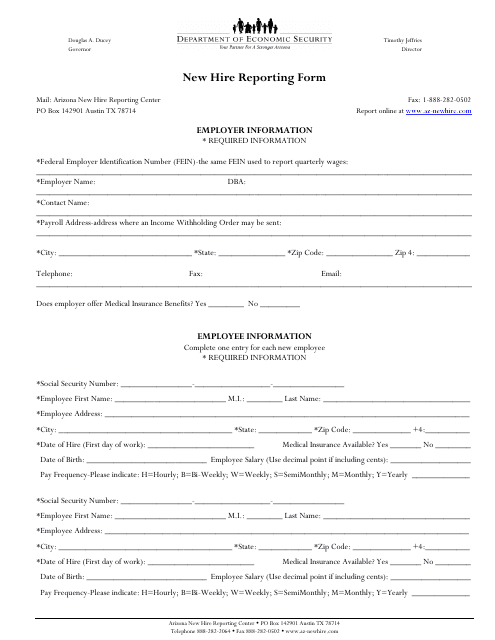

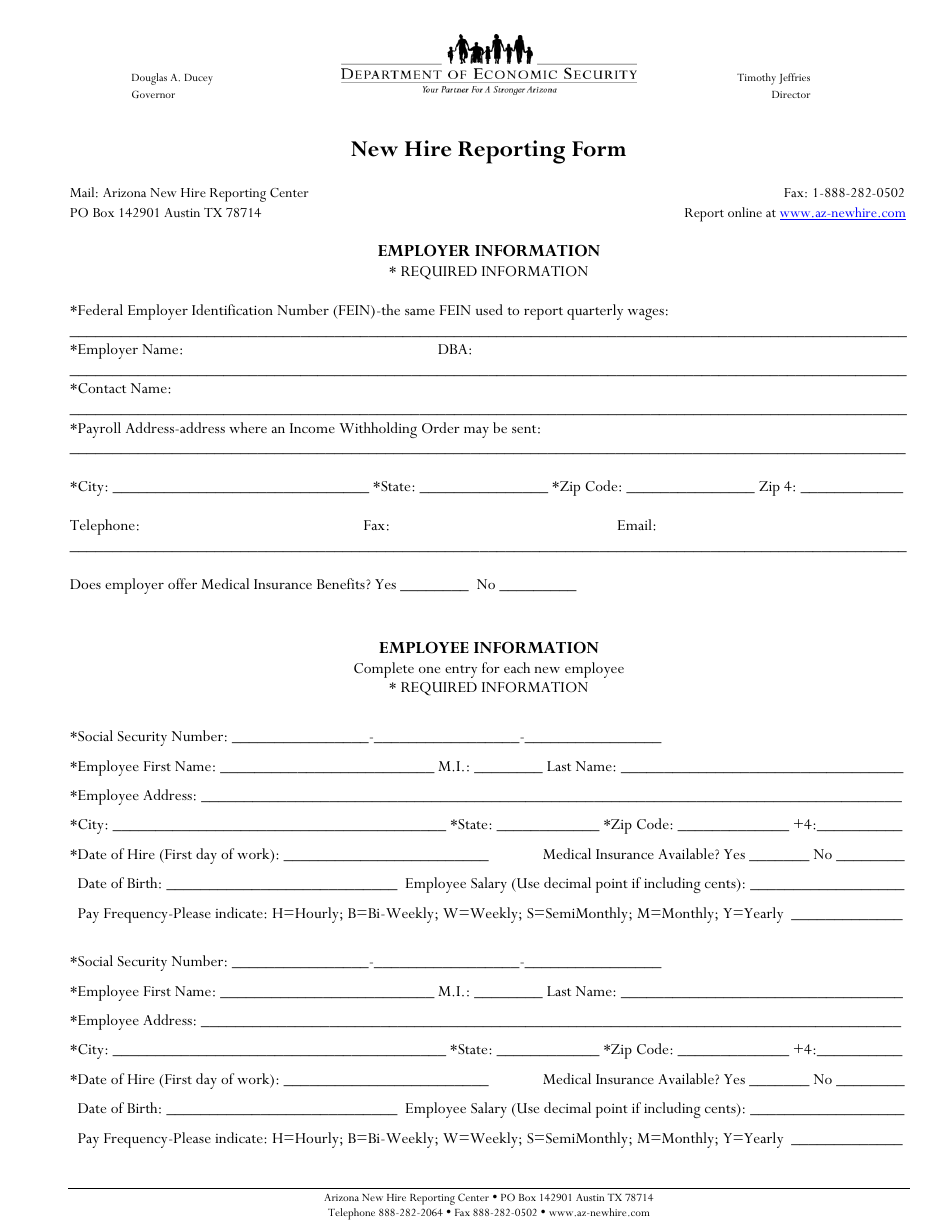

New Hire Reporting Form - Arizona

New Hire Reporting Form is a legal document that was released by the Arizona Department of Economic Security - a government authority operating within Arizona.

FAQ

Q: What is the New Hire Reporting Form?

A: The New Hire Reporting Form is a document used in Arizona to report newly hired employees.

Q: Who needs to file the New Hire Reporting Form?

A: Employers in Arizona are required to file the New Hire Reporting Form for all newly hired employees.

Q: When should the New Hire Reporting Form be filed?

A: The New Hire Reporting Form should be filed within 20 days of the employee's hire date.

Q: What information is required on the New Hire Reporting Form?

A: The New Hire Reporting Form requires information such as the employee's name, social security number, and address.

Q: Why is the New Hire Reporting Form important?

A: The New Hire Reporting Form is important because it helps enforce child support orders and prevents fraud in public assistance programs.

Q: Is there a penalty for not filing the New Hire Reporting Form?

A: Yes, there can be penalties for employers who fail to file the New Hire Reporting Form, including monetary fines.

Q: Do I need to file a separate New Hire Reporting Form for each employee?

A: Yes, a separate New Hire Reporting Form should be filed for each newly hired employee.

Form Details:

- The latest edition currently provided by the Arizona Department of Economic Security;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Arizona Department of Economic Security.