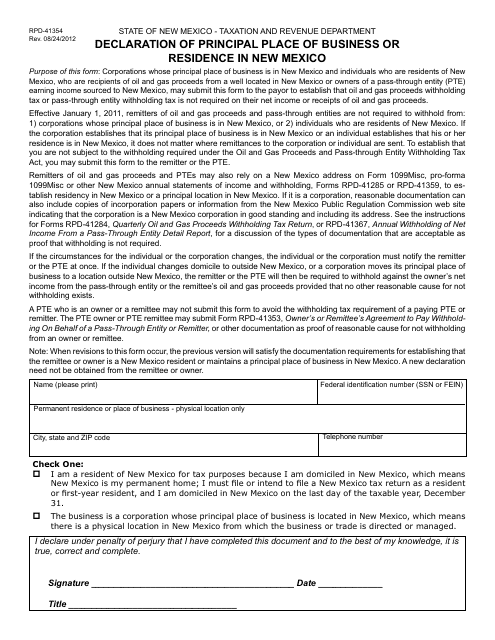

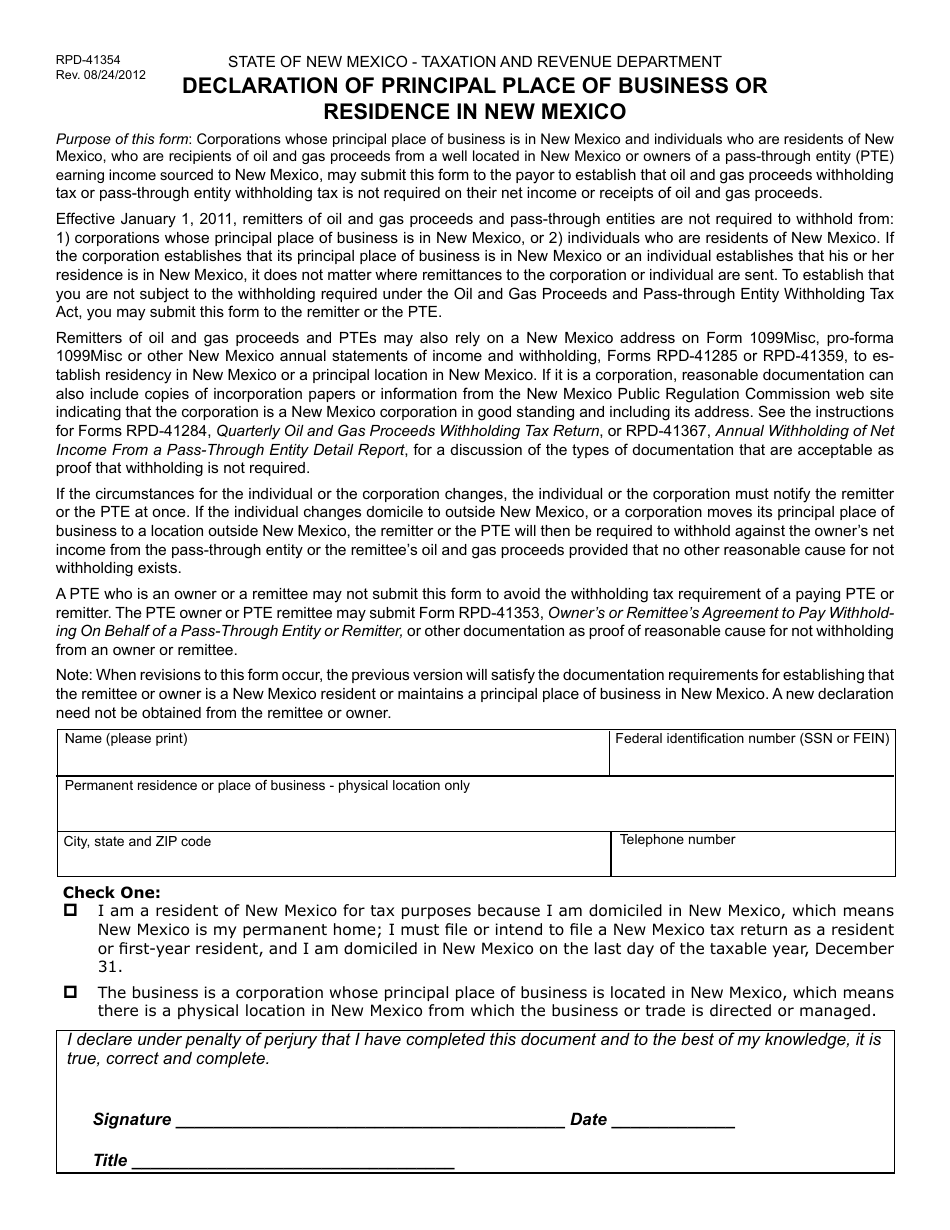

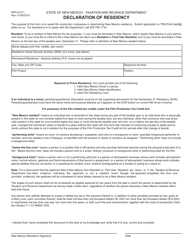

Form RPD-41354 Declaration of Principal Place of Business or Residence in New Mexico - New Mexico

What Is Form RPD-41354?

This is a legal form that was released by the New Mexico Taxation and Revenue Department - a government authority operating within New Mexico. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RPD-41354?

A: Form RPD-41354 is the Declaration of Principal Place of Business or Residence in New Mexico.

Q: Who needs to fill out Form RPD-41354?

A: Anyone who wants to declare their principal place of business or residence in New Mexico.

Q: What is the purpose of Form RPD-41354?

A: The purpose of this form is to declare the principal place of business or residence in New Mexico for tax purposes.

Q: Is Form RPD-41354 only for businesses?

A: No, this form can also be used by individuals to declare their principal place of residence in New Mexico.

Q: Do I need to submit additional documentation with Form RPD-41354?

A: No, you only need to complete and submit the form itself.

Q: Are there any fees associated with Form RPD-41354?

A: No, there are no fees required to file Form RPD-41354.

Q: When is the deadline for filing Form RPD-41354?

A: The deadline for filing Form RPD-41354 varies, so it is recommended to check the instructions or contact the New Mexico Taxation and Revenue Department for specific deadlines.

Q: What happens after I submit Form RPD-41354?

A: Once you submit Form RPD-41354, the New Mexico Taxation and Revenue Department will process your declaration and update their records accordingly.

Form Details:

- Released on August 24, 2012;

- The latest edition provided by the New Mexico Taxation and Revenue Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RPD-41354 by clicking the link below or browse more documents and templates provided by the New Mexico Taxation and Revenue Department.