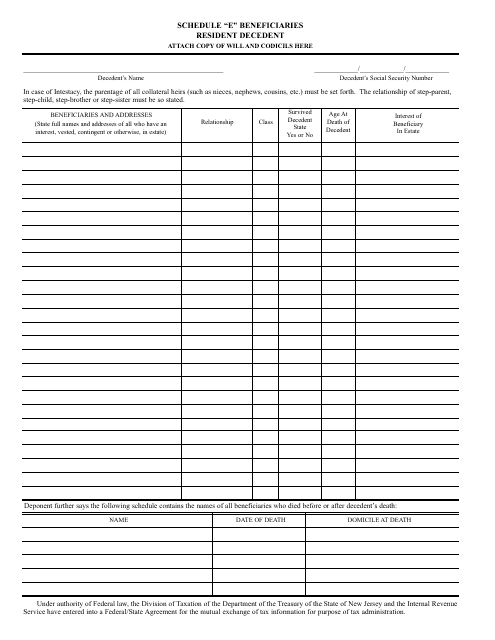

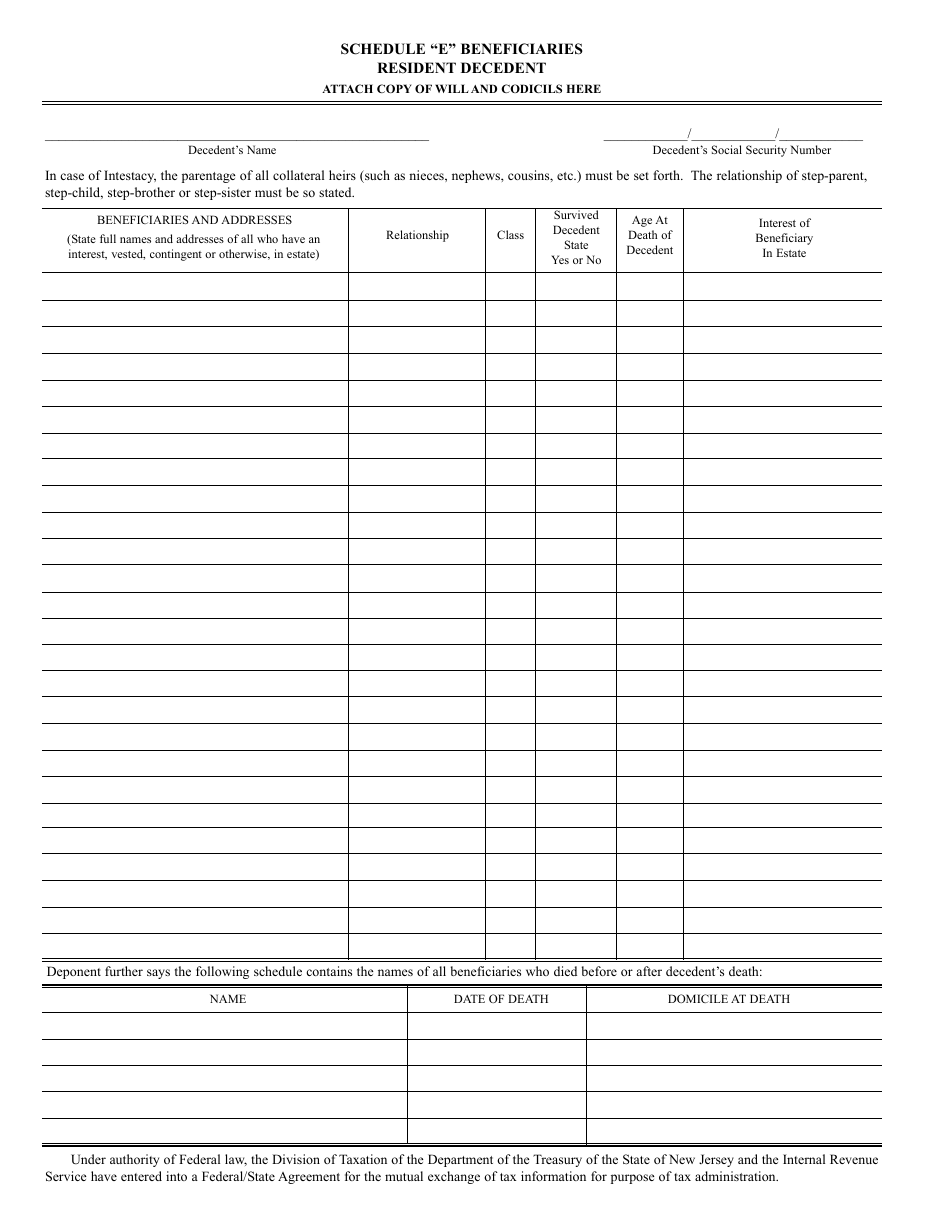

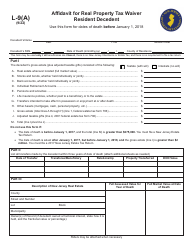

Schedule E Beneficiaries Resident Decedent - New Jersey

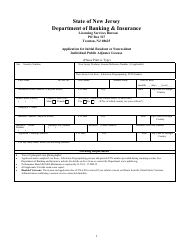

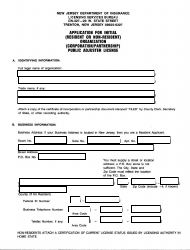

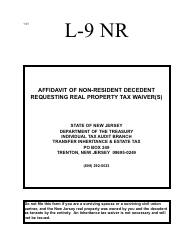

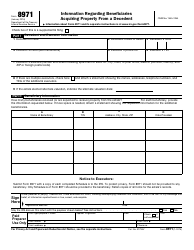

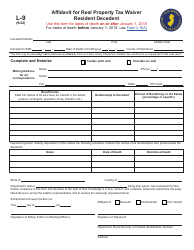

What Is Schedule E?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

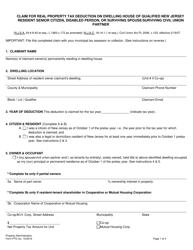

Q: Who needs to file Schedule E for resident decedent beneficiaries in New Jersey?

A: Residents of New Jersey who are beneficiaries of a decedent's estate need to file Schedule E.

Q: What is Schedule E for resident decedent beneficiaries?

A: Schedule E is a form used by residents of New Jersey who are beneficiaries of a decedent's estate to report and pay any inheritance or estate tax owed.

Q: Do all beneficiaries need to file Schedule E?

A: No, only residents of New Jersey who are beneficiaries of a decedent's estate need to file Schedule E.

Q: What is the purpose of filing Schedule E?

A: The purpose of filing Schedule E is to report and pay any inheritance or estate tax owed by resident decedent beneficiaries in New Jersey.

Q: When is the deadline to file Schedule E?

A: The deadline to file Schedule E for resident decedent beneficiaries in New Jersey is within 8 months after the date of death, unless an extension is granted.

Q: What happens if I fail to file Schedule E on time?

A: If you fail to file Schedule E on time, you may be subject to penalties and interest on any taxes owed.

Q: Is there a minimum threshold for filing Schedule E?

A: Yes, if the total value of the decedent's taxable estate is less than $675,000, you do not need to file Schedule E.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule E by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.