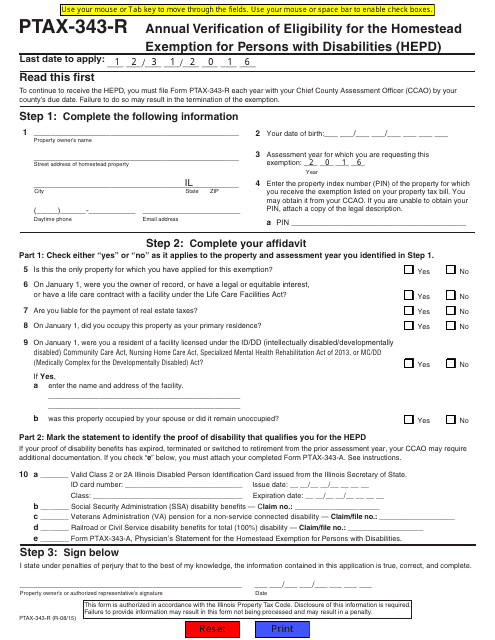

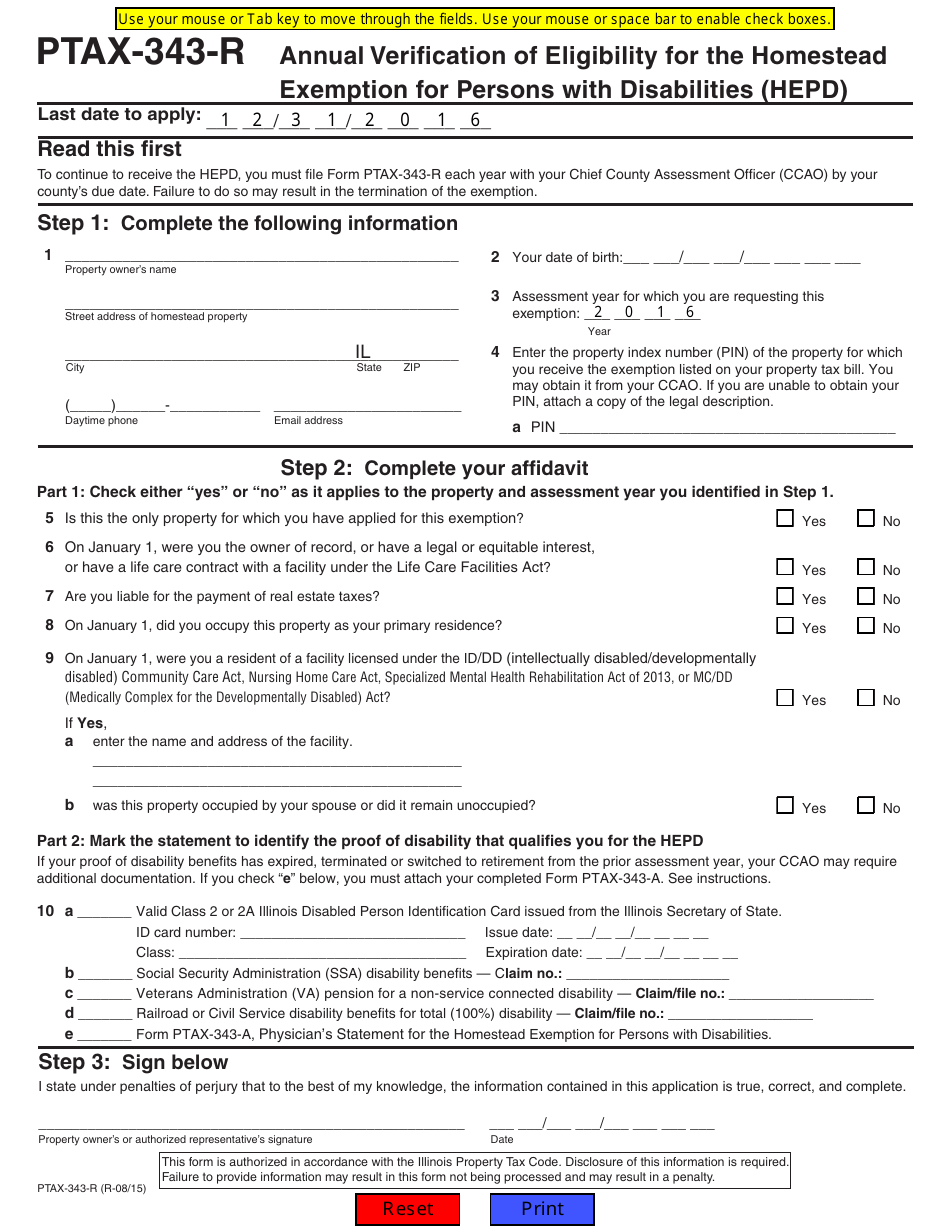

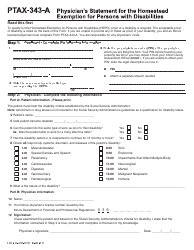

Form PTAX-343-r Annual Verification of Eligibility for the Homestead Exemption for Persons With Disabilities (Hepd) - Illinois

What Is Form PTAX-343-r?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PTAX-343-r?

A: Form PTAX-343-r is the Annual Verification of Eligibility for the Homestead Exemption for Persons With Disabilities (HEPD) in Illinois.

Q: What is the purpose of Form PTAX-343-r?

A: The purpose of Form PTAX-343-r is to verify the eligibility of persons with disabilities for the Homestead Exemption in Illinois.

Q: Who needs to complete Form PTAX-343-r?

A: Persons with disabilities who are claiming the Homestead Exemption in Illinois need to complete Form PTAX-343-r.

Q: What is the Homestead Exemption for Persons With Disabilities in Illinois?

A: The Homestead Exemption for Persons With Disabilities is a property tax exemption available to qualifying individuals with disabilities in Illinois.

Q: What information is required on Form PTAX-343-r?

A: Form PTAX-343-r requires information such as the property address, disability information, income information, and other details to verify eligibility.

Q: When is the deadline to submit Form PTAX-343-r?

A: The deadline to submit Form PTAX-343-r may vary by county, so it is important to check with the county assessor's office for the specific deadline.

Q: What happens if I do not submit Form PTAX-343-r?

A: If Form PTAX-343-r is not submitted or is not approved, the person with disabilities may not be eligible for the Homestead Exemption in Illinois for that tax year.

Form Details:

- Released on August 1, 2015;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PTAX-343-r by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.