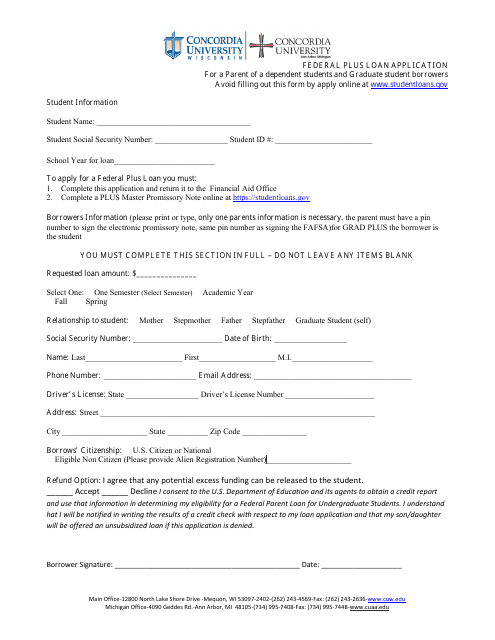

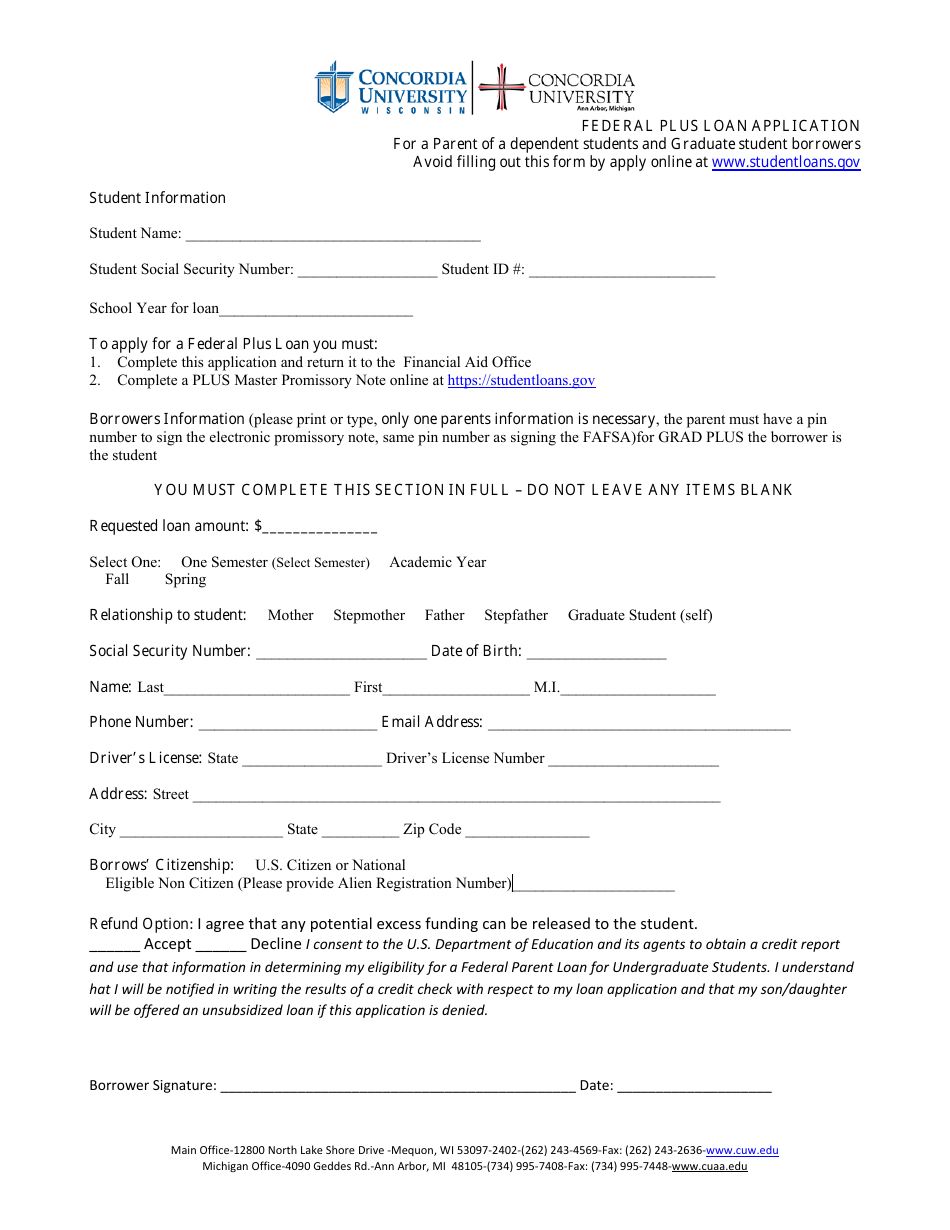

Federal Plus Loan Application Form for a Parent of a Dependent Students and Graduate Student Borrowers - Concordia University

The Federal PLUS Loan Application form for a parent of a dependent student or graduate student borrowers is used by individuals who are seeking financial aid to cover the cost of education at Concordia University. This form is specifically for applying for the Federal PLUS Loan, which is a type of loan available to parents and graduate students to help meet the expenses of their education. The form allows the applicant to provide necessary information about their financial situation, allowing the university or the financial aid office to evaluate their eligibility for the loan.

The Federal PLUS Loan application form for a parent of a dependent student or a graduate student borrower is typically filed by the parent or the graduate student borrower themselves. In the case of Concordia University, the parent or graduate student borrower would need to submit the form directly to the university's financial aid office or follow the specific instructions provided by the university.

FAQ

Q: What is a Federal Plus Loan?

A: A Federal Plus Loan is a loan program offered by the U.S. Department of Education to help parents of dependent undergraduate students and graduate students cover education expenses that are not met by other financial aid.

Q: Who is eligible to apply for a Federal Plus Loan?

A: Parents of dependent undergraduate students and graduate students who meet the eligibility criteria can apply for a Federal Plus Loan. The student must be enrolled at least half-time at an eligible institution.

Q: How can I apply for a Federal Plus Loan?

A: To apply for a Federal Plus Loan, you need to complete the Free Application for Federal Student Aid (FAFSA) and then submit a Federal Plus Loan Application Form to the school's financial aid office.

Q: What are the eligibility criteria for a Federal Plus Loan?

A: To be eligible for a Federal Plus Loan, you must be a U.S. citizen or eligible non-citizen, have a good credit history, and meet other general eligibility requirements imposed by the U.S. Department of Education.

Q: How much can I borrow with a Federal Plus Loan?

A: The amount you can borrow with a Federal Plus Loan is determined by the cost of attendance at the institution minus any other financial aid received. There is no maximum loan limit, but you cannot borrow more than the cost of attendance.

Q: What is the interest rate for a Federal Plus Loan?

A: The interest rate for a Federal Plus Loan is fixed and set annually by the U.S. Department of Education. It may vary from year to year.

Q: Is there a fee to apply for a Federal Plus Loan?

A: Yes, there is a loan origination fee associated with Federal Plus Loans. The fee percentage is set by the U.S. Department of Education and deducted from the loan disbursement.

Q: When do I have to start repaying a Federal Plus Loan?

A: Repayment for a Federal Plus Loan generally starts within 60 days after the final disbursement of the loan. However, you have the option to defer the repayment while the student is enrolled at least half-time.

Q: Are there any repayment options for Federal Plus Loans?

A: Yes, there are several repayment options available for Federal Plus Loans, including standard repayment, extended repayment, graduated repayment, and income-contingent repayment. You can choose the option that best suits your financial situation.

Q: What happens if I am unable to repay a Federal Plus Loan?

A: If you are unable to repay a Federal Plus Loan, you should contact the loan servicer immediately. There are options available, such as loan deferment, forbearance, or income-driven repayment plans, to help borrowers who experience financial difficulties.