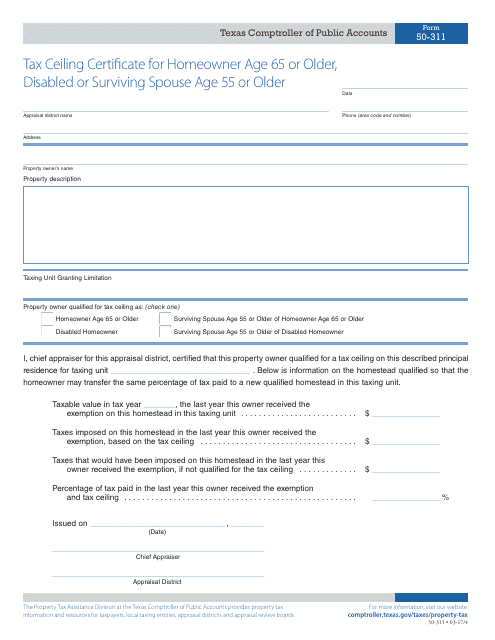

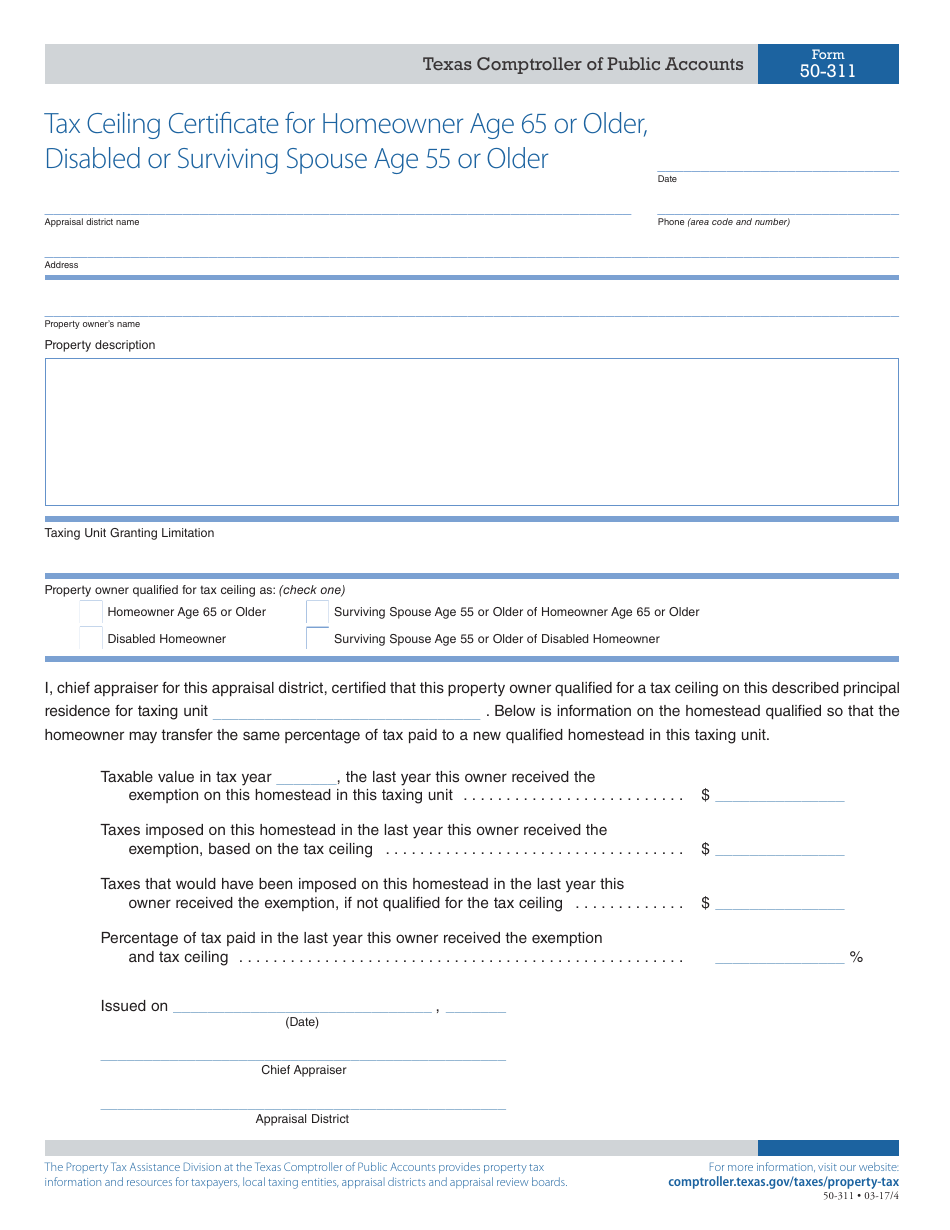

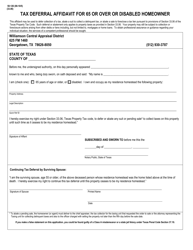

Form 50-311 Tax Ceiling Certificate for Homeowner Age 65 or Older, Disabled or Surviving Spouse Age 55 or Older - Texas

What Is Form 50-311?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-311?

A: Form 50-311 is a Tax Ceiling Certificate for Homeowner Age 65 or Older, Disabled or Surviving Spouse Age 55 or Older in Texas.

Q: Who is eligible to use Form 50-311?

A: Homeowners who are age 65 or older, disabled, or surviving spouse age 55 or older in Texas are eligible to use Form 50-311.

Q: What is the purpose of Form 50-311?

A: The purpose of Form 50-311 is to apply for a tax ceiling on the appraised value of the homeowner's residence.

Q: What does a tax ceiling on the appraised value mean?

A: A tax ceiling limits the amount of property taxes a homeowner has to pay on the appraised value of their residence.

Q: How can I obtain Form 50-311?

A: You can obtain Form 50-311 from the appraisal district or the local tax office in Texas.

Q: What documentation is required to complete Form 50-311?

A: Documentation such as proof of age, disability, or marriage may be required to complete Form 50-311.

Q: Is there a deadline for submitting Form 50-311?

A: The deadline for submitting Form 50-311 is usually before April 30th of the year following the year in which the taxes became due.

Q: Are there any fees associated with submitting Form 50-311?

A: There are no fees associated with submitting Form 50-311 in Texas.

Q: What are the benefits of obtaining a tax ceiling?

A: Obtaining a tax ceiling can help limit the property tax burden for eligible homeowners in Texas.

Q: Can I transfer my tax ceiling to a new residence?

A: In some cases, homeowners may be able to transfer their tax ceiling to a new residence when they move within the same taxing unit in Texas.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-311 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.