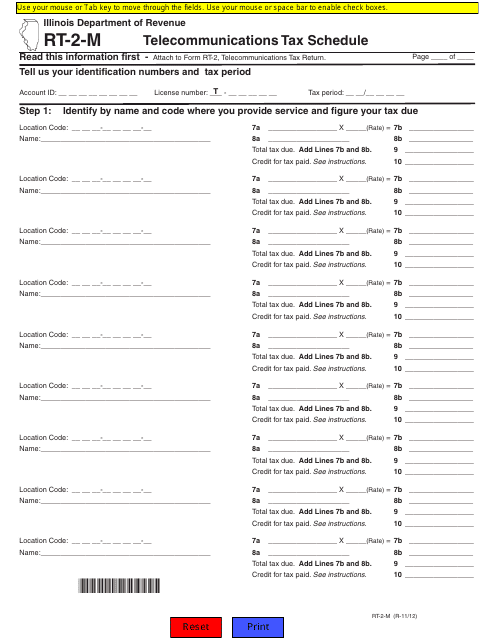

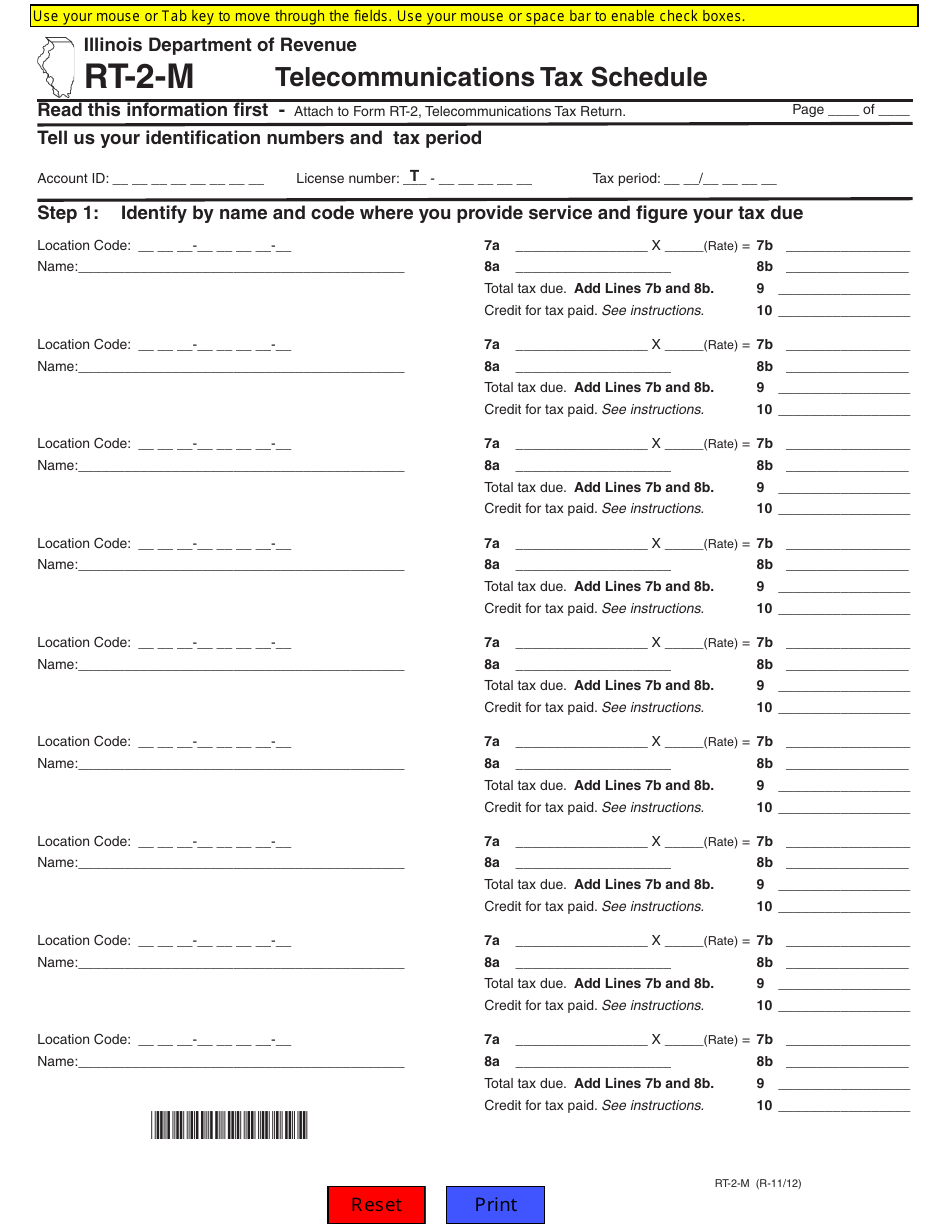

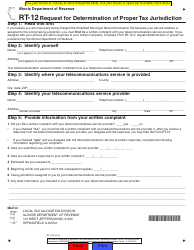

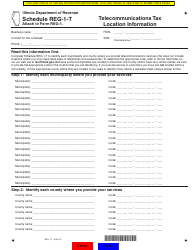

Form RT-2-M Telecommunications Tax Schedule - Illinois

What Is Form RT-2-M?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form RT-2-M?

A: Form RT-2-M is the Telecommunications Tax Schedule for the state of Illinois.

Q: What is the purpose of Form RT-2-M?

A: The purpose of Form RT-2-M is to report and remit telecommunications taxes in Illinois.

Q: Who needs to file Form RT-2-M?

A: Telecommunications companies operating in Illinois that are subject to telecommunications taxes must file Form RT-2-M.

Q: What are telecommunications taxes?

A: Telecommunications taxes are taxes imposed on the provision of telecommunications services, such as phone calls, internet services, and cable or satellite television services.

Q: When is Form RT-2-M due?

A: Form RT-2-M is generally due on a monthly basis, with the due date falling on the 20th day of the following month.

Q: Are there any penalties for not filing Form RT-2-M?

A: Yes, failure to file Form RT-2-M or pay the required telecommunications taxes may result in penalties and interest.

Q: Is Form RT-2-M separate from other tax forms?

A: Yes, Form RT-2-M is a separate form specifically for reporting and remitting telecommunications taxes in Illinois.

Q: Is Form RT-2-M required for personal telecommunications use?

A: No, Form RT-2-M is only required for telecommunications companies operating in Illinois.

Form Details:

- Released on November 1, 2012;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RT-2-M by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.