This version of the form is not currently in use and is provided for reference only. Download this version of

Form RS6221

for the current year.

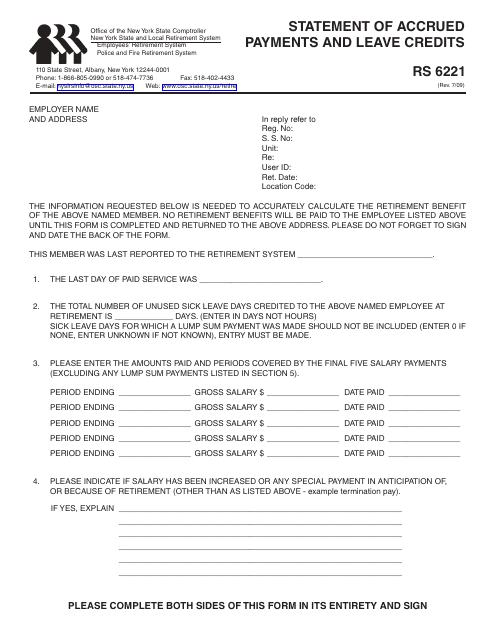

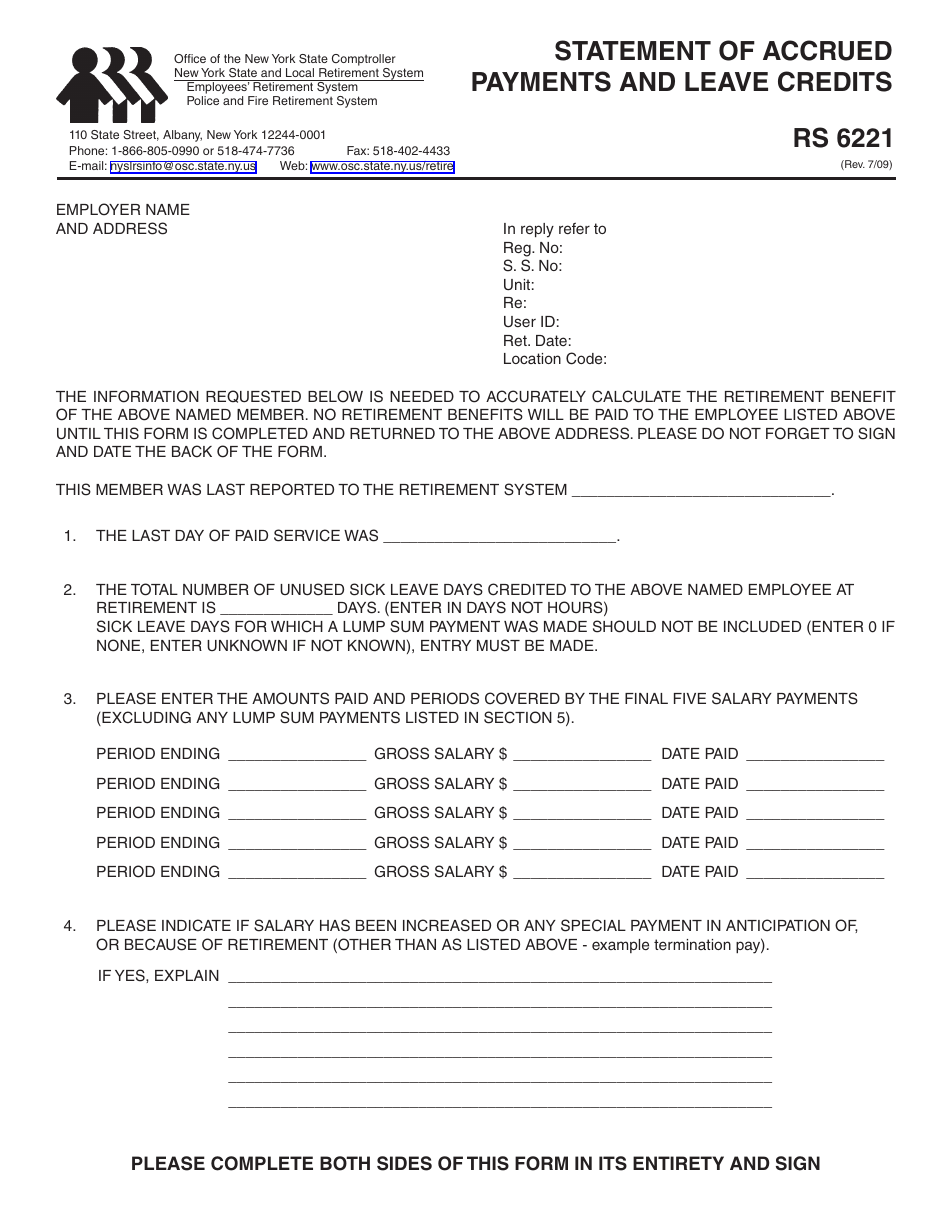

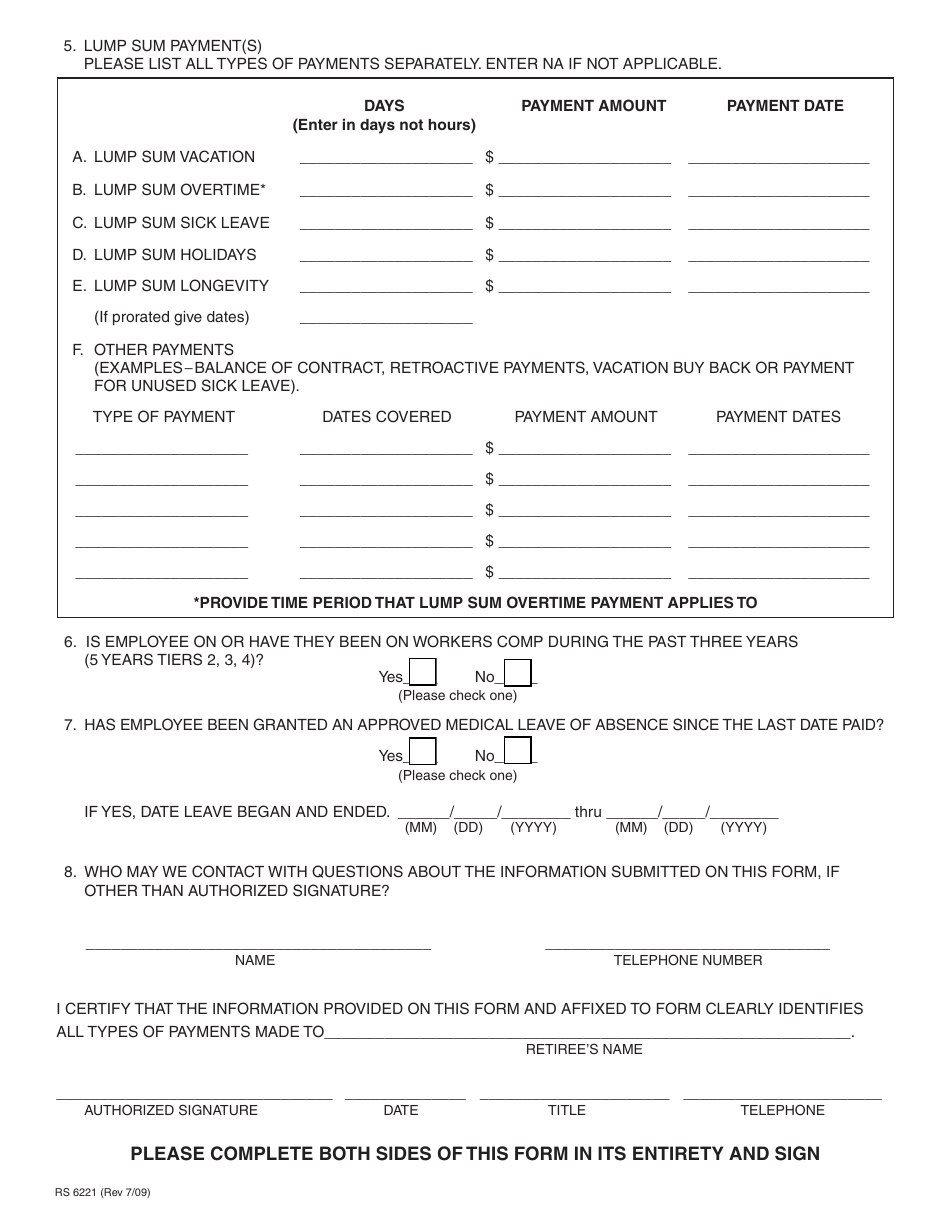

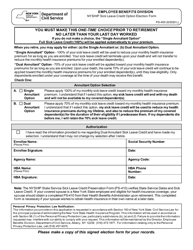

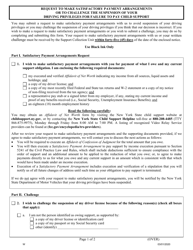

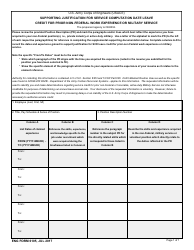

Form RS6221 Statement of Accrued Payments and Leave Credits - New York

What Is Form RS6221?

This is a legal form that was released by the Office of the New York State Comptroller - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RS6221?

A: Form RS6221 is the Statement of Accrued Payments and Leave Credits.

Q: Who should use Form RS6221?

A: Form RS6221 should be used by employees in New York.

Q: What information does Form RS6221 provide?

A: Form RS6221 provides information about accrued payments and leave credits.

Q: What is the purpose of Form RS6221?

A: The purpose of Form RS6221 is to report and track accrued payments and leave credits.

Q: Is Form RS6221 mandatory?

A: The requirement to use Form RS6221 may vary depending on the employer and state regulations. Please consult your employer or the appropriate government agency in New York.

Q: What should I do with Form RS6221 once completed?

A: Once completed, you should submit Form RS6221 to your employer or the appropriate government agency in New York, as instructed.

Q: Are there any deadlines for submitting Form RS6221?

A: Deadlines for submitting Form RS6221 may vary depending on employer and state regulations. Please consult your employer or the appropriate government agency in New York.

Q: Can I make corrections to Form RS6221?

A: You may be able to make corrections to Form RS6221 if needed. Please consult your employer or the appropriate government agency in New York for guidance.

Q: What should I do if I have additional questions about Form RS6221?

A: If you have additional questions about Form RS6221, you should contact your employer or the appropriate government agency in New York.

Form Details:

- Released on July 1, 2009;

- The latest edition provided by the Office of the New York State Comptroller;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RS6221 by clicking the link below or browse more documents and templates provided by the Office of the New York State Comptroller.