This version of the form is not currently in use and is provided for reference only. Download this version of

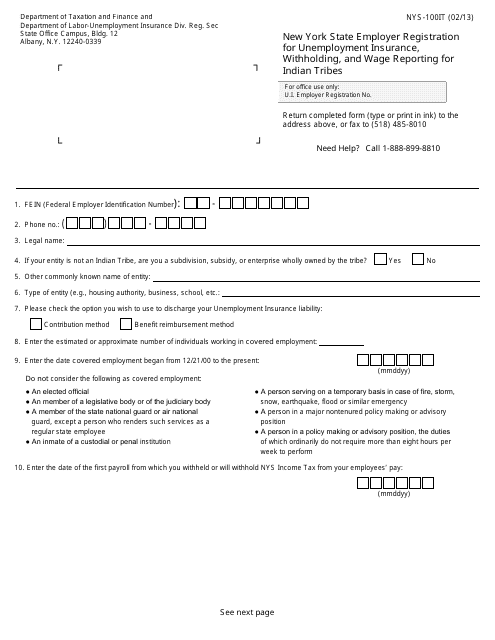

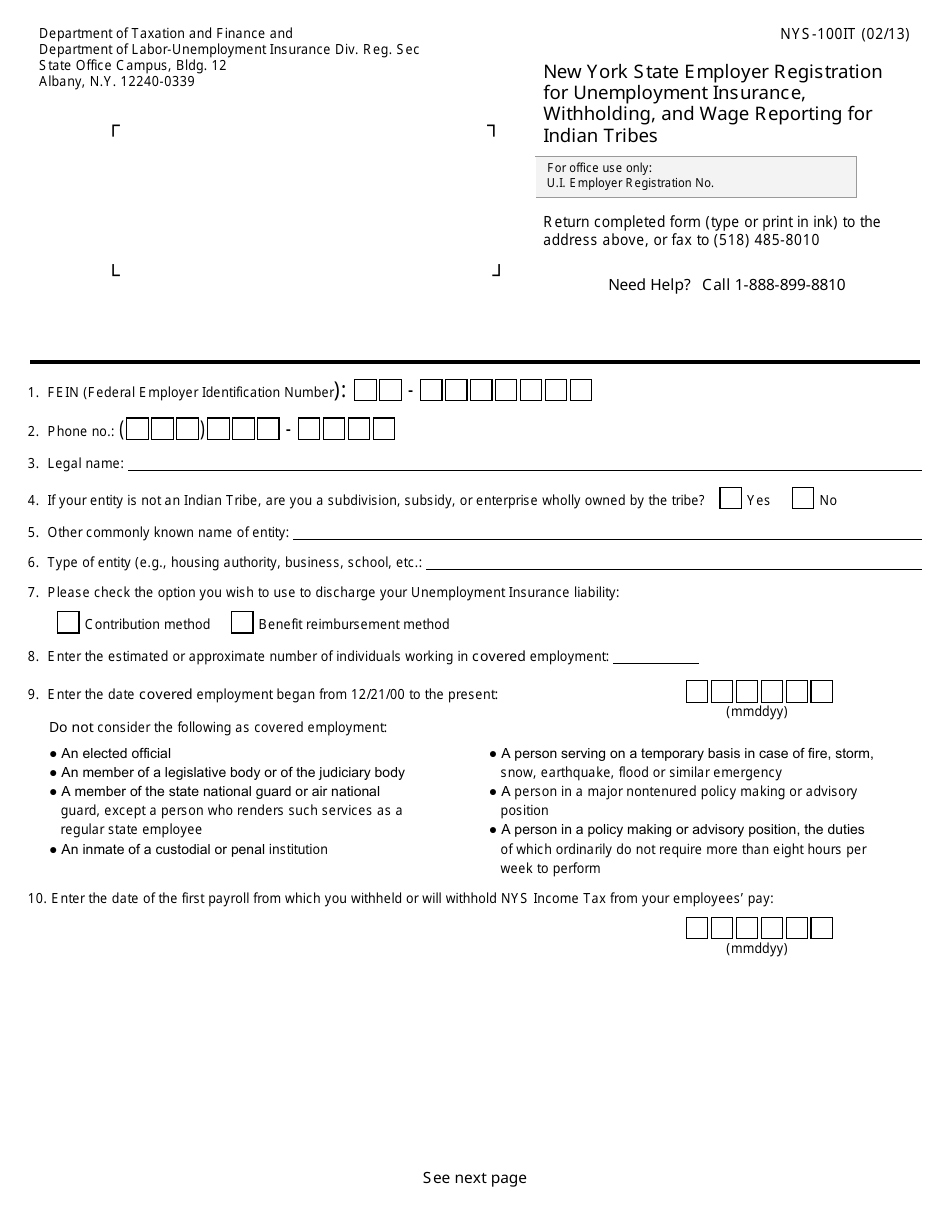

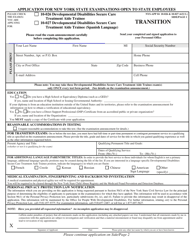

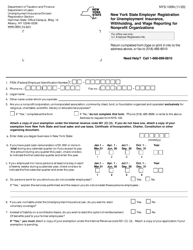

Form NYS-100IT

for the current year.

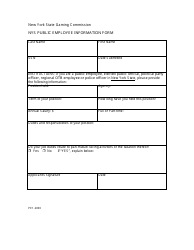

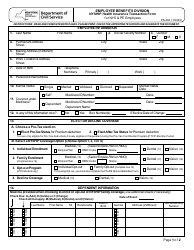

Form NYS-100IT New York State Employer Registration for Unemployment Insurance, Withholding, and Wage Reporting for Indian Tribes - New York

What Is Form NYS-100IT?

This is a legal form that was released by the New York State Department of Labor - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NYS-100IT?

A: Form NYS-100IT is the New York State Employer Registration form for Indian Tribes to register for Unemployment Insurance, Withholding, and Wage Reporting.

Q: Who should use Form NYS-100IT?

A: Indian Tribes in New York State who employ workers should use Form NYS-100IT to register for Unemployment Insurance, Withholding, and Wage Reporting.

Q: What is the purpose of Form NYS-100IT?

A: The purpose of Form NYS-100IT is to register Indian Tribes as employers in New York State for the purpose of Unemployment Insurance, Withholding, and Wage Reporting.

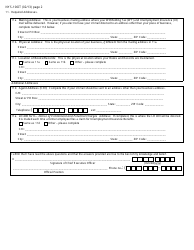

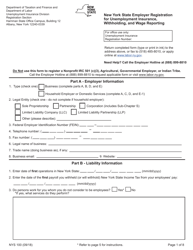

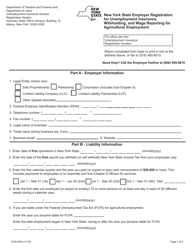

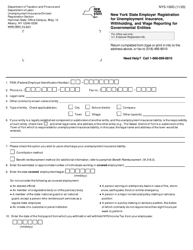

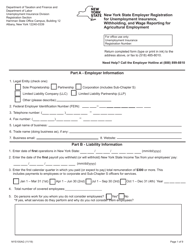

Q: What information is required on Form NYS-100IT?

A: Form NYS-100IT requires information about the Indian Tribe, including the name, address, and federal identification number, as well as information about the designated contacts and any related entities.

Q: When should Form NYS-100IT be filed?

A: Form NYS-100IT should be filed within 20 days of becoming an employer or within 20 days of taking over a business that has employees.

Q: Are there any fees associated with filing Form NYS-100IT?

A: There are no fees associated with filing Form NYS-100IT.

Q: What if there are changes to the information provided on Form NYS-100IT?

A: If there are changes to the information provided on Form NYS-100IT, the Indian Tribe should notify the New York State Department of Labor within 10 days of the change.

Q: What are the consequences of not filing Form NYS-100IT?

A: Failure to file Form NYS-100IT may result in penalties and interest.

Q: Is there any additional documentation required with Form NYS-100IT?

A: There may be additional documentation required depending on the specific circumstances of the Indian Tribe and its employees. It is recommended to review the instructions accompanying Form NYS-100IT for more information.

Form Details:

- Released on February 1, 2013;

- The latest edition provided by the New York State Department of Labor;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYS-100IT by clicking the link below or browse more documents and templates provided by the New York State Department of Labor.