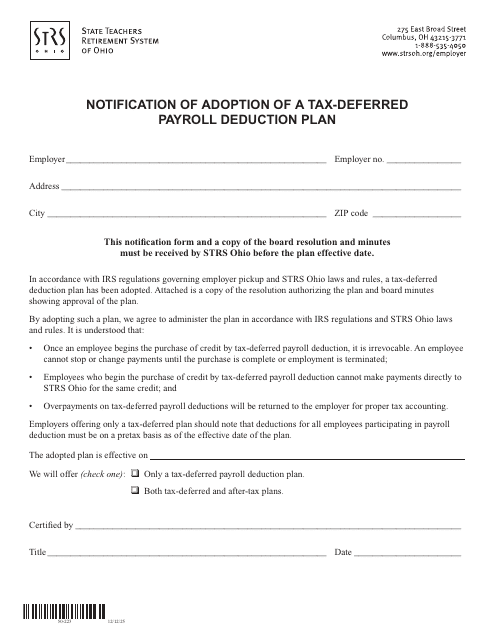

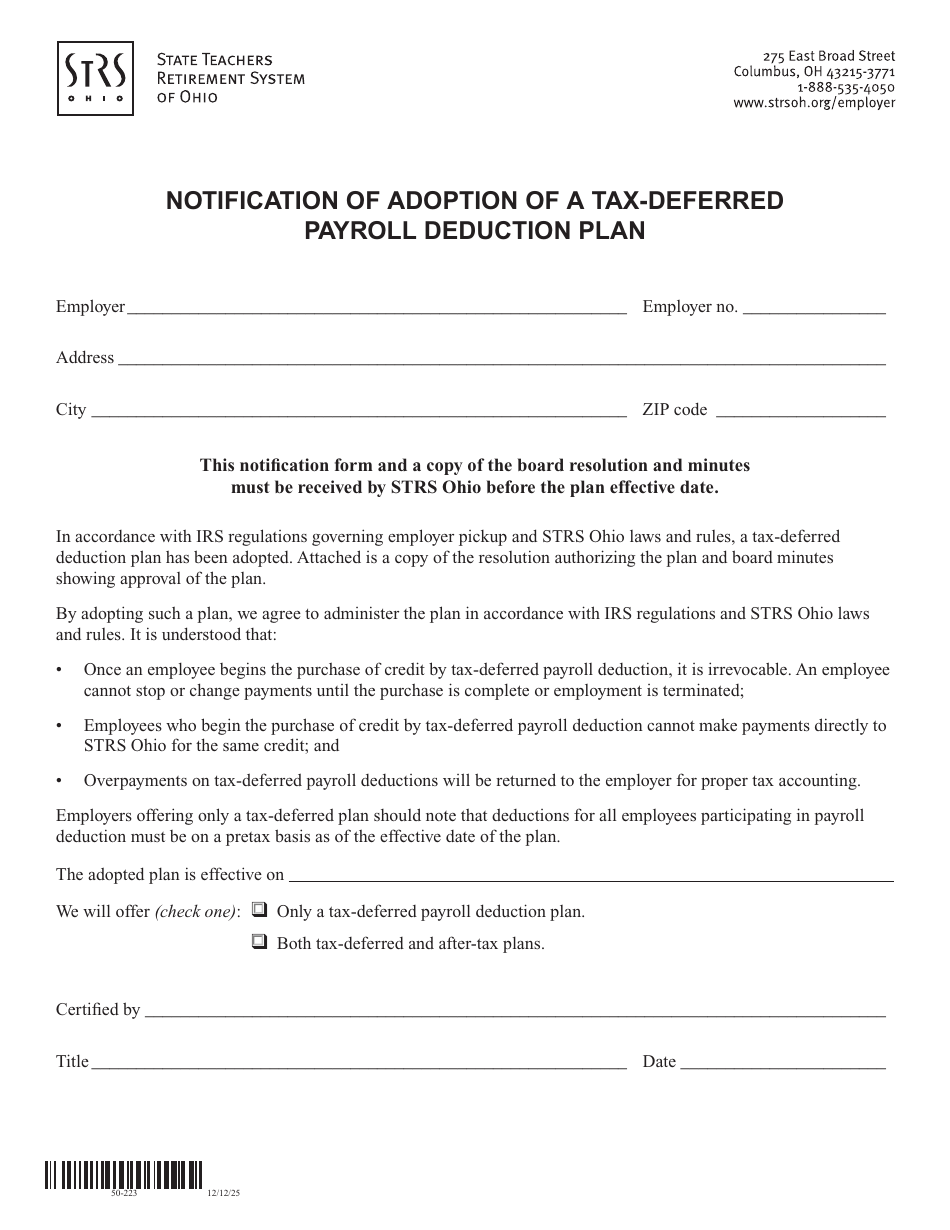

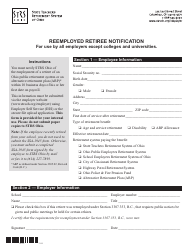

Notification of Adoption of a Tax-Deferred Payroll Deduction Plan - State Teachers Retirement System of Ohio - Ohio

The Notification of Adoption of a Tax-Deferred Payroll Deduction Plan is for Ohio state teachers who want to participate in a retirement savings plan that allows them to defer a portion of their salary for future retirement benefits on a tax-deferred basis.

The employer, in this case the State Teachers Retirement System of Ohio, would typically file the notification of adoption of a tax-deferred payroll deduction plan.

FAQ

Q: What is the Tax-Deferred Payroll Deduction Plan?

A: The Tax-Deferred Payroll Deduction Plan is a retirement savings plan offered by the State Teachers Retirement System of Ohio (STRS Ohio) that allows employees to contribute a portion of their salary to a retirement account before taxes are deducted.

Q: Who is eligible to participate in the Tax-Deferred Payroll Deduction Plan?

A: Employees who are members of STRS Ohio and meet certain requirements set by their employer are eligible to participate in the Tax-Deferred Payroll Deduction Plan.

Q: What are the benefits of participating in the Tax-Deferred Payroll Deduction Plan?

A: Participating in the Tax-Deferred Payroll Deduction Plan allows employees to save for retirement on a tax-deferred basis, meaning they don't pay taxes on their contributions until they withdraw the money in retirement. Additionally, some employers may offer matching contributions, which can help employees increase their retirement savings.

Q: How much can employees contribute to the Tax-Deferred Payroll Deduction Plan?

A: The maximum amount employees can contribute to the Tax-Deferred Payroll Deduction Plan is determined by the Internal Revenue Service (IRS) and may vary each year. For 2021, the maximum contribution limit is $19,500.

Q: Can employees change their contribution amount?

A: Yes, employees can change their contribution amount at any time, within the limits set by the IRS. It's important to note that making changes to contributions may have tax implications, so it's best to consult with a financial advisor or tax professional before making any changes.

Q: What happens if an employee leaves their job?

A: If an employee leaves their job, they generally have several options for their retirement account, including rolling the funds over to another qualified retirement plan, leaving the funds with STRS Ohio, or cashing out the funds. Each option may have different tax implications, so it's important to carefully consider the best option for individual circumstances.