This version of the form is not currently in use and is provided for reference only. Download this version of

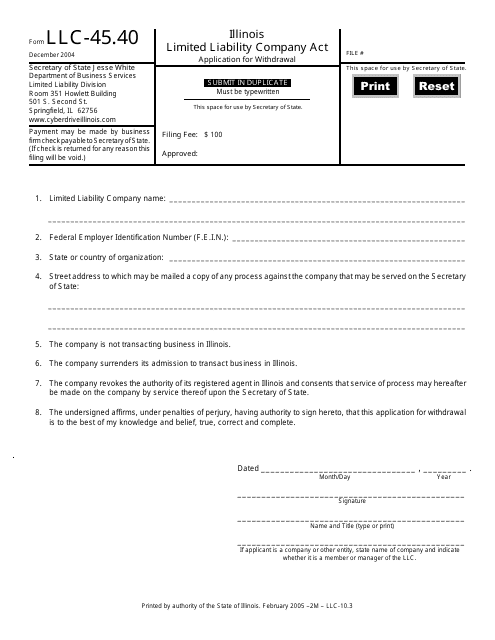

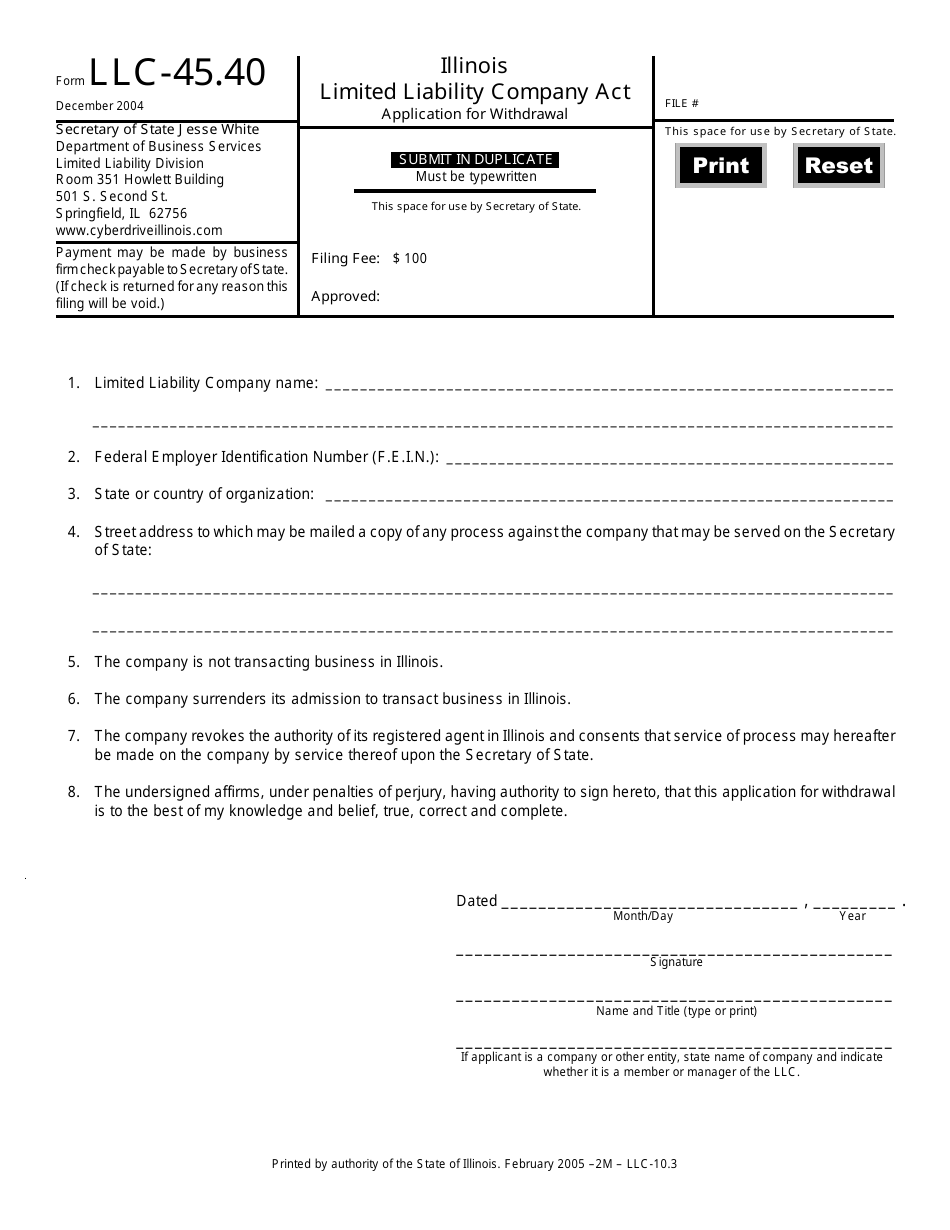

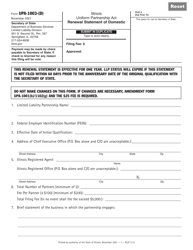

Form LLC-45.40

for the current year.

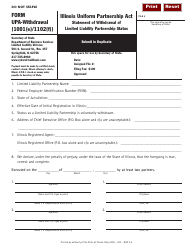

Form LLC-45.40 Limited Liability Company Act Application for Withdrawal - Illinois

What Is Form LLC-45.40?

This is a legal form that was released by the Illinois Secretary of State - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

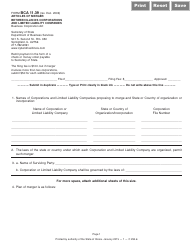

Q: What is LLC-45.40?

A: LLC-45.40 is the form used to apply for withdrawal of a limited liability company (LLC) under the Illinois Limited Liability Company Act.

Q: What is the purpose of LLC-45.40?

A: The purpose of LLC-45.40 is to request the withdrawal of a LLC from the state of Illinois.

Q: What information is required on LLC-45.40?

A: LLC-45.40 requires information such as the name of the LLC, date of formation, reason for withdrawal, and signature of a authorized person.

Q: How long does it take to process LLC-45.40?

A: The processing time for LLC-45.40 may vary. It is recommended to check with the Illinois Secretary of State for the current processing time.

Q: Is it mandatory to withdraw a LLC using LLC-45.40?

A: Yes, if a LLC wants to withdraw from the state of Illinois, it is mandatory to submit LLC-45.40.

Q: Is there a deadline for submitting LLC-45.40?

A: There is no specific deadline mentioned for submitting LLC-45.40. However, it is recommended to submit the form as soon as the decision to withdraw the LLC is made.

Q: What happens after submitting LLC-45.40?

A: After submitting LLC-45.40 and paying the necessary fees, the Illinois Secretary of State will process the withdrawal request and update the records of the LLC accordingly.

Form Details:

- Released on February 1, 2005;

- The latest edition provided by the Illinois Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LLC-45.40 by clicking the link below or browse more documents and templates provided by the Illinois Secretary of State.