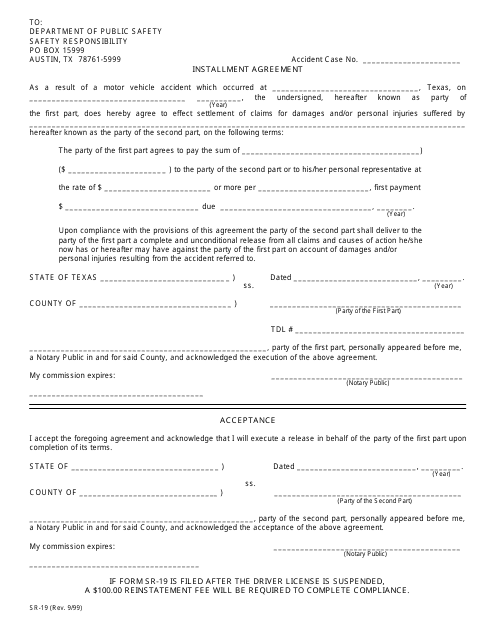

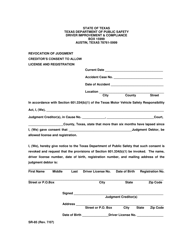

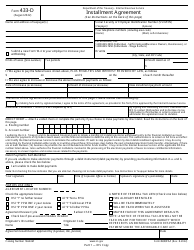

Form SR-19 Installment Agreement - Texas

What Is Form SR-19?

This is a legal form that was released by the Texas Department of Public Safety - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

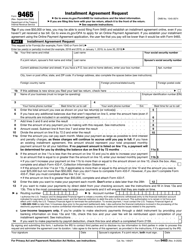

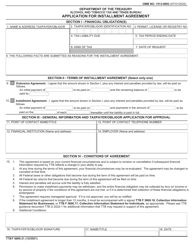

Q: What is Form SR-19?

A: Form SR-19 is a document used in Texas to apply for an installment agreement with the Department of Motor Vehicles (DMV).

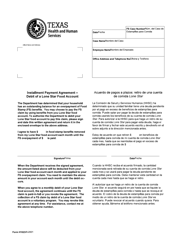

Q: What is an installment agreement?

A: An installment agreement is a payment plan that allows you to pay off your taxes or fees in smaller, more manageable amounts over time.

Q: Who can use Form SR-19?

A: Texas residents who owe taxes or fees to the DMV and cannot afford to pay the full amount upfront.

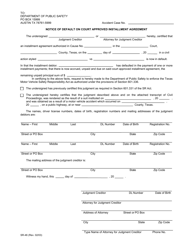

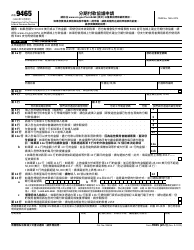

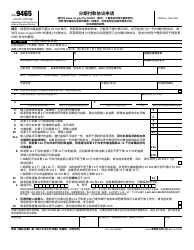

Q: What information do I need to fill out Form SR-19?

A: You will need to provide your personal information, the amount you owe, and details about your financial situation.

Q: How do I submit Form SR-19?

A: You can submit the form by mail, fax, or in person at your local DMV office.

Q: What happens after I submit Form SR-19?

A: The DMV will review your application and determine if you qualify for an installment agreement.

Q: What are the benefits of an installment agreement?

A: An installment agreement allows you to pay off your taxes or fees over time, avoiding the need for a large upfront payment.

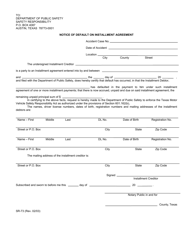

Q: What happens if I miss a payment on my installment agreement?

A: Missing a payment on your installment agreement can result in penalties and additional fees.

Q: Can I pay off my installment agreement early?

A: Yes, you can pay off your installment agreement early without any penalties.

Form Details:

- Released on September 1, 1999;

- The latest edition provided by the Texas Department of Public Safety;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SR-19 by clicking the link below or browse more documents and templates provided by the Texas Department of Public Safety.