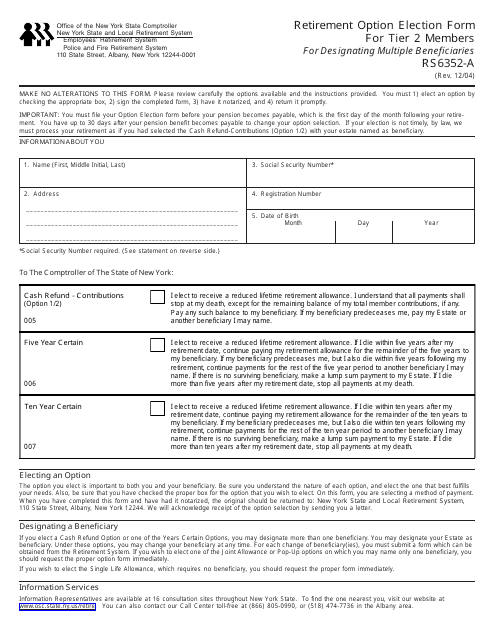

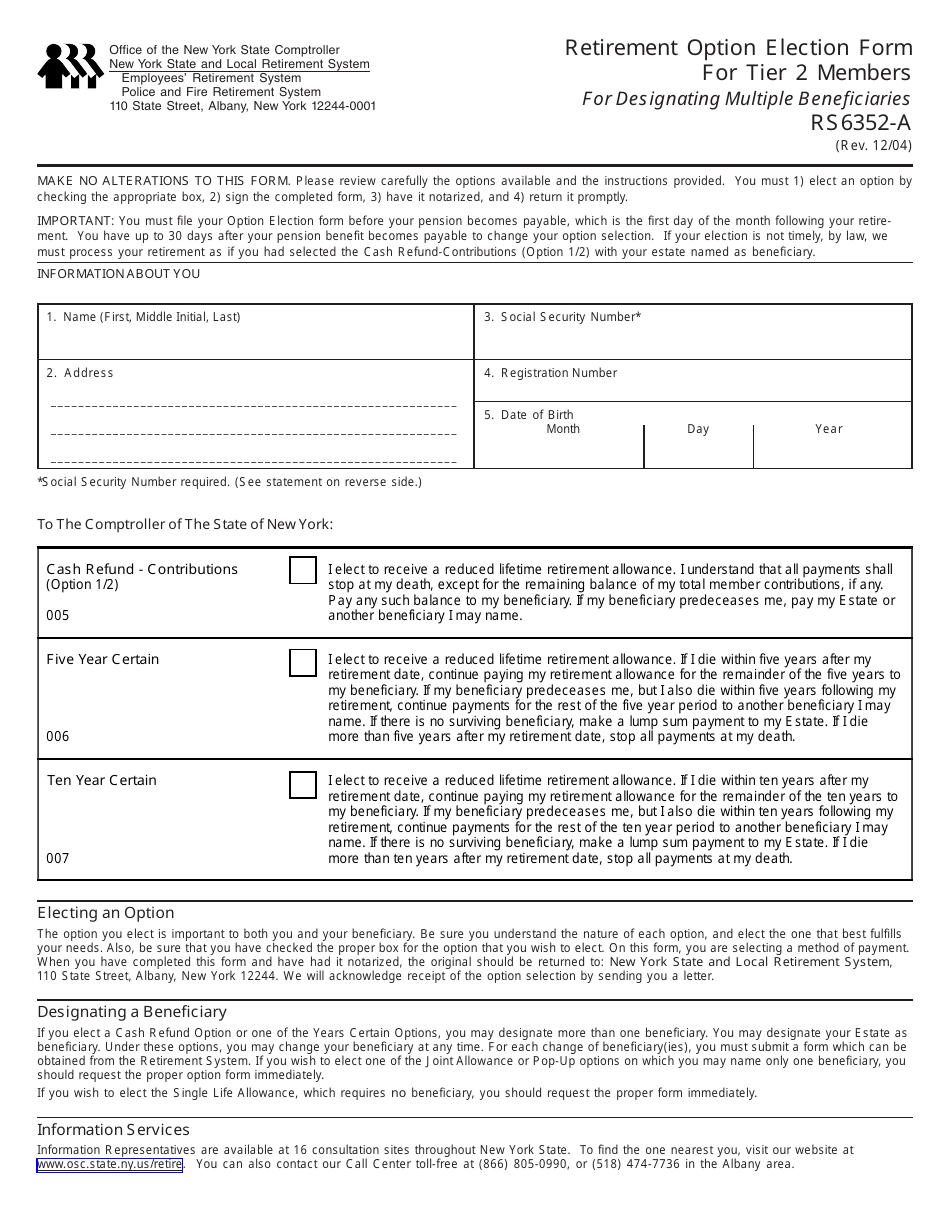

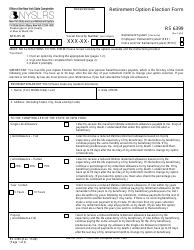

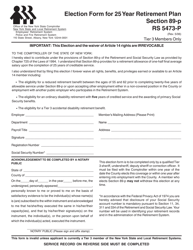

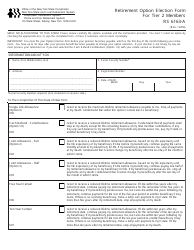

Form RS6352-A Retirement Option Election Form for Tier 2 Members for Designating Multiple Beneficiaries - New York

What Is Form RS6352-A?

This is a legal form that was released by the Office of the New York State Comptroller - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

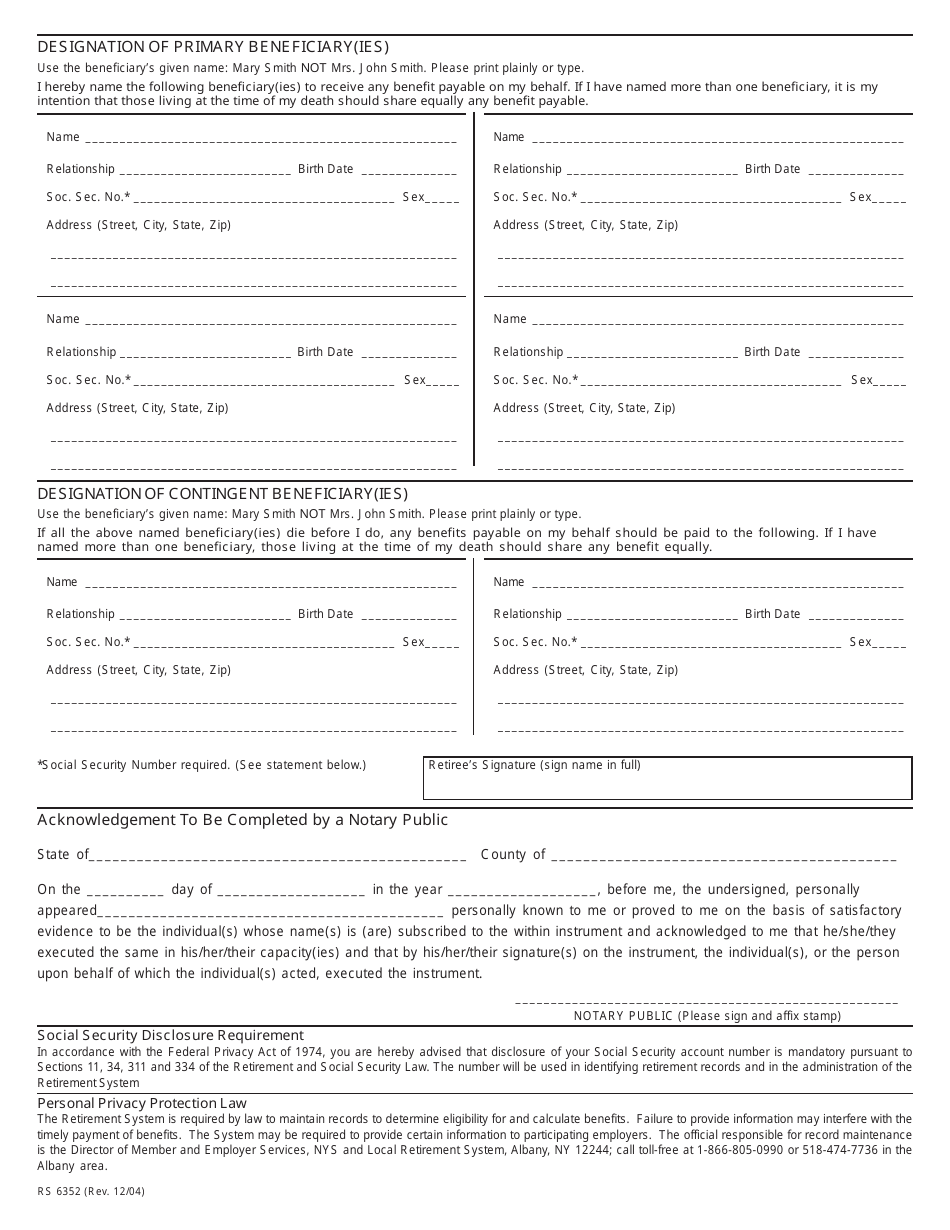

Q: What is the RS6352-A form?

A: The RS6352-A form is the Retirement Option Election Form for Tier 2 Members for Designating Multiple Beneficiaries in New York.

Q: Who is the form for?

A: The form is for Tier 2 members in New York who want to designate multiple beneficiaries for their retirement.

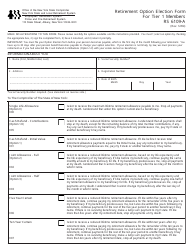

Q: What is the purpose of the form?

A: The form allows Tier 2 members to choose the retirement option and specify multiple beneficiaries to receive their benefits.

Q: Can I designate more than one beneficiary on this form?

A: Yes, the RS6352-A form is specifically for designating multiple beneficiaries.

Q: What benefits can be designated for the beneficiaries?

A: The form allows you to designate various benefits including a lifetime benefit, option for a lump sum payment, or a combination of both.

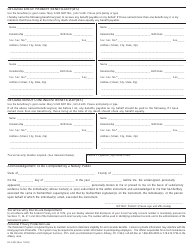

Q: Do I need to provide personal information about the beneficiaries?

A: Yes, you will need to provide the names, addresses, and social security numbers of all the beneficiaries you wish to designate.

Q: Is there a deadline to submit the form?

A: There may be a deadline determined by your employer or the retirement system. Contact your employer or check with the retirement system for specific submission deadlines.

Q: Can I make changes to the designations after submitting the form?

A: It depends on the rules of the retirement system. Contact the retirement system for information on making changes to beneficiary designations.

Form Details:

- Released on December 1, 2004;

- The latest edition provided by the Office of the New York State Comptroller;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RS6352-A by clicking the link below or browse more documents and templates provided by the Office of the New York State Comptroller.