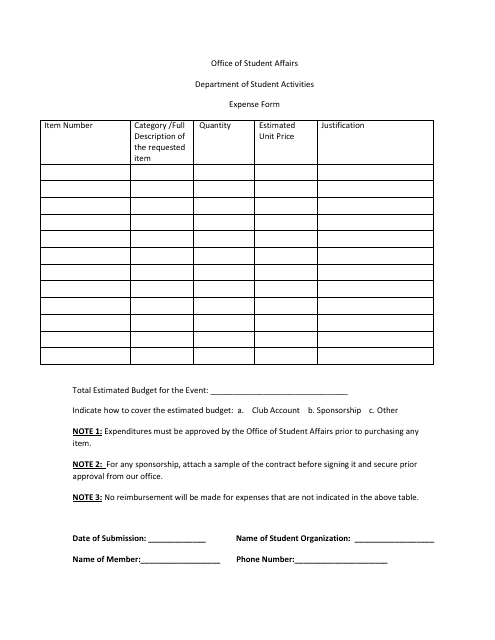

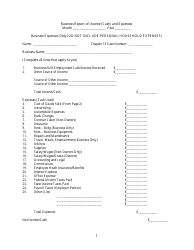

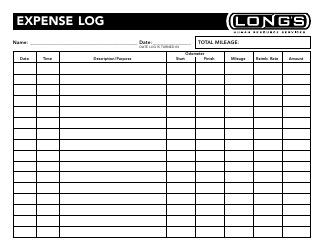

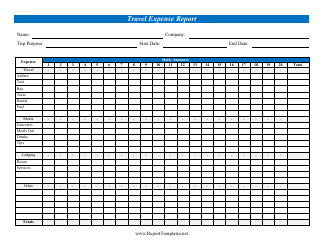

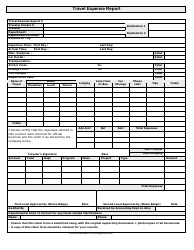

Expense Form

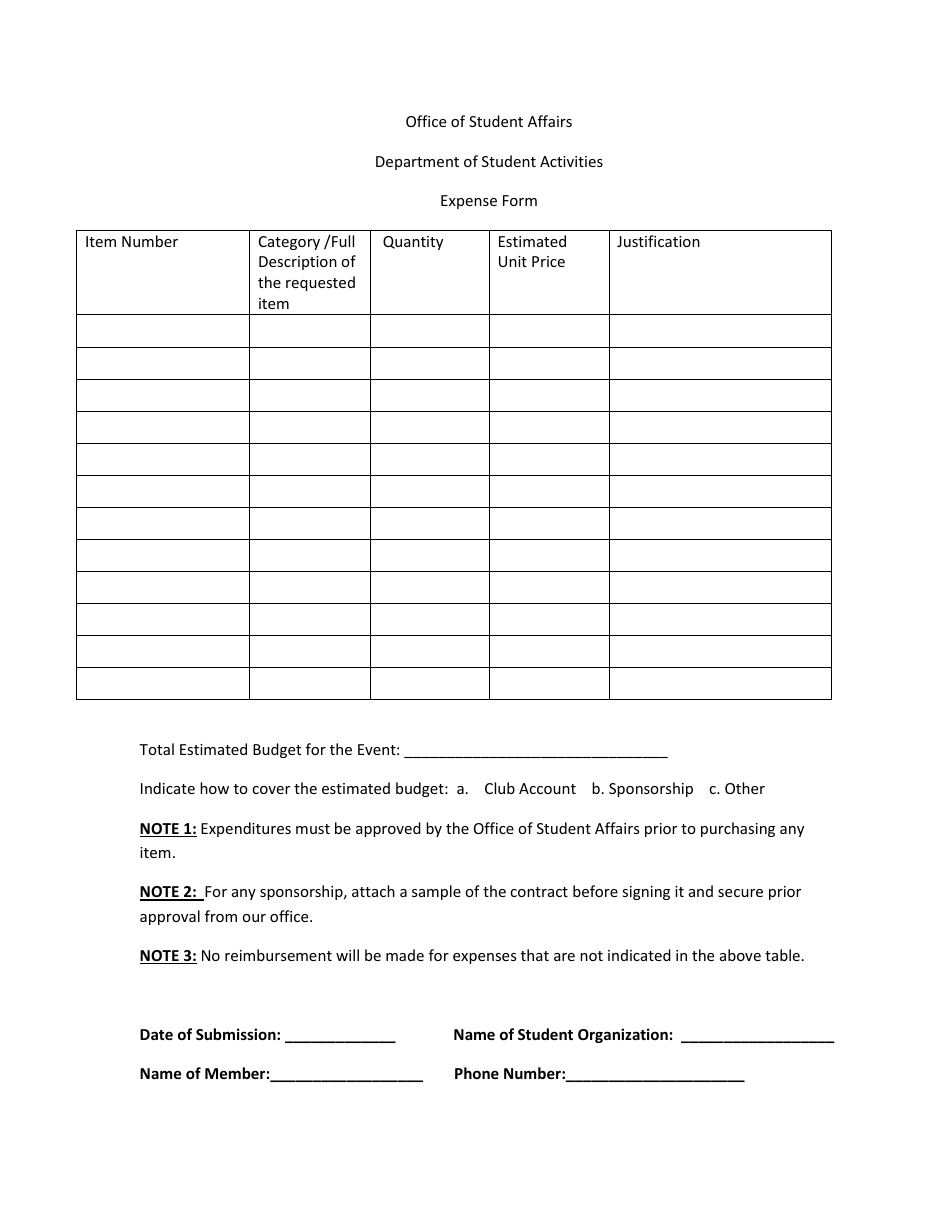

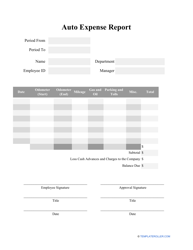

Expense forms are used to track and report expenses incurred by an individual or organization. They help to keep a record of all the costs associated with business trips, purchases, or other activities, allowing for reimbursement or tax deductions.

The person who incurred the expenses typically files the expense form.

FAQ

Q: What is an expense form?

A: An expense form is a document used to record and report expenses incurred by an individual or organization.

Q: Why is an expense form important?

A: Expense forms are important as they help track and manage expenses, ensure accurate reimbursement, and maintain financial records.

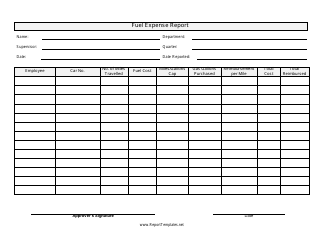

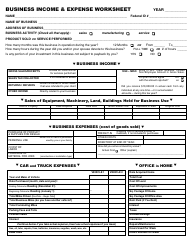

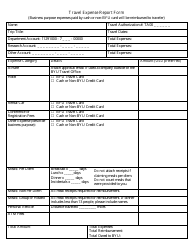

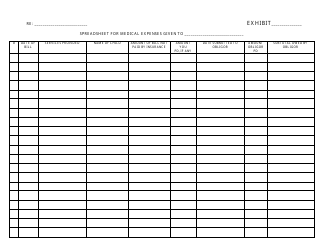

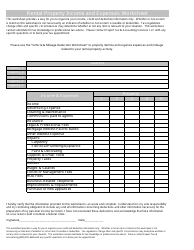

Q: What information is typically required on an expense form?

A: Common information required on an expense form includes the date of the expense, a description of the expense, the amount spent, and any supporting documentation like receipts.

Q: Who needs to fill out an expense form?

A: Anyone who needs to be reimbursed for business-related expenses or wishes to claim eligible deductions should fill out an expense form. This can include employees, freelancers, contractors, and self-employed individuals.

Q: Are there any rules or guidelines for filling out an expense form?

A: Yes, guidelines may vary depending on your organization or employer. Generally, it is important to accurately and honestly report the expenses, provide necessary documentation, and adhere to any specific policies or limitations.

Q: How long should I keep my expense forms?

A: It is advisable to keep your expense forms and supporting documentation for a minimum of three to seven years. This helps in case of audits or if you need to refer back to the expenses at a later date.

Q: Can I claim personal expenses on an expense form?

A: No, expense forms are typically used for business-related expenses only. Personal expenses are not eligible for reimbursement or deduction unless specifically allowed by your employer or for specific tax purposes.

Q: What happens after I submit an expense form?

A: After you submit an expense form, it will be reviewed by the appropriate authority, such as your supervisor or the finance department. If approved, you may receive reimbursement or have the expenses accounted for accordingly.

Q: Can I make changes to an expense form after it has been submitted?

A: It depends on your organization's policies. Some may allow limited changes if the form has not yet been processed, while others may require you to submit a revised form. It's best to check with your employer or the relevant department for guidance.