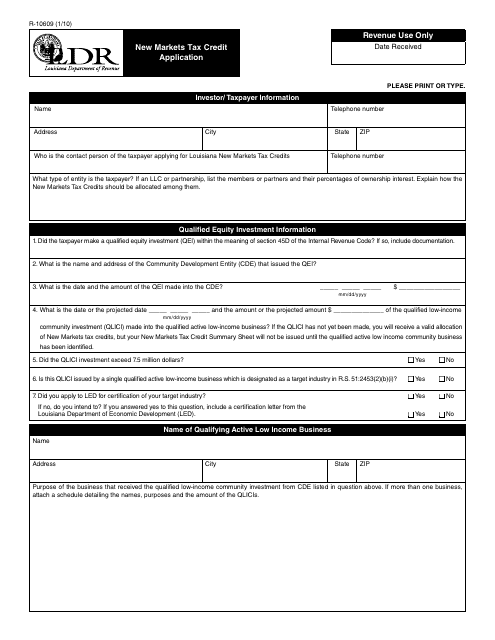

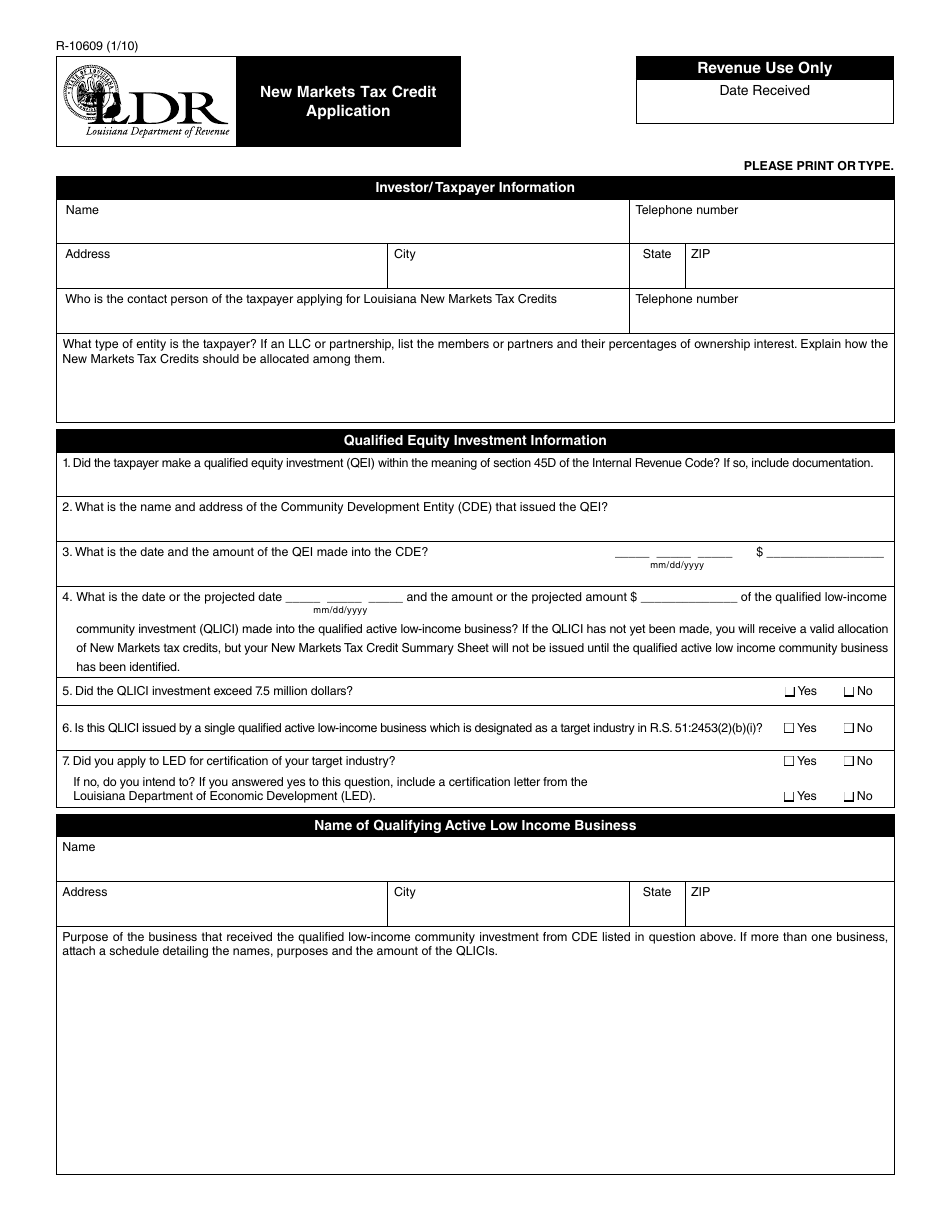

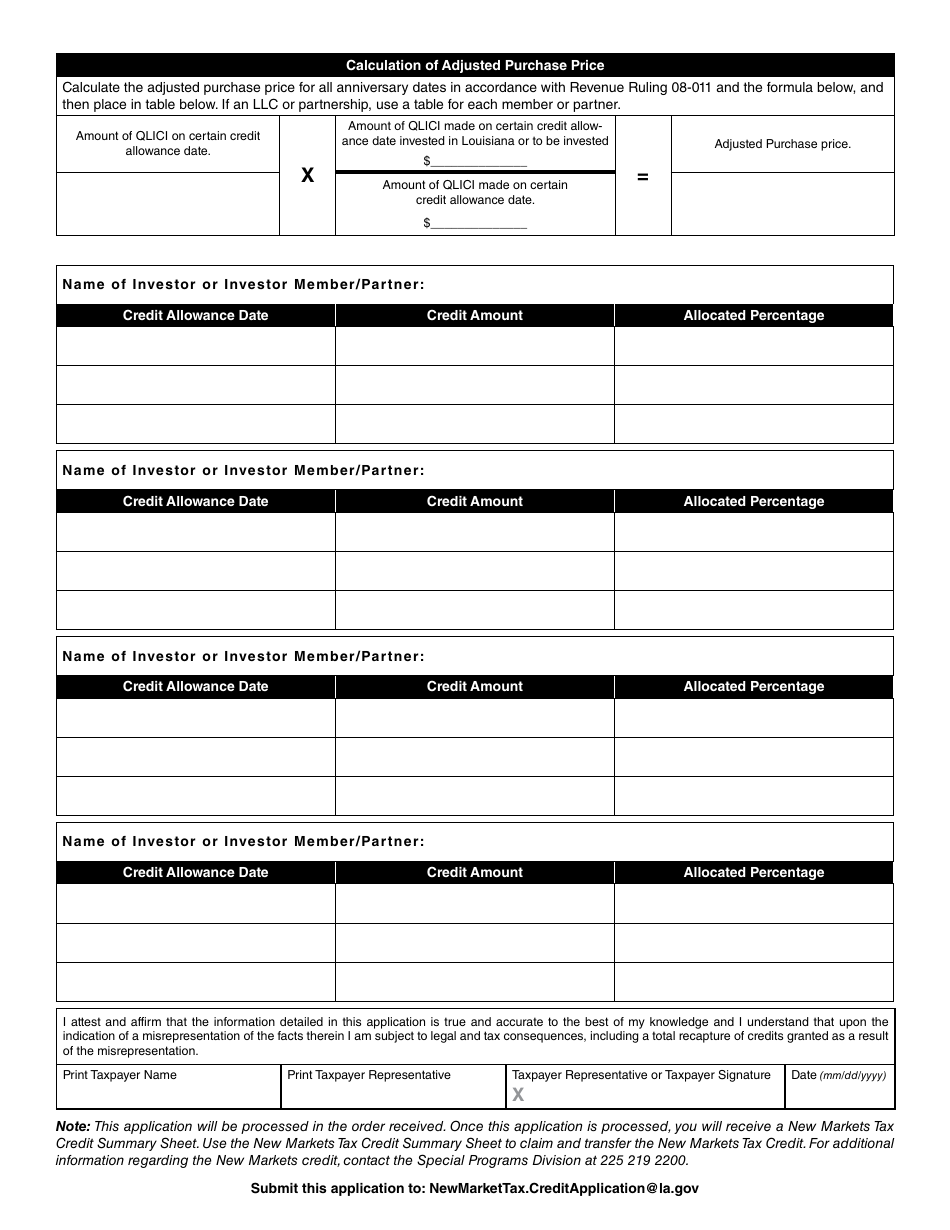

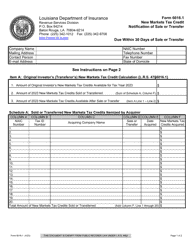

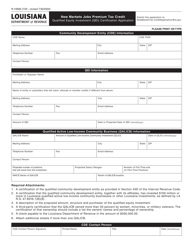

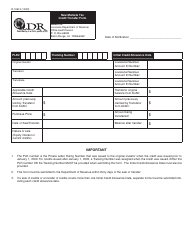

Form R-10609 New Markets Tax Credit Application - Louisiana

What Is Form R-10609?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-10609?

A: Form R-10609 is the New Markets Tax Credit application for Louisiana.

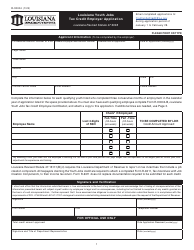

Q: What is the New Markets Tax Credit?

A: The New Markets Tax Credit is a federal program designed to stimulate economic development in low-income communities.

Q: How do I apply for the New Markets Tax Credit in Louisiana?

A: To apply for the New Markets Tax Credit in Louisiana, you need to complete and submit Form R-10609.

Q: Who is eligible for the New Markets Tax Credit?

A: Various entities, such as community development entities and qualified active low-income community businesses, may be eligible for the New Markets Tax Credit.

Q: What are the benefits of the New Markets Tax Credit?

A: The New Markets Tax Credit can provide a substantial tax credit for investments made in qualified low-income communities, encouraging economic growth and job creation.

Form Details:

- Released on January 1, 2010;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-10609 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.