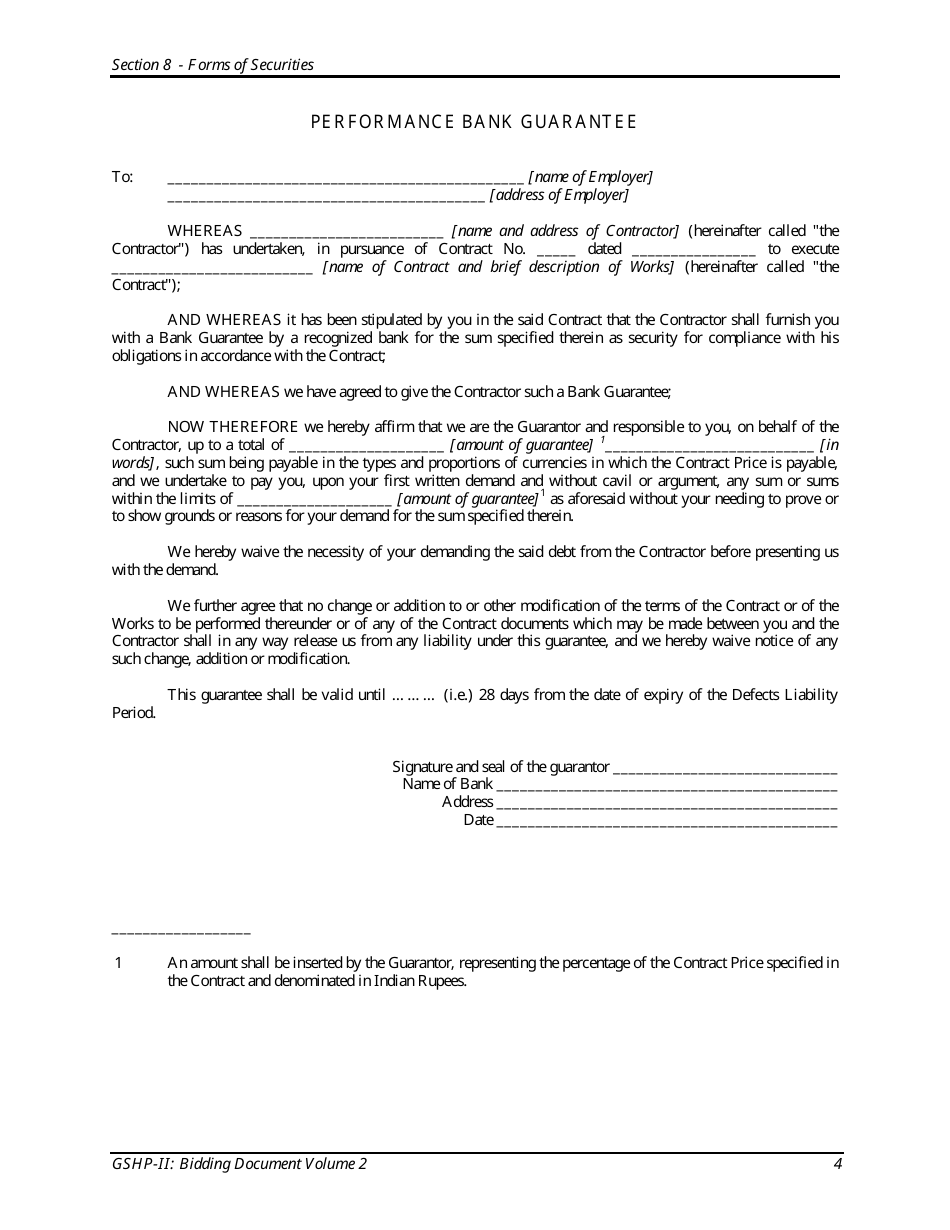

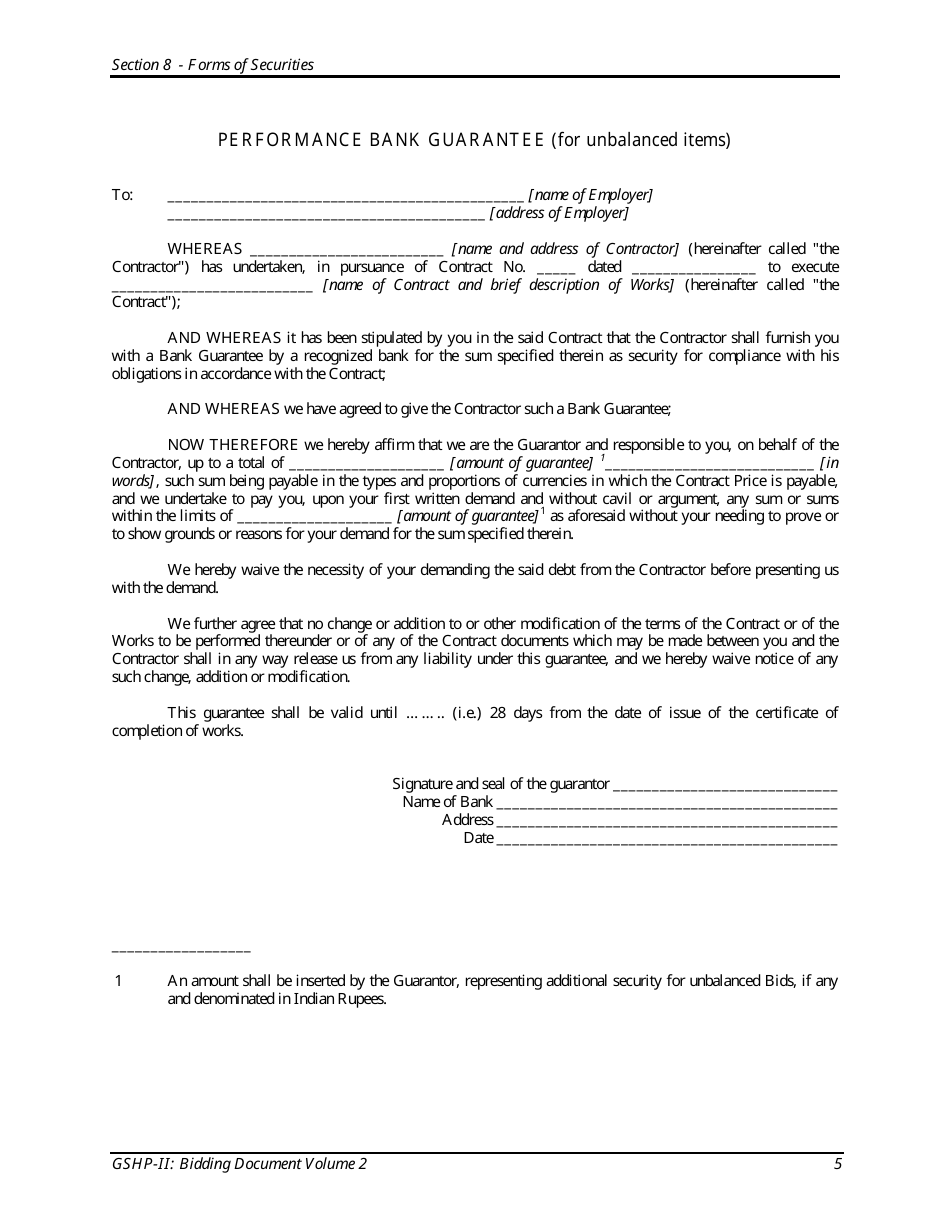

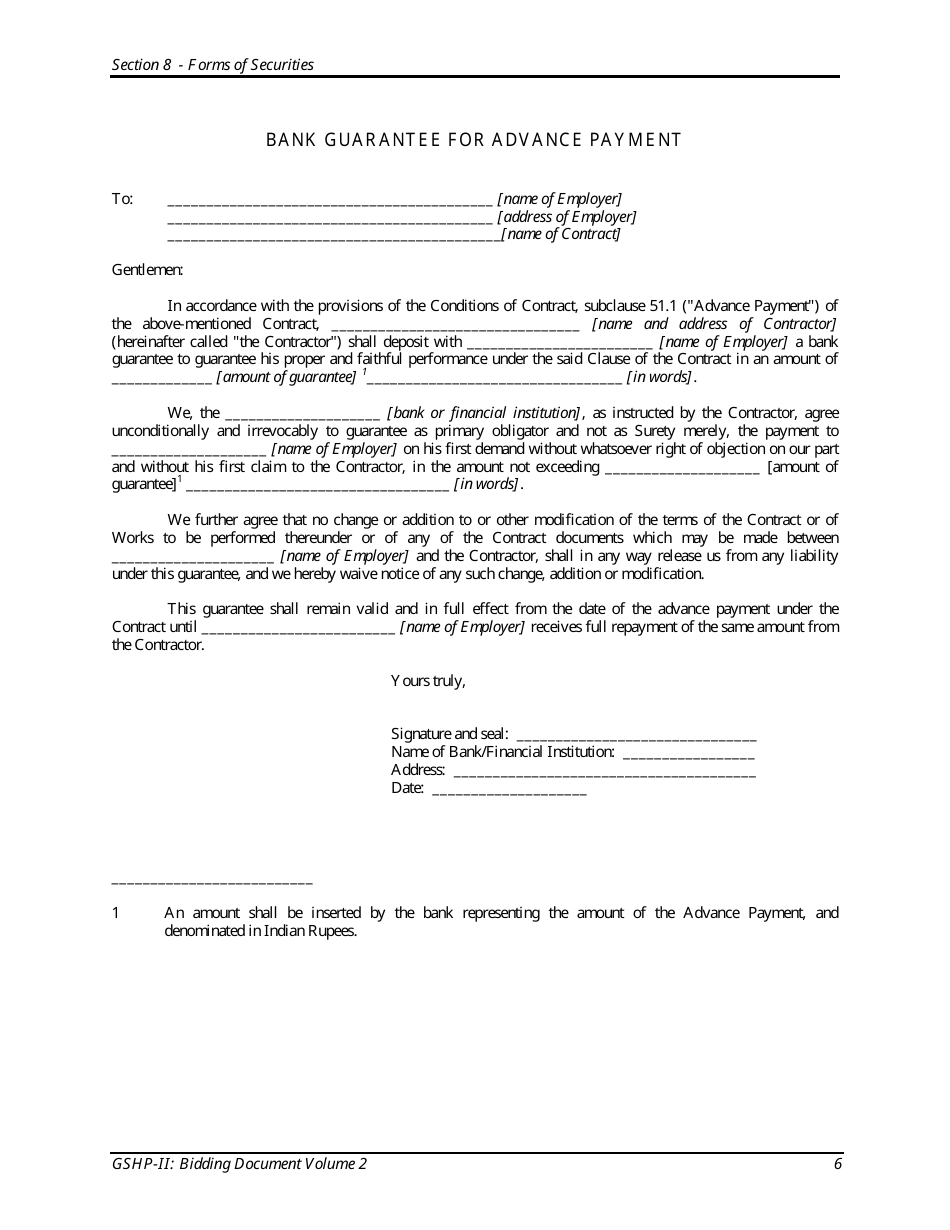

Sample Section 8 - Forms of Securities - Gujarat, India

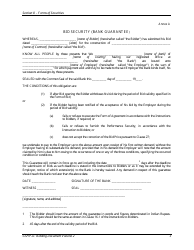

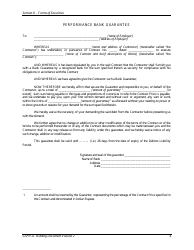

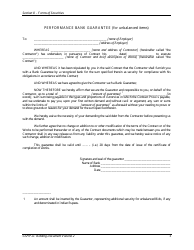

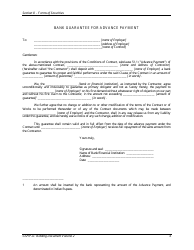

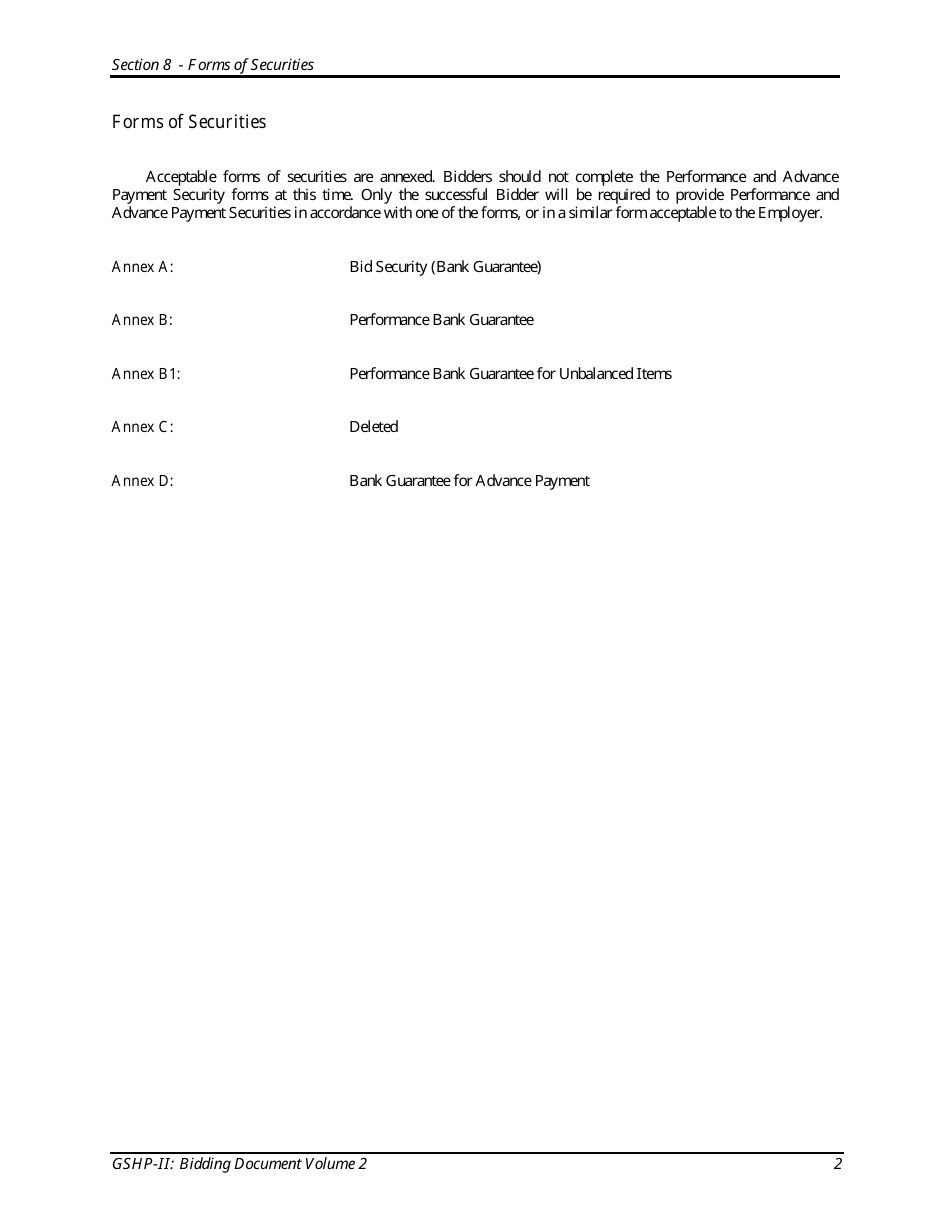

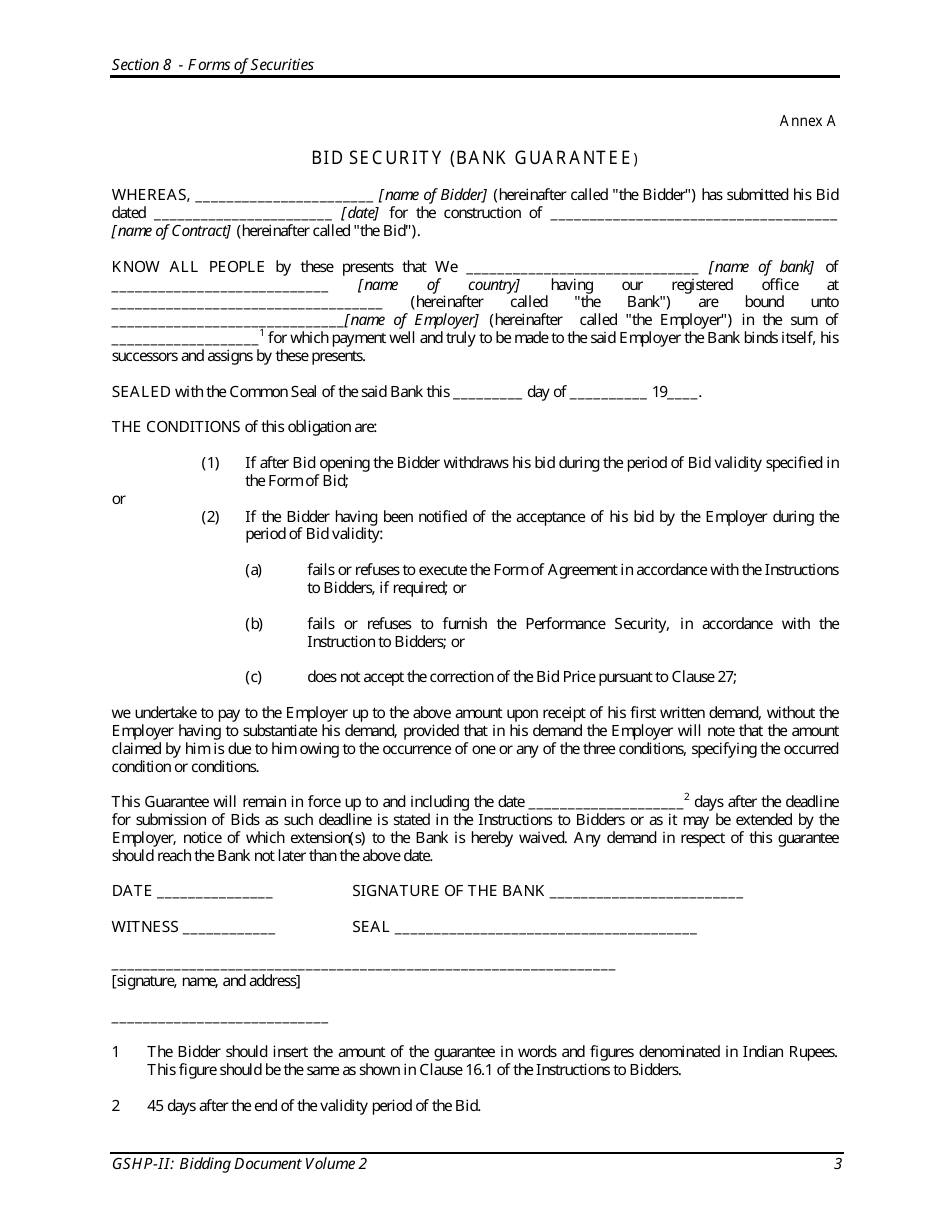

Sample Section 8 - Forms of Securities in Gujarat, India refers to a specific section of legal or regulatory documents that outline the different types or forms of securities that can be issued or traded in the state of Gujarat, India. These documents provide guidelines and rules for companies, investors, and financial institutions regarding the issuance and trading of securities such as stocks, bonds, or other financial instruments. The purpose of Sample Section 8 is to establish a framework to ensure transparency, fairness, and proper functioning of the securities market in Gujarat, India. It provides clarity on the various forms of securities that can be used, which helps in promoting investor confidence and maintaining a healthy financial environment.

The sample Section 8 - Forms of Securities for Gujarat, India is typically filed by the concerned business or individual seeking to issue securities in Gujarat. It is important to consult with legal and financial experts for specific guidance on filing requirements and procedures.

FAQ

Q: What are forms of securities in Gujarat, India?

A: Forms of securities in Gujarat, India can include shares, debentures, bonds, and units of mutual funds.

Q: What are shares?

A: Shares represent ownership in a company. When individuals purchase shares of a company, they become partial owners of that company.

Q: What are debentures?

A: Debentures are a type of long-term debt instrument issued by companies to borrow money. They usually have a fixed rate of interest and a specified maturity date.

Q: What are bonds?

A: Bonds are financial instruments used by governments, municipalities, and corporations to borrow money from investors. They typically have a fixed interest rate and a specific maturity date.

Q: What are units of mutual funds?

A: Units of mutual funds represent investments in professionally managed pools of funds collected from various investors. These funds are then invested in a diversified portfolio of securities.