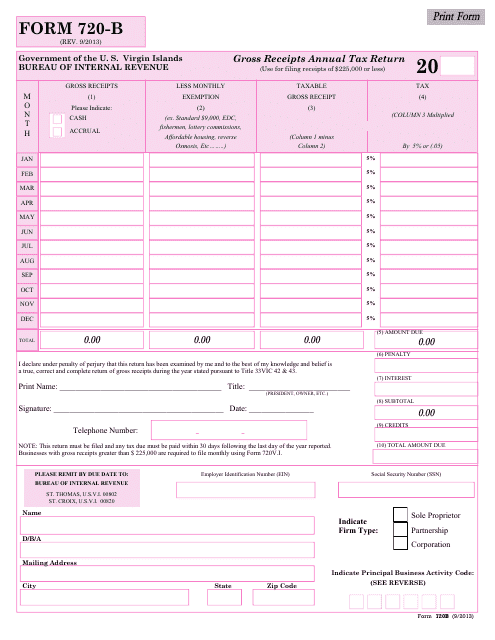

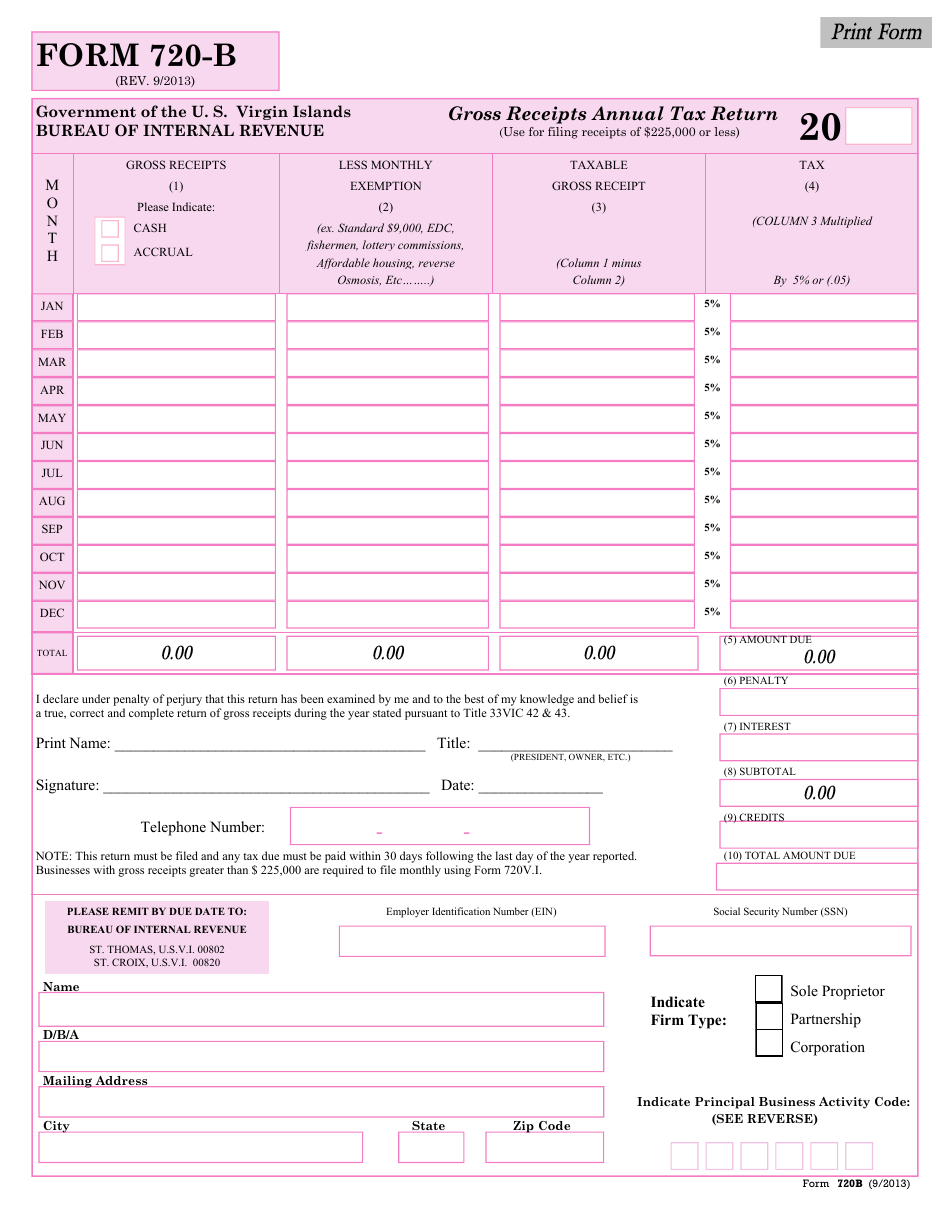

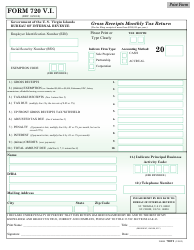

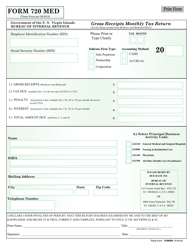

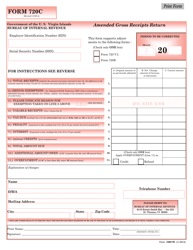

Form 720-b Gross Receipts Annual Tax Return - Virgin Islands

What Is Form 720-b?

This is a legal form that was released by the Virgin Islands Bureau of Internal Revenue - a government authority operating within Virgin Islands. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 720-B?

A: Form 720-B is the Gross ReceiptsAnnual Tax Return specifically for the Virgin Islands.

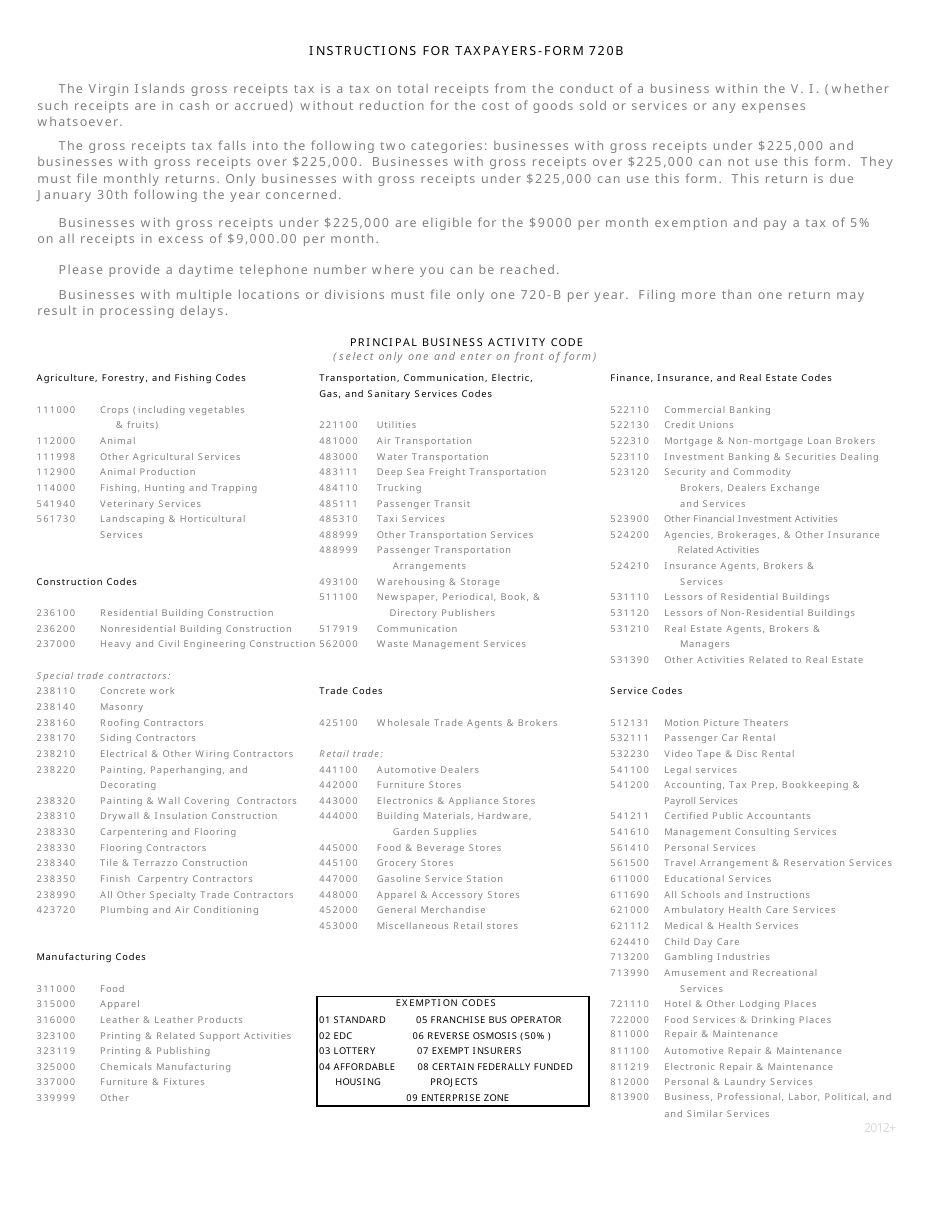

Q: Who needs to file Form 720-B?

A: Businesses operating in the Virgin Islands that have gross receipts above a certain threshold are required to file Form 720-B.

Q: What are gross receipts?

A: Gross receipts are the total amount of money a business receives from its sales or services before deducting any expenses.

Q: What is the purpose of filing Form 720-B?

A: The purpose of filing Form 720-B is for businesses to report and pay their annual gross receipts tax in the Virgin Islands.

Q: How often do businesses need to file Form 720-B?

A: Form 720-B is an annual tax return, so businesses need to file it once every year.

Q: What are the penalties for not filing Form 720-B?

A: Penalties for not filing Form 720-B or filing it late can include monetary fines and interest charges.

Q: Can Form 720-B be filed electronically?

A: Yes, Form 720-B can be filed electronically through the Virgin Islands Bureau of Internal Revenue's e-filing system.

Q: What information is required to complete Form 720-B?

A: To complete Form 720-B, you will need to provide information such as your business's gross receipts, applicable exemptions, and any other required details.

Q: Can I request an extension to file Form 720-B?

A: Yes, you can request an extension to file Form 720-B. However, any tax owed must still be paid by the original due date.

Form Details:

- Released on September 1, 2013;

- The latest edition provided by the Virgin Islands Bureau of Internal Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 720-b by clicking the link below or browse more documents and templates provided by the Virgin Islands Bureau of Internal Revenue.