This version of the form is not currently in use and is provided for reference only. Download this version of

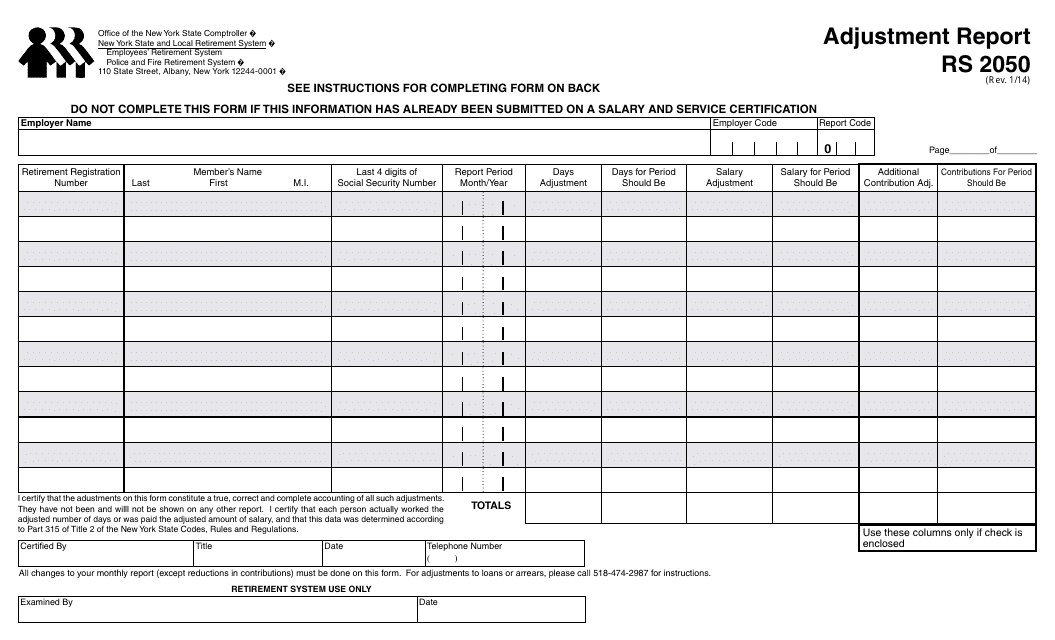

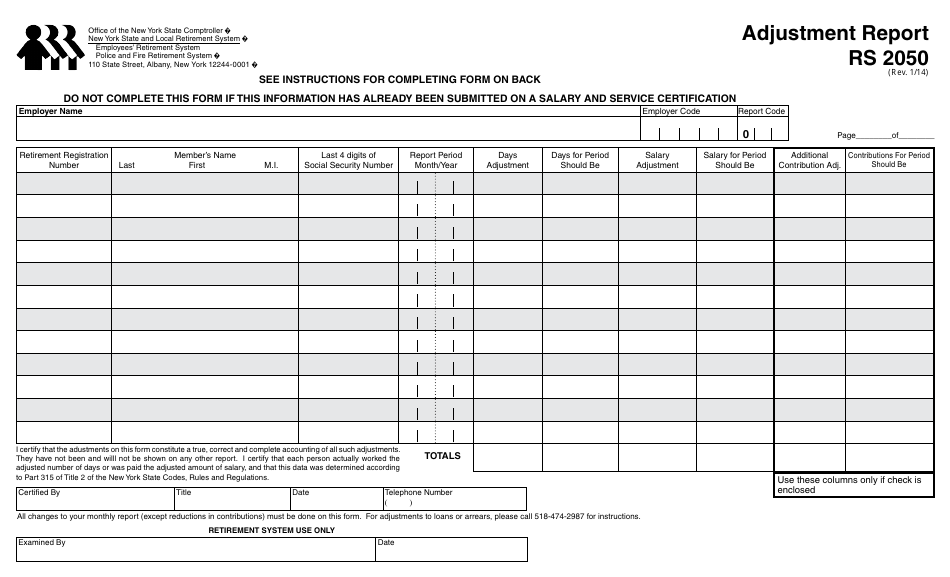

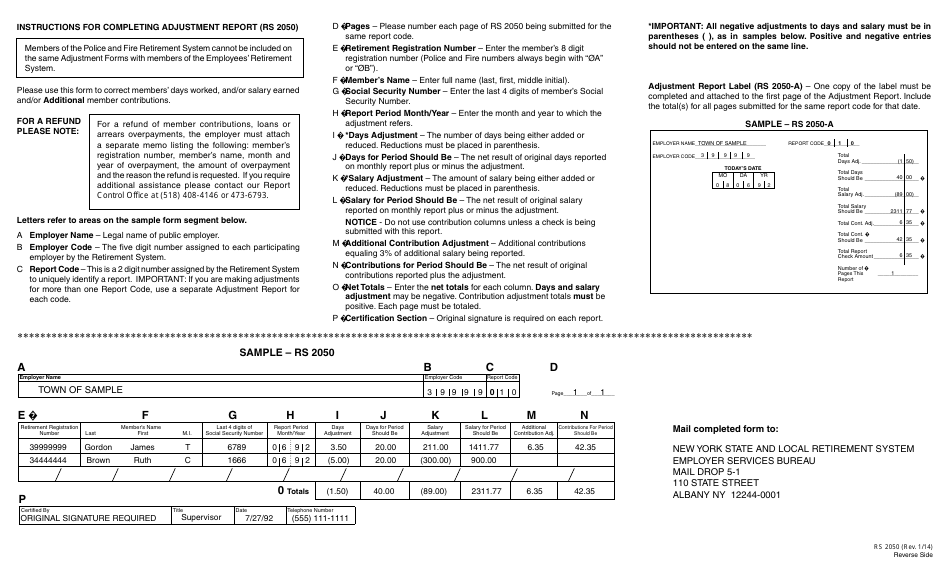

Form RS2050

for the current year.

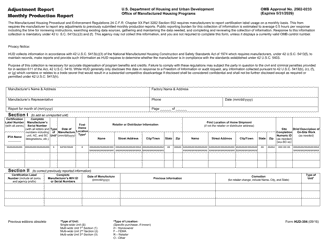

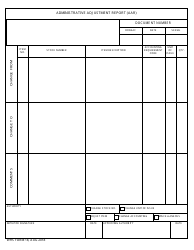

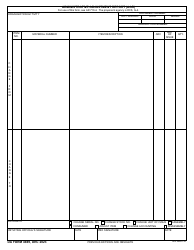

Form RS2050 Adjustment Report - New York

What Is Form RS2050?

This is a legal form that was released by the Office of the New York State Comptroller - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

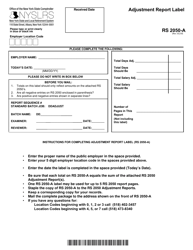

Q: What is Form RS2050?

A: Form RS2050 is an Adjustment Report.

Q: What is the purpose of Form RS2050?

A: The purpose of Form RS2050 is to report adjustments for New York state taxes.

Q: Who needs to file Form RS2050?

A: Anyone who needs to report adjustments for New York state taxes needs to file Form RS2050.

Q: Is there a deadline for filing Form RS2050?

A: Yes, Form RS2050 must be filed by the due date for the corresponding tax return.

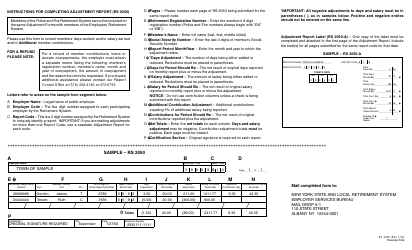

Q: Are there any supporting documents required for Form RS2050?

A: Yes, you may need to attach supporting documents, such as Schedule A or Schedule C, depending on the nature of your adjustments.

Q: How can I file Form RS2050?

A: You can file Form RS2050 by mail or electronically through the New York State Department of Taxation and Finance's e-file system.

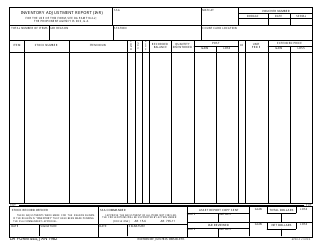

Q: What should I do if I made a mistake on my Form RS2050?

A: If you made a mistake on your Form RS2050, you should file an amended form as soon as possible to correct the error.

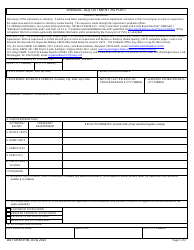

Form Details:

- Released on January 1, 2014;

- The latest edition provided by the Office of the New York State Comptroller;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RS2050 by clicking the link below or browse more documents and templates provided by the Office of the New York State Comptroller.