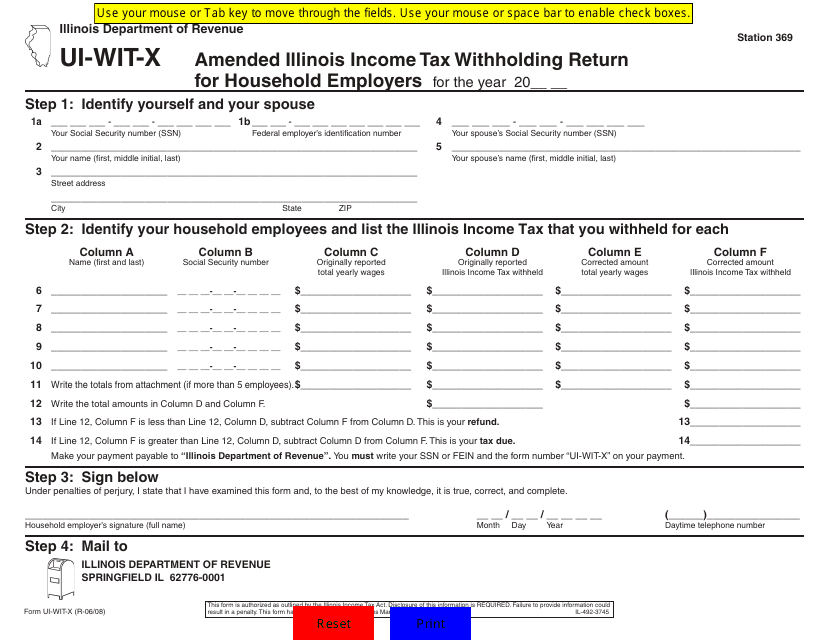

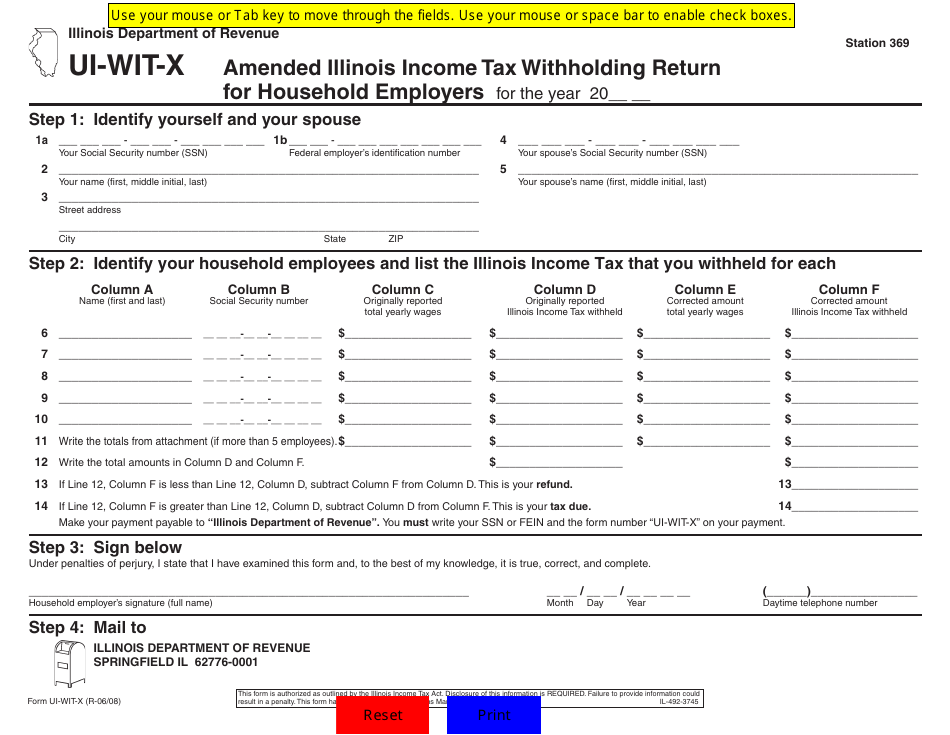

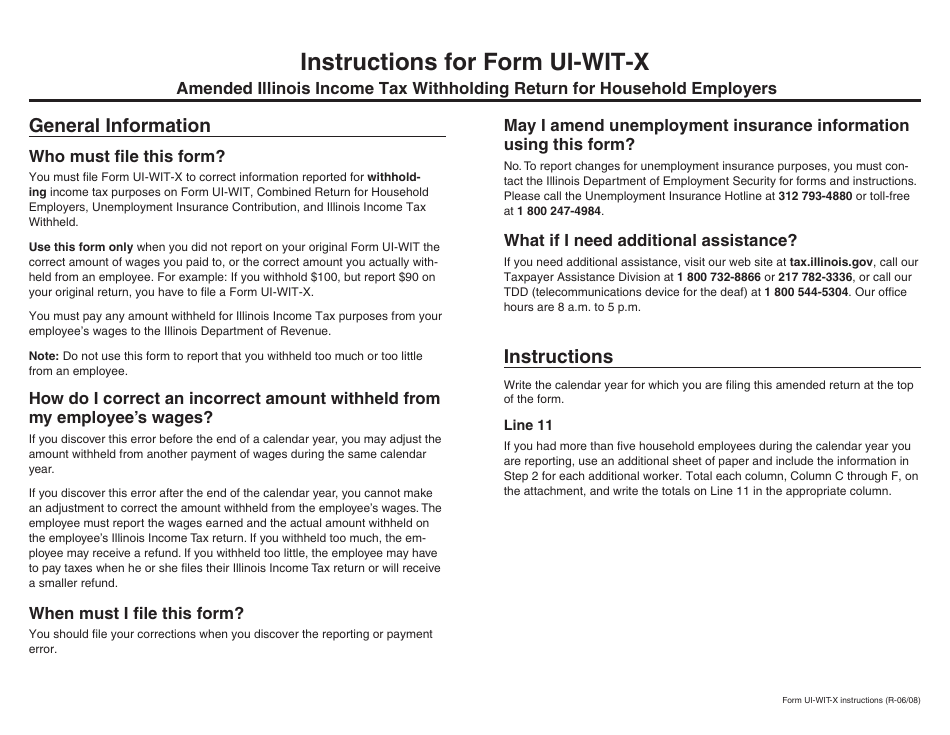

Form UI-WIT-X Amended Illinois Income Tax Withholding Return for Household Employers - Illinois

What Is Form UI-WIT-X?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form UI-WIT-X?

A: Form UI-WIT-X is the Amended Illinois Income Tax Withholding Return for Household Employers.

Q: Who should use Form UI-WIT-X?

A: Form UI-WIT-X should be used by household employers in Illinois who need to amend their previously filed income tax withholding return.

Q: What is the purpose of Form UI-WIT-X?

A: The purpose of Form UI-WIT-X is to report any changes or corrections to the income tax withholding information for household employees.

Q: When should I use Form UI-WIT-X?

A: You should use Form UI-WIT-X when you need to make changes or corrections to your previously filed income tax withholding return for household employees.

Q: Can I file Form UI-WIT-X electronically?

A: No, you cannot file Form UI-WIT-X electronically. It must be filed by mail.

Form Details:

- Released on June 1, 2008;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form UI-WIT-X by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.