Verification of Employment / Loss of Income Form - Sarasota County, Florida

What Is a Verification of Employment/Loss of Income Form?

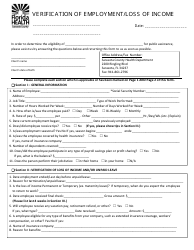

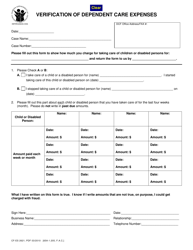

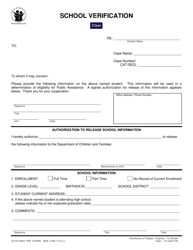

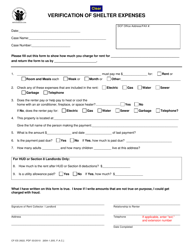

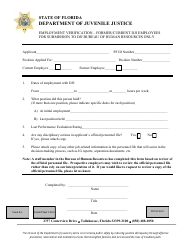

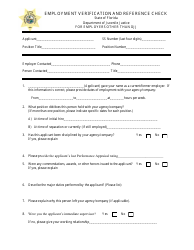

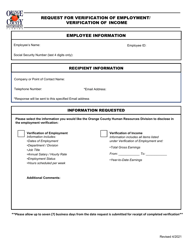

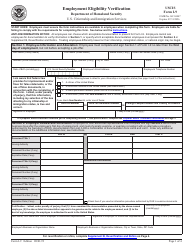

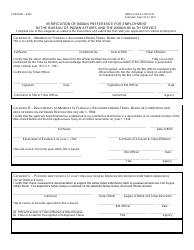

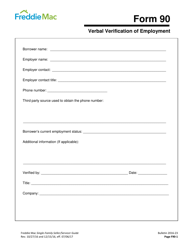

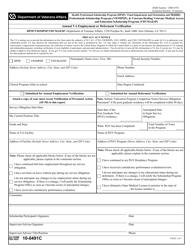

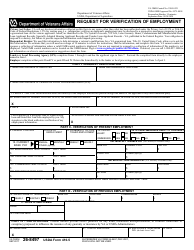

The Verification of Employment/Loss of Income Form is a legal document needed to confirm an applicant's eligibility for several assistance programs in Sarasota County and apply and manage for benefits. Whether you need Food Assistance to buy healthy food, Temporary Cash Assistance to help you become self-supporting and pay for your expenses and bills, or Medicaid to obtain coverage and save significantly on your bills, this is the document for you. Various forms can be completed in the eligibility determination process - for instance, Verification of Dependent Care Expenses, School Verification, and Verification of Shelter Expenses. A Verification of Employment form must be filled out and signed by your employer who receives the form with the name of the employee and the date by which the document must be filed.

This form was released by the Florida Department of Children and Families . The latest version of the form was issued on with all previous editions obsolete. You can download a fillable Sarasota County Verification of Employment/Loss of Income Form through the link below.

How to Fill Out a Verification of Employment/Loss of Income Form

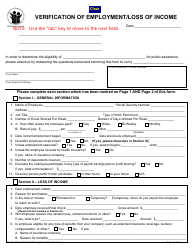

The Loss of Income Form instructions are as follows:

- Provide the general information - name, social security number, and address of the employee. Indicate the job title, type of work that is performed and where the job duties are performed. Record how many hours and days the applicant works per week and how often is the employee paid. State the date the current employment began or the date of previous employment. If the employee receives tips or the employment is seasonal, provide these details in the form. Write down the health insurance information if applicable. If the employee participates in the payroll savings plan or profit-sharing, record the balance;

- If the employment ended and entailed a loss of income, state the date it ended. Provide the reason for termination and indicate if the loss of income is permanent or temporary. Write down the date the employee received the final check and its gross amount. If the employee will receive any vacation pay, retirement refund, or any benefits from the company, record their type and amount;

- List the pay periods, dates of checks and cash, gross earnings, and rates of pay applied in the last four weeks. If the rate of pay or hours varied in this period indicate why;

- Confirm the statements in the form are true to the best of your knowledge and provide the employer information - the name of the business, employer's title, telephone number, and address. Sign and date the form.