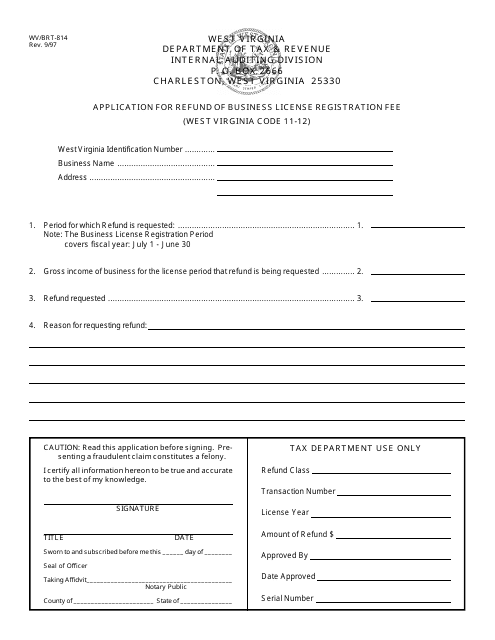

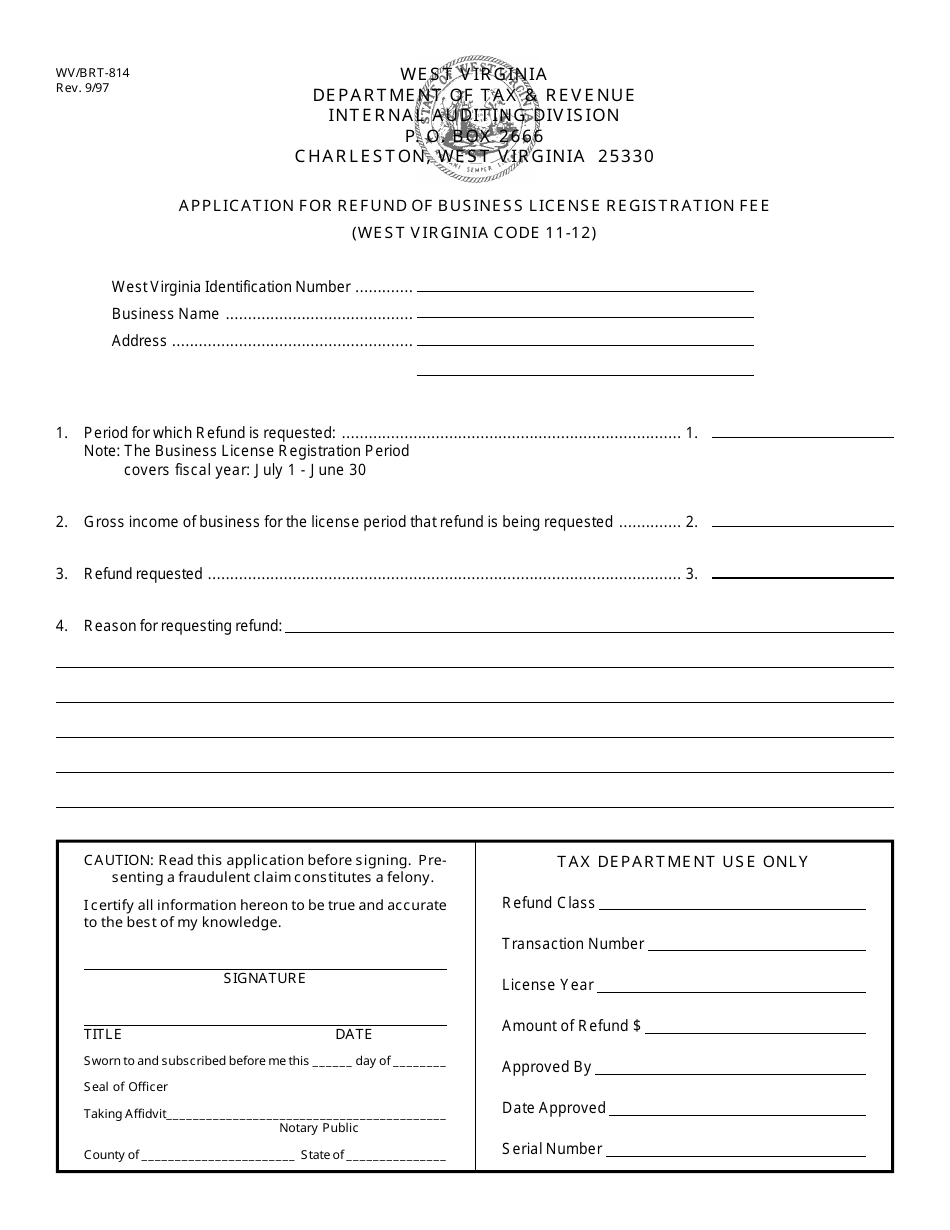

Form WV / BRT-814 Application for Refund of Business License Registration Fee - West Virginia

What Is Form WV/BRT-814?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is WV/BRT-814?

A: WV/BRT-814 is an application for refund of business license registration fee in West Virginia.

Q: What is the purpose of WV/BRT-814?

A: The purpose of WV/BRT-814 is to apply for a refund of the business license registration fee.

Q: Who can use WV/BRT-814?

A: Anyone who paid a business license registration fee in West Virginia and is eligible for a refund can use WV/BRT-814.

Q: What information do I need to provide in WV/BRT-814?

A: You will need to provide your personal and business details, reason for refund, and any supporting documents.

Q: Is there a deadline for submitting WV/BRT-814?

A: Yes, WV/BRT-814 should be submitted within one year from the date of payment of the business license registration fee.

Q: What happens after I submit WV/BRT-814?

A: After submitting WV/BRT-814, it will be reviewed by the government office and you will be notified of the refund decision.

Q: Can I appeal if my WV/BRT-814 refund application is denied?

A: Yes, if your WV/BRT-814 refund application is denied, you have the right to appeal the decision.

Form Details:

- Released on September 1, 1997;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form WV/BRT-814 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.