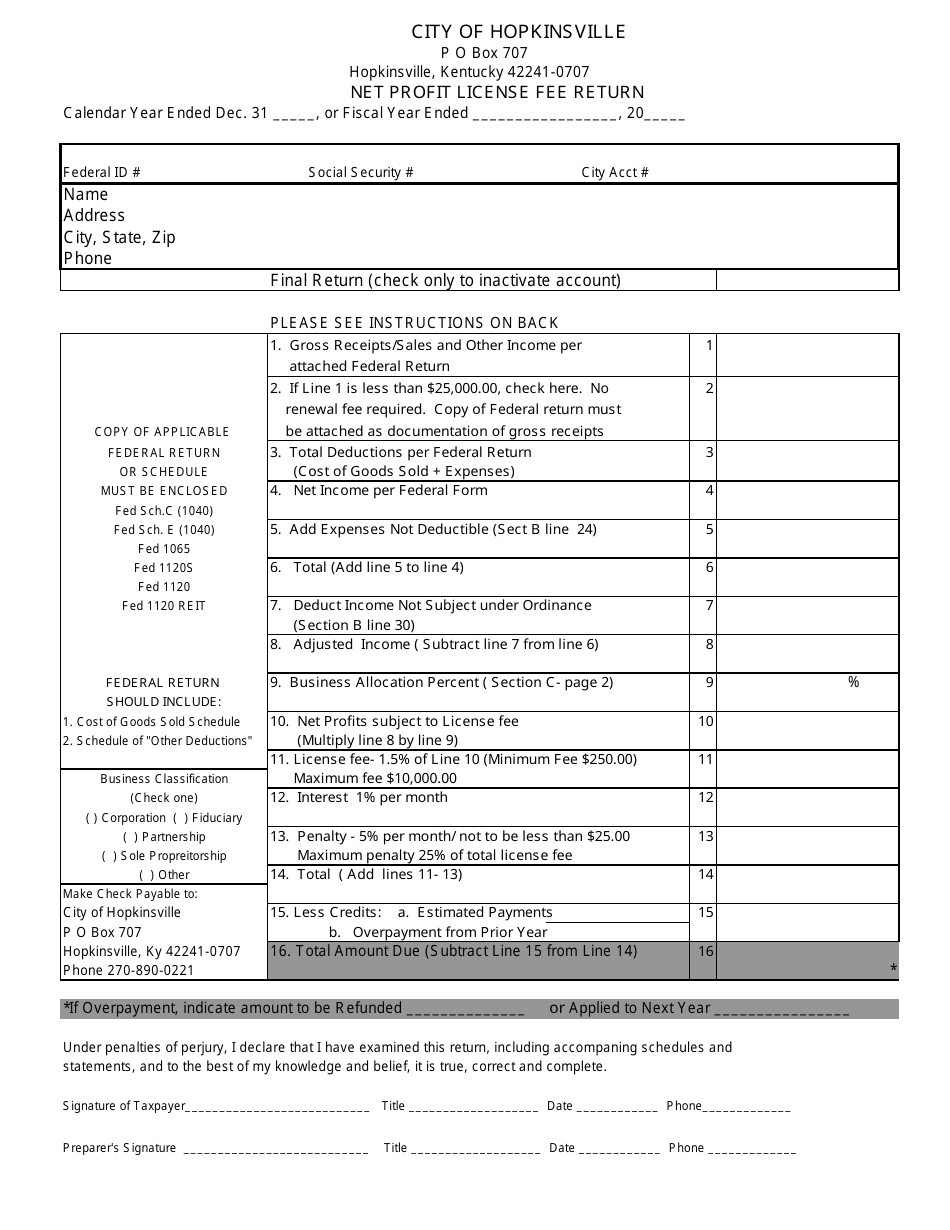

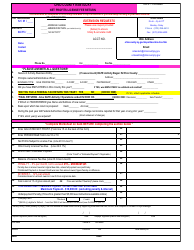

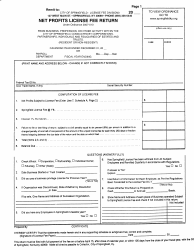

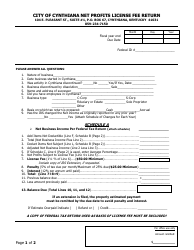

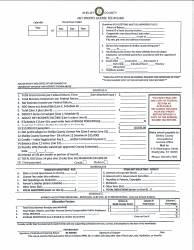

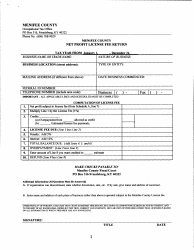

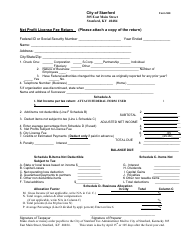

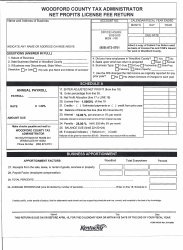

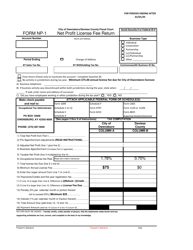

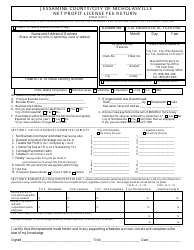

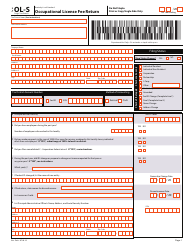

Net Profit License Fee Return Form - City of Hopkinsville, Kentucky

Net Profit License Fee Return Form is a legal document that was released by the Finance Department - City of Hopkinsville, Kentucky - a government authority operating within Kentucky. The form may be used strictly within City of Hopkinsville.

FAQ

Q: What is the Net Profit License Fee Return Form?

A: The Net Profit License Fee Return Form is a form used by businesses in Hopkinsville, Kentucky to report their net profit and pay the corresponding license fee.

Q: Who needs to file the Net Profit License Fee Return Form?

A: Businesses operating in Hopkinsville, Kentucky that have a net profit are required to file the Net Profit License Fee Return Form.

Q: What is the purpose of the Net Profit License Fee Return Form?

A: The purpose of the form is to calculate and collect license fees from businesses based on their net profit.

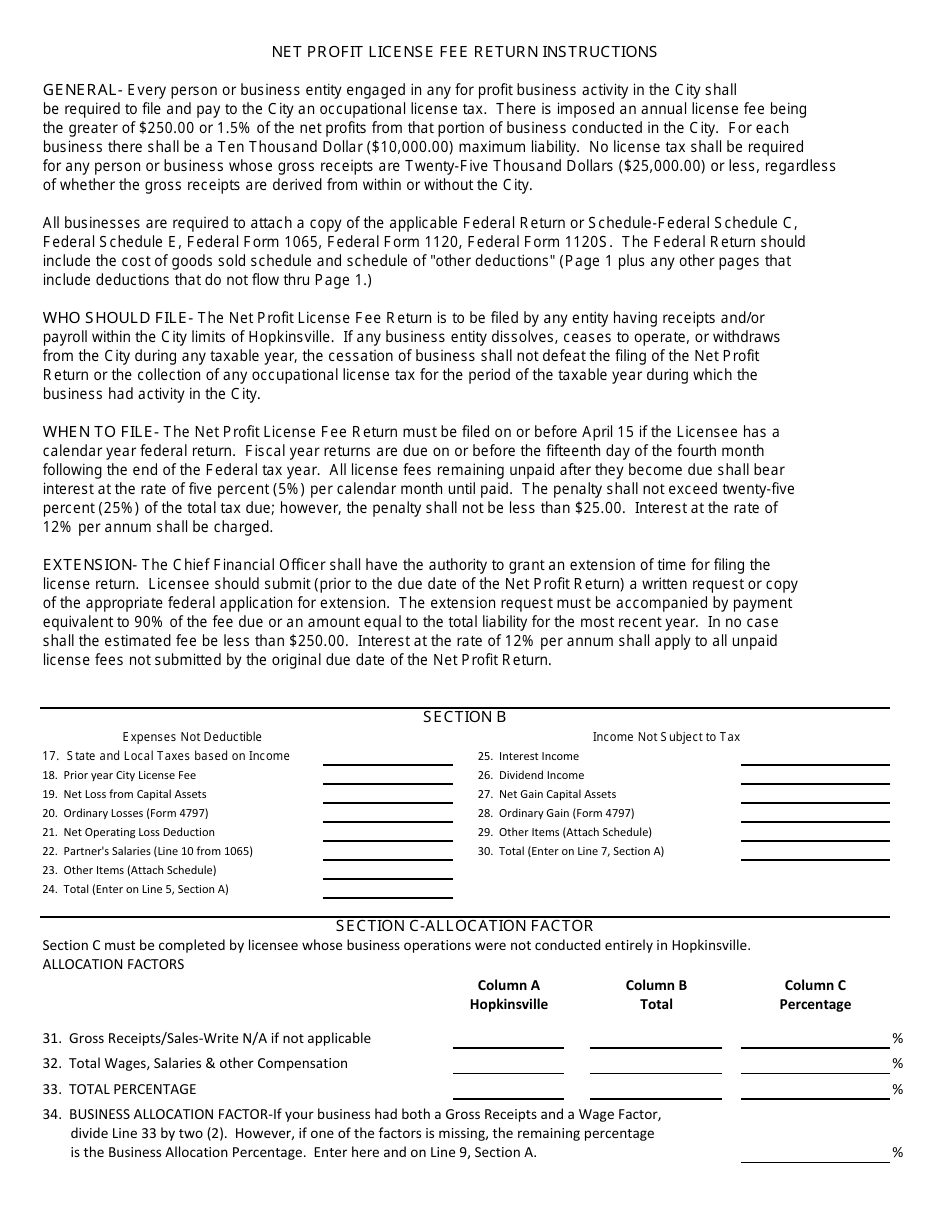

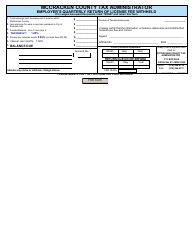

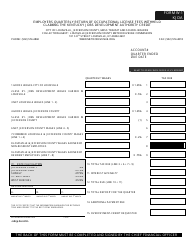

Q: When is the deadline for filing the Net Profit License Fee Return Form?

A: The deadline for filing the form is typically specified on the form itself. It is important to ensure timely submission to avoid penalties or late fees.

Q: What should be included in the Net Profit License Fee Return Form?

A: The form typically requires businesses to report their net profit and calculate the corresponding license fee based on the city's fee schedule.

Q: Is there a fee for filing the Net Profit License Fee Return Form?

A: No, there is usually no fee for simply filing the form. The fee is calculated based on the net profit reported and paid separately.

Q: What happens if I don't file the Net Profit License Fee Return Form?

A: Failure to file the form or pay the license fee can result in penalties, fees, or legal consequences, so it is important to comply with the requirements.

Form Details:

- The latest edition currently provided by the Finance Department - City of Hopkinsville, Kentucky;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Finance Department - City of Hopkinsville, Kentucky.