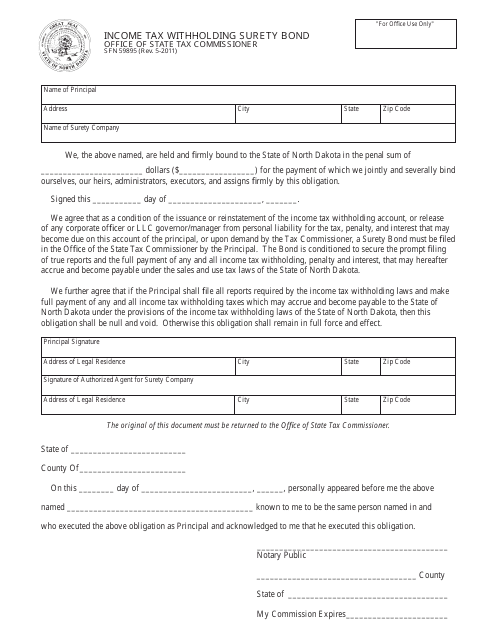

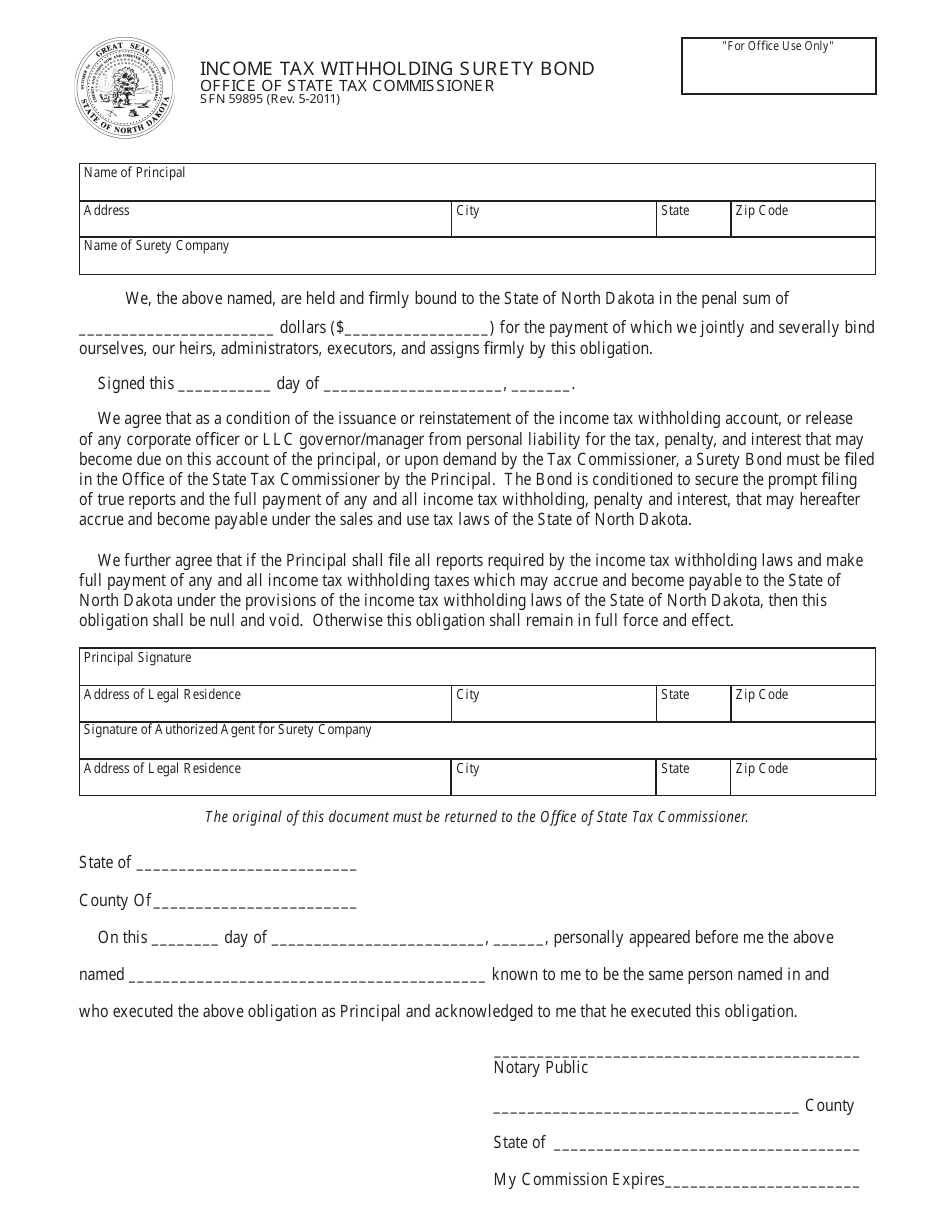

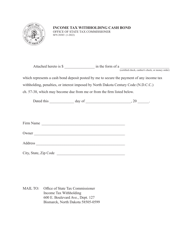

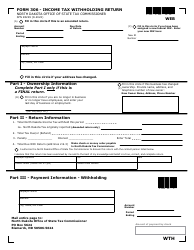

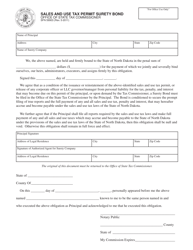

Form SFN59895 Income Tax Withholding Surety Bond - North Dakota

What Is Form SFN59895?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SFN59895?

A: Form SFN59895 is an Income Tax Withholding Surety Bond used in North Dakota.

Q: What is the purpose of Form SFN59895?

A: The purpose of Form SFN59895 is to serve as a surety bond for income tax withholding.

Q: Who needs to file Form SFN59895?

A: Anyone who is required to withhold income tax in North Dakota may need to file Form SFN59895.

Q: When should Form SFN59895 be filed?

A: Form SFN59895 should be filed prior to the due date for withholding tax payments.

Q: Is there a fee for filing Form SFN59895?

A: There may be a fee for filing Form SFN59895, depending on the specific circumstances. Contact the North Dakota Office of State Tax Commissioner for more information.

Q: Are there any penalties for not filing Form SFN59895?

A: Failure to file Form SFN59895 or inadequate bond coverage may result in penalties and interest.

Q: What supporting documents are required when filing Form SFN59895?

A: Supporting documents may include proof of surety bond coverage and any relevant tax information.

Q: Can I claim a refund on the surety bond?

A: No, the surety bond is not eligible for refund.

Q: Is Form SFN59895 specific to North Dakota?

A: Yes, Form SFN59895 is specific to income tax withholding in North Dakota.

Q: Who can I contact for more information about Form SFN59895?

A: For more information about Form SFN59895, you can contact the North Dakota Office of State Tax Commissioner.

Form Details:

- Released on May 1, 2011;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN59895 by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.