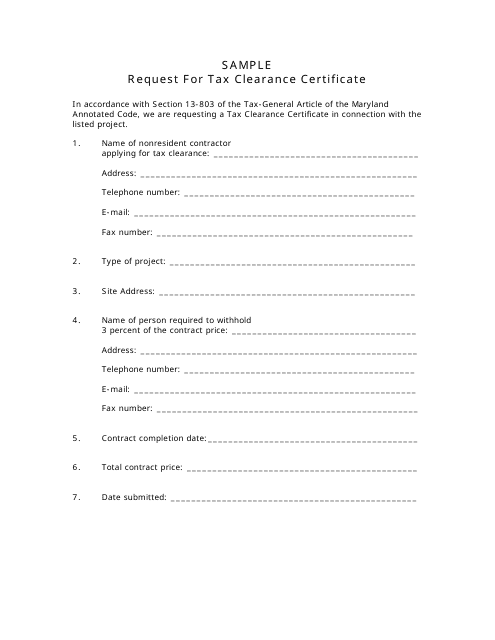

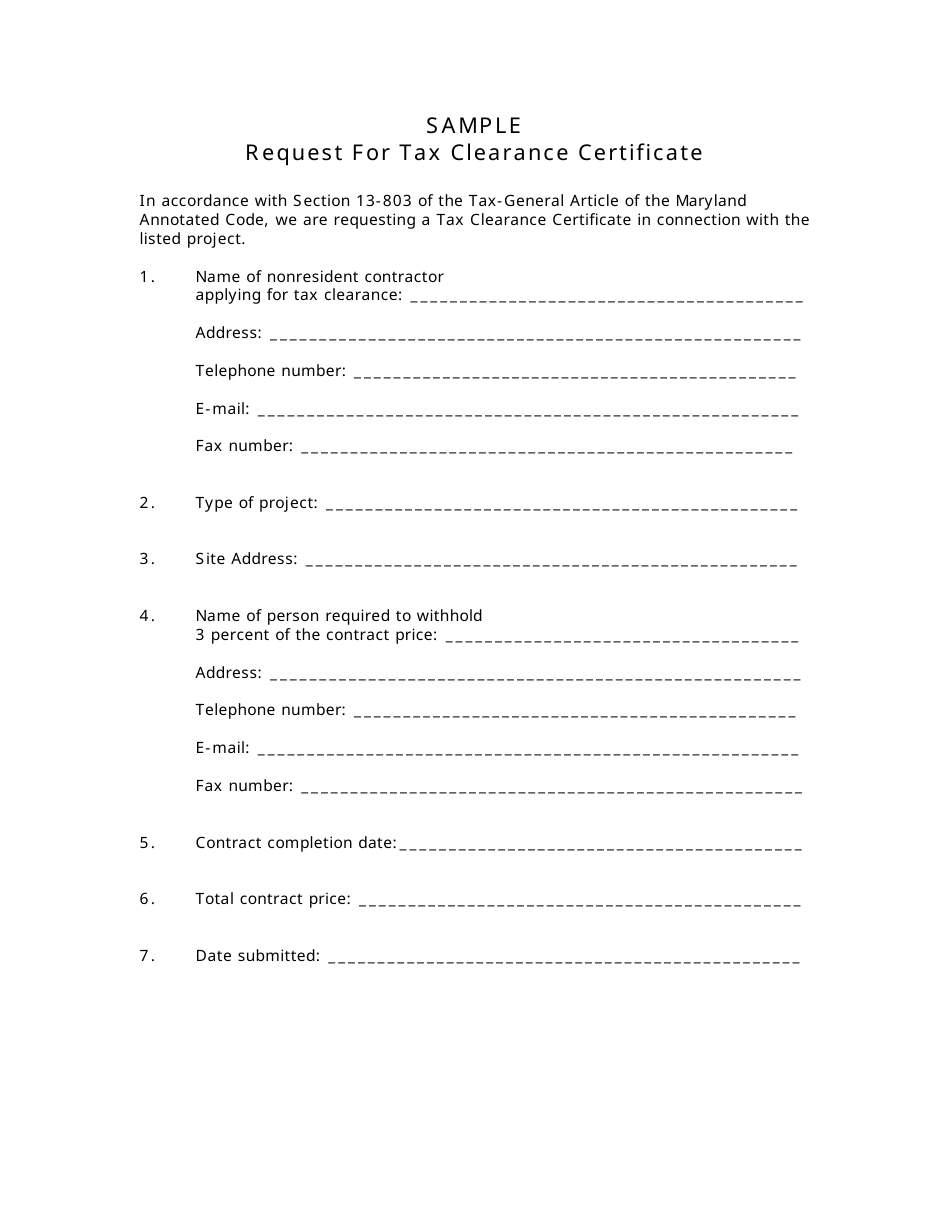

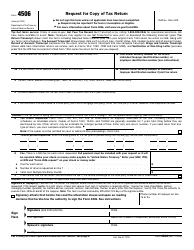

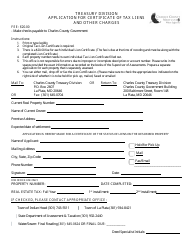

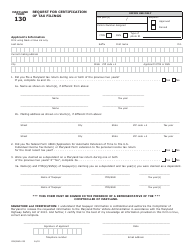

Request for Tax Clearance Certificate - Sample - Maryland

Request for Tax Clearance Certificate - Sample is a legal document that was released by the Comptroller of Maryland - a government authority operating within Maryland.

FAQ

Q: What is a Tax Clearance Certificate?

A: A Tax Clearance Certificate is a document issued by the state of Maryland to verify that an individual or business has paid all required taxes and has no outstanding tax liabilities.

Q: Why would I need a Tax Clearance Certificate?

A: You may need a Tax Clearance Certificate for various reasons, such as when selling a business, applying for certain licenses or permits, or participating in government contracts.

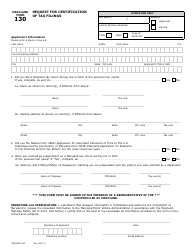

Q: How can I request a Tax Clearance Certificate in Maryland?

A: To request a Tax Clearance Certificate in Maryland, you can submit Form MW506R to the Comptroller of Maryland's office. The form includes information about the individual or business, along with a processing fee.

Q: How long does it take to receive a Tax Clearance Certificate?

A: The processing time for a Tax Clearance Certificate in Maryland can vary, but it typically takes about 10-15 business days to receive the certificate.

Form Details:

- The latest edition currently provided by the Comptroller of Maryland;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Comptroller of Maryland.