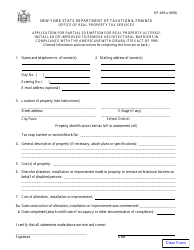

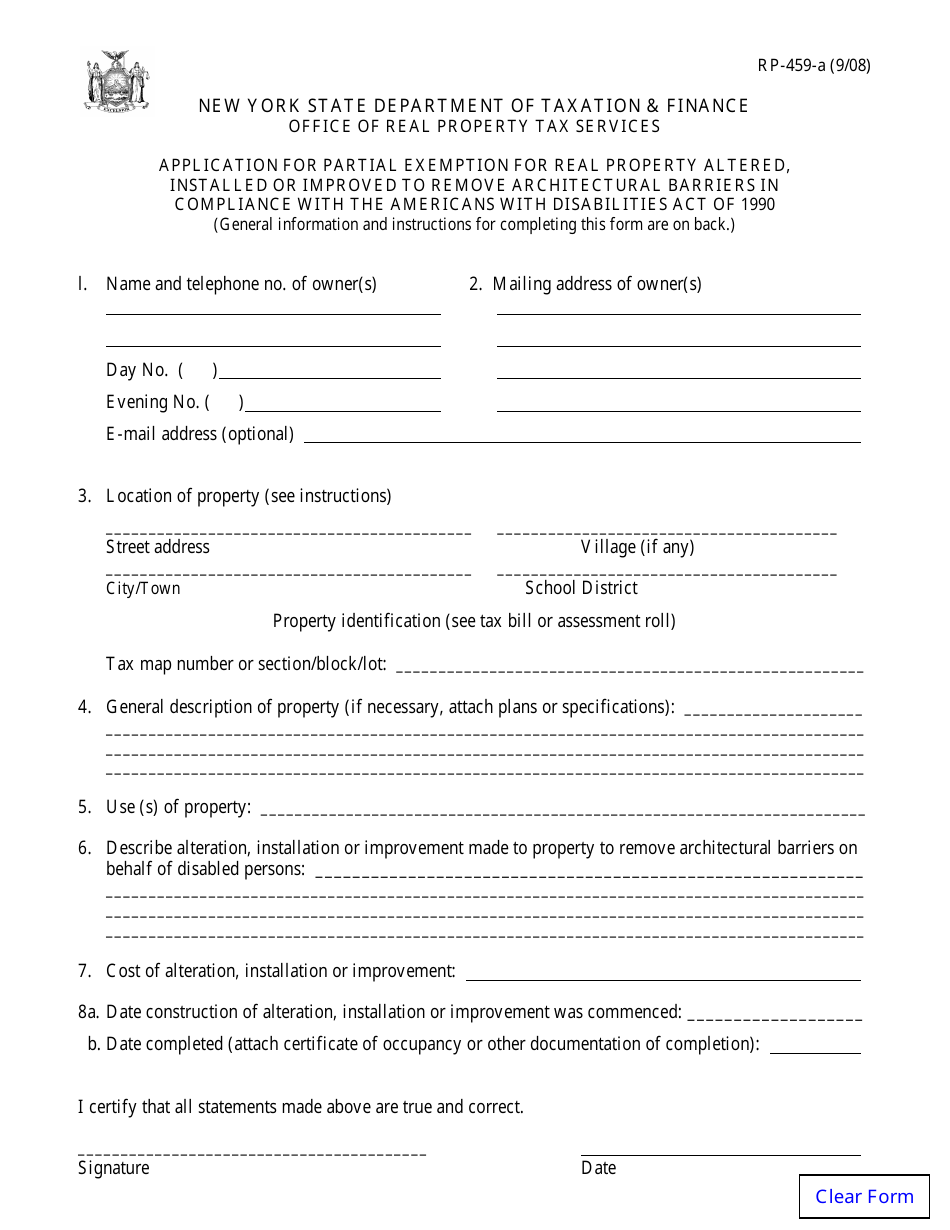

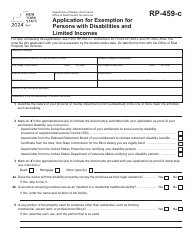

Form RP-459-A Application for Partial Exemption for Real Property Altered, Installed or Improved to Remove Architectural Barriers in Compliance With the Americans With Disabilities Act of 1990 - New York

What Is Form RP-459-A?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-459-A?

A: Form RP-459-A is an application for partial exemption for real property altered, installed, or improved to remove architectural barriers in compliance with the Americans with Disabilities Act of 1990 in New York.

Q: What is the purpose of Form RP-459-A?

A: The purpose of Form RP-459-A is to apply for a partial exemption for real property that has been modified to remove architectural barriers, in compliance with the Americans with Disabilities Act.

Q: Who should fill out Form RP-459-A?

A: Property owners or their authorized representatives should fill out Form RP-459-A.

Q: Is there a fee to file Form RP-459-A?

A: There is no fee to file Form RP-459-A.

Q: What documentation is required to be submitted with Form RP-459-A?

A: Documentation such as architectural plans, cost estimates, and evidence of compliance with ADA guidelines may be required to be submitted with Form RP-459-A.

Q: When is the deadline to file Form RP-459-A?

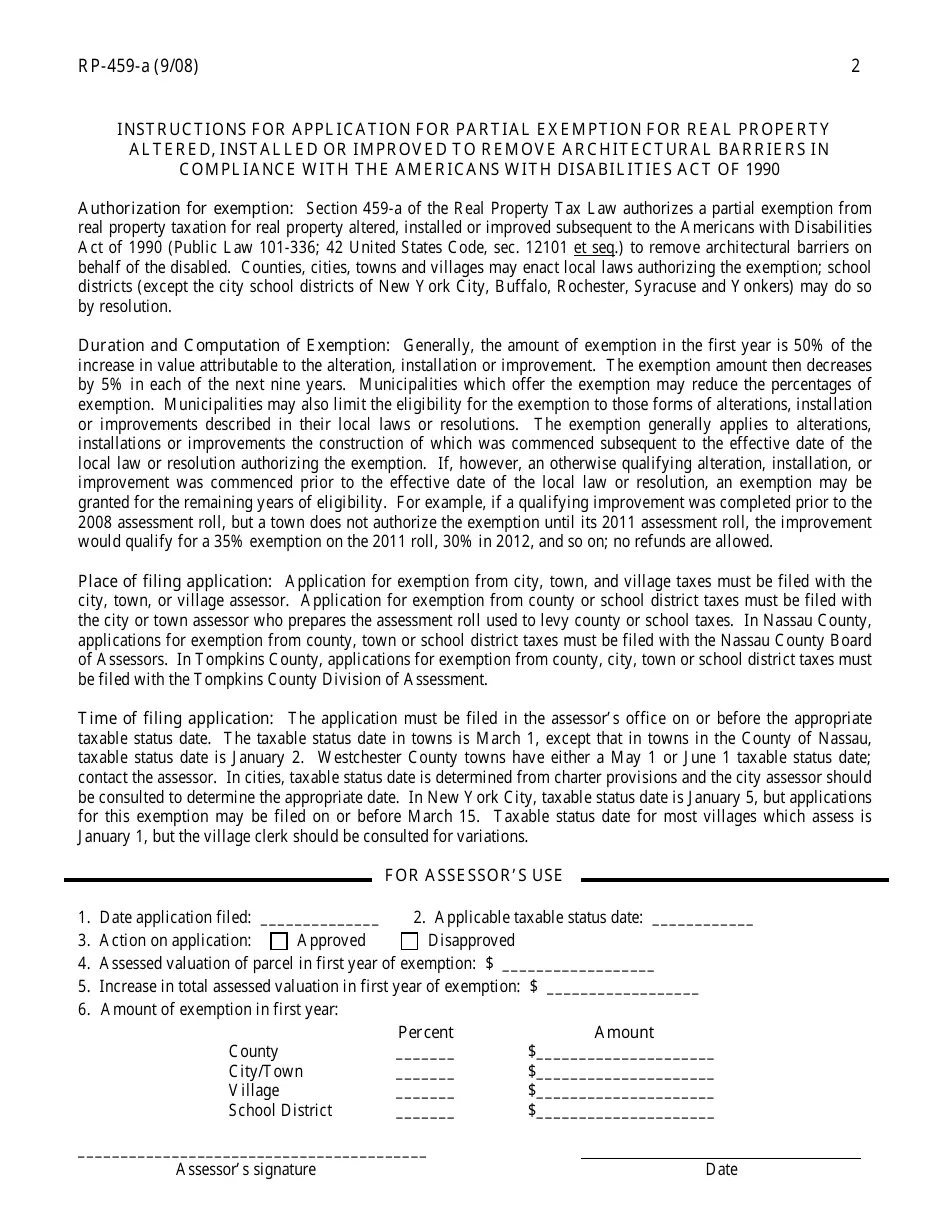

A: The deadline to file Form RP-459-A is typically March 1st, but it is recommended to check with your local assessor's office for the specific deadline.

Q: What happens after submitting Form RP-459-A?

A: After submitting Form RP-459-A, the assessor's office will review the application and may request additional information or schedule an inspection of the property.

Q: How long does the partial exemption last?

A: The partial exemption lasts for the length of time specified by the local governing body, typically up to five years.

Q: Can I renew the partial exemption?

A: Yes, the partial exemption can be renewed by filing a new application before the expiration date of the current exemption.

Form Details:

- Released on September 1, 2008;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-459-A by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.