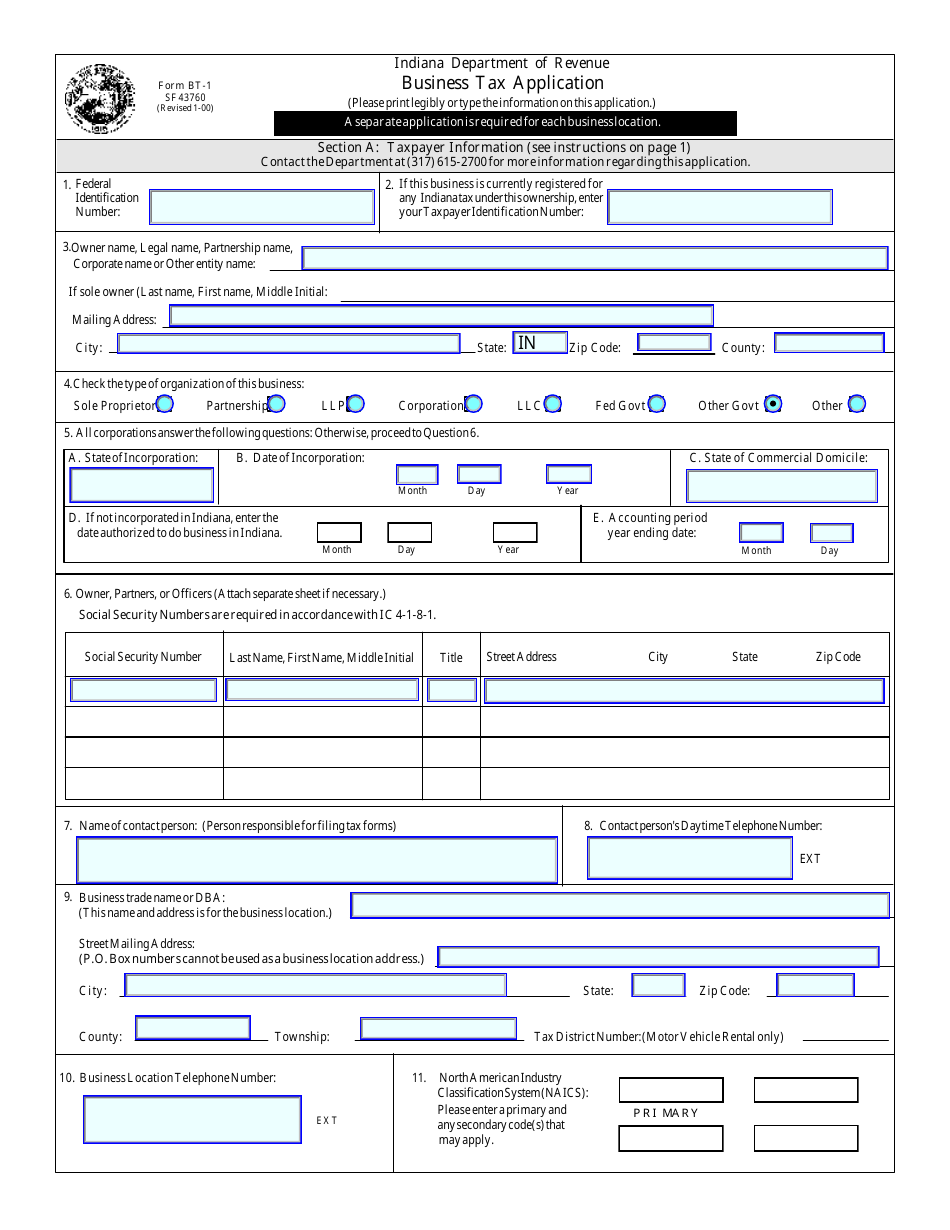

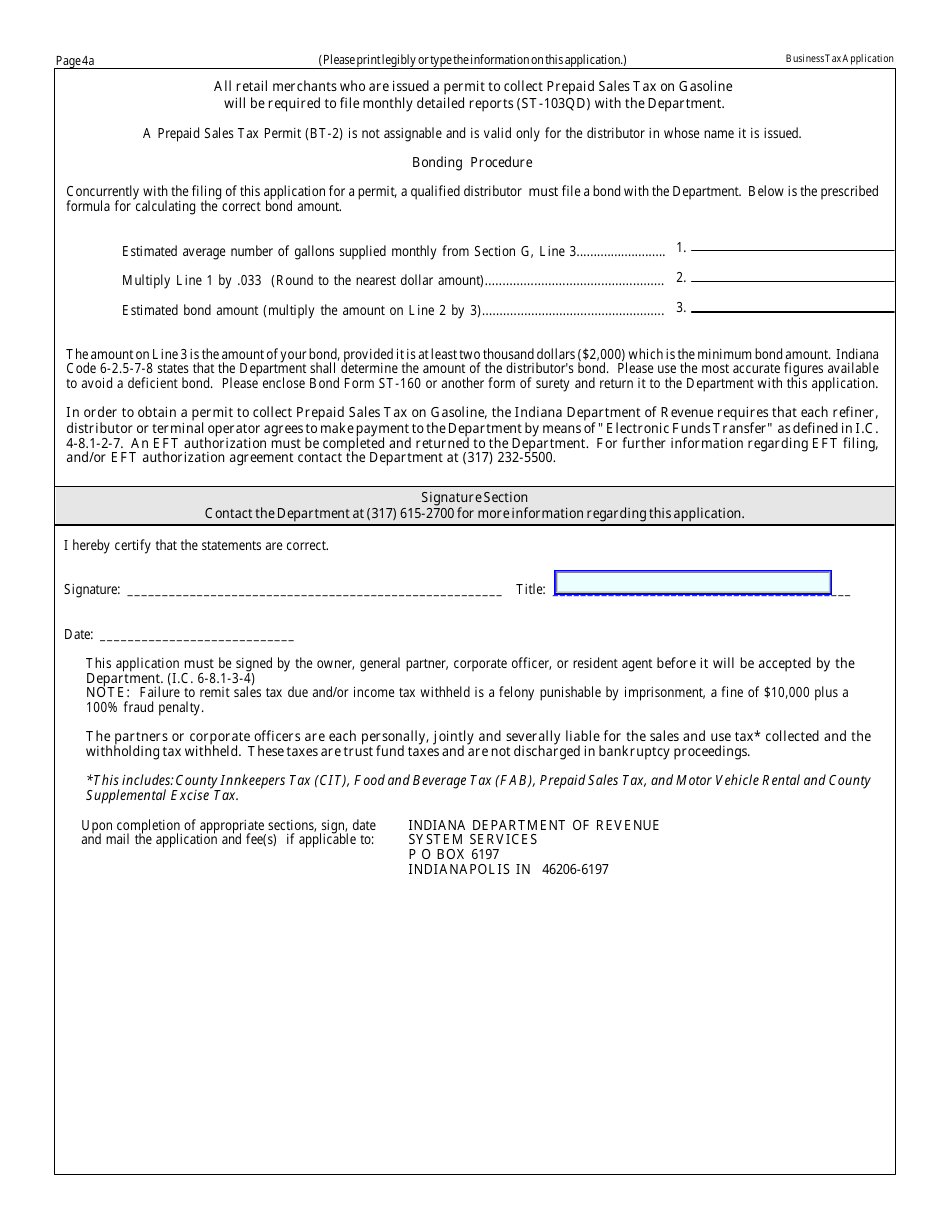

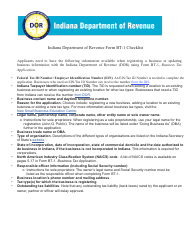

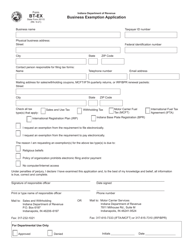

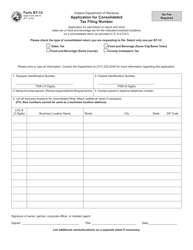

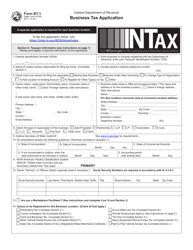

Form BT-1 Business Tax Application - Indiana

What Is Form BT-1?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BT-1?

A: Form BT-1 is the Business Tax Application form for Indiana.

Q: Who needs to file Form BT-1?

A: Any new business operating in Indiana needs to file Form BT-1.

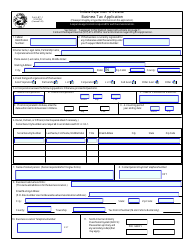

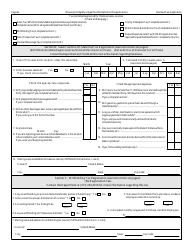

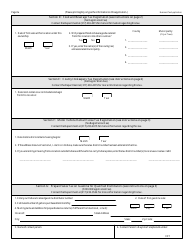

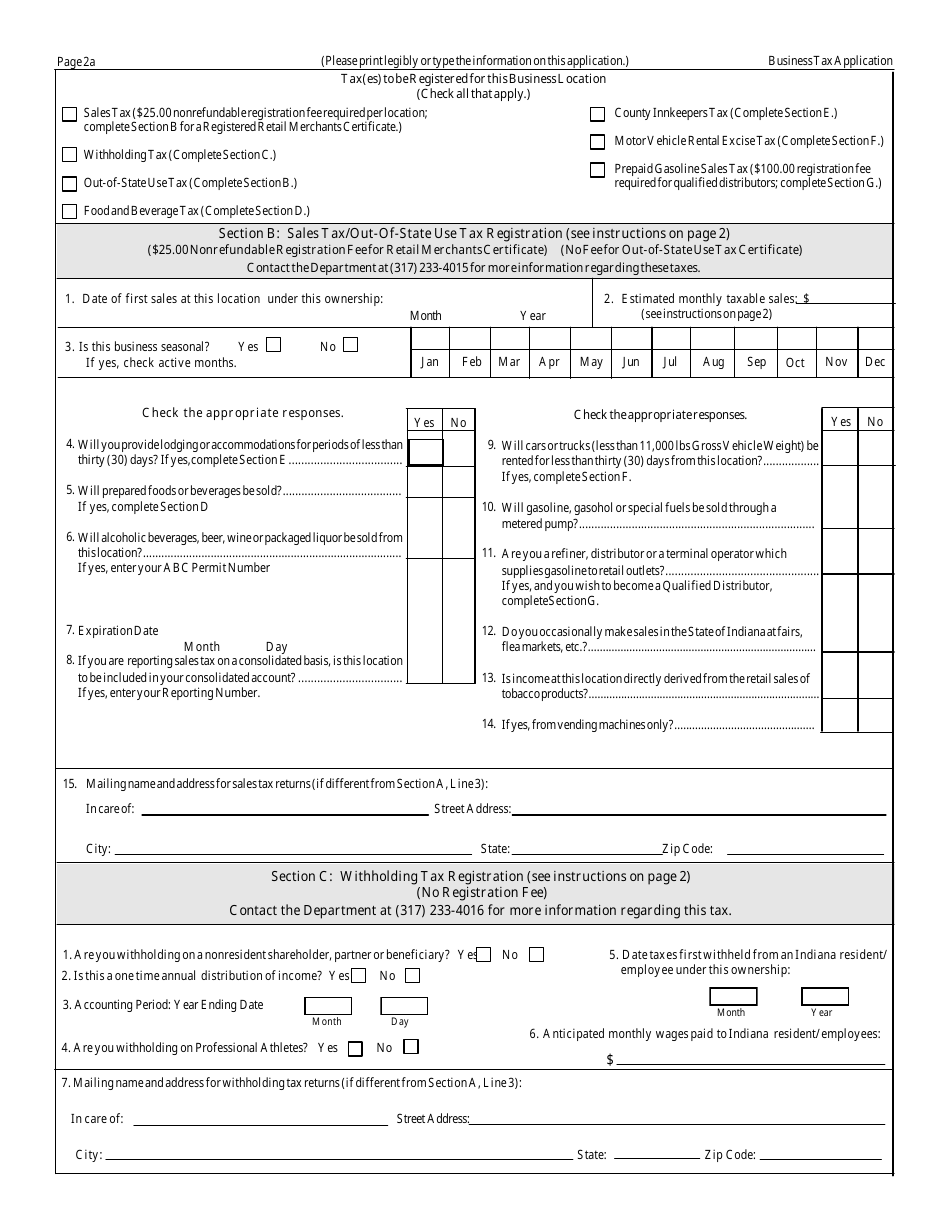

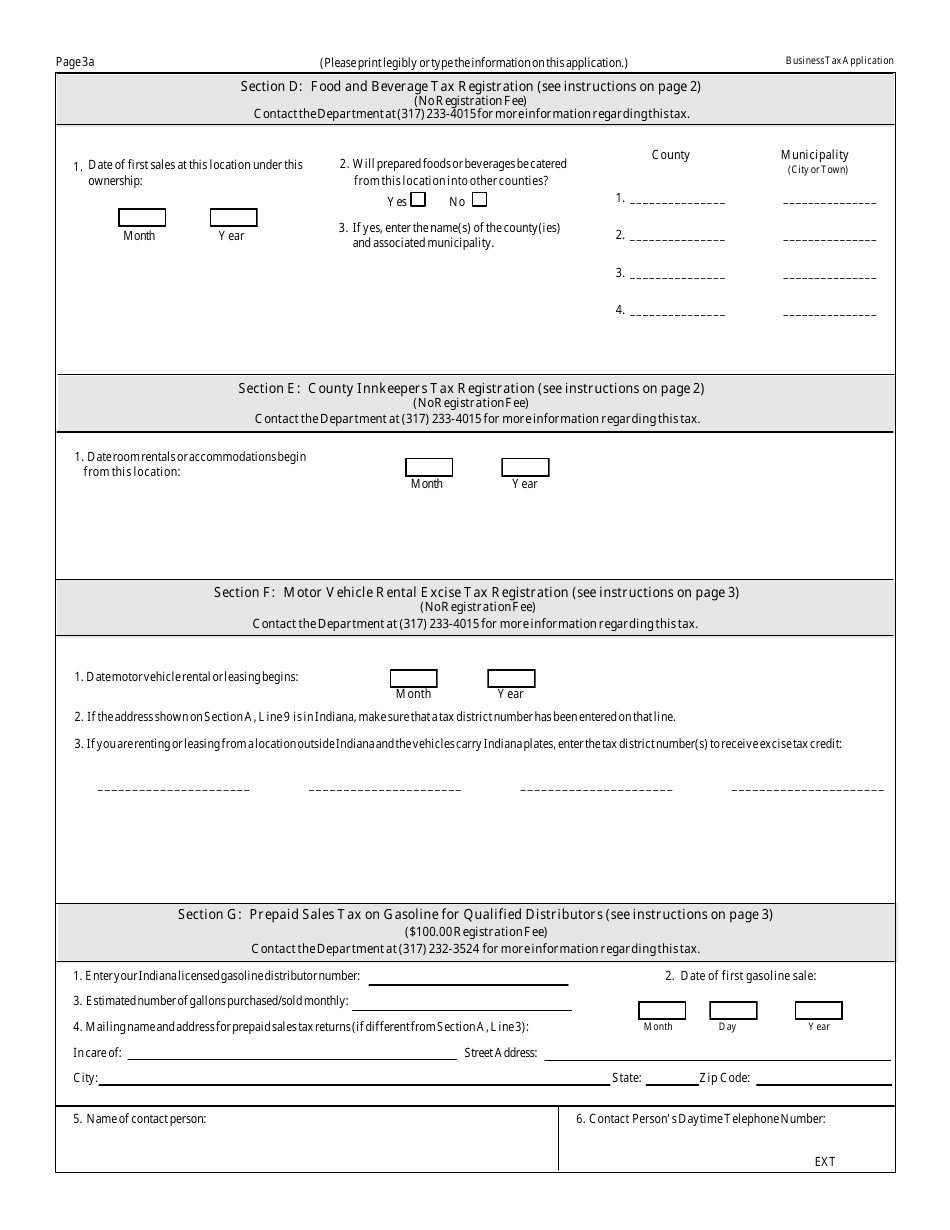

Q: What information is required on Form BT-1?

A: Form BT-1 requires information about the business entity, its owners, the nature of the business, and its tax obligations.

Q: When should Form BT-1 be filed?

A: Form BT-1 should be filed within 15 days of starting business operations in Indiana.

Form Details:

- Released on January 1, 2000;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

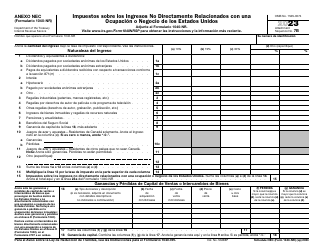

- Available in Spanish;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BT-1 by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.