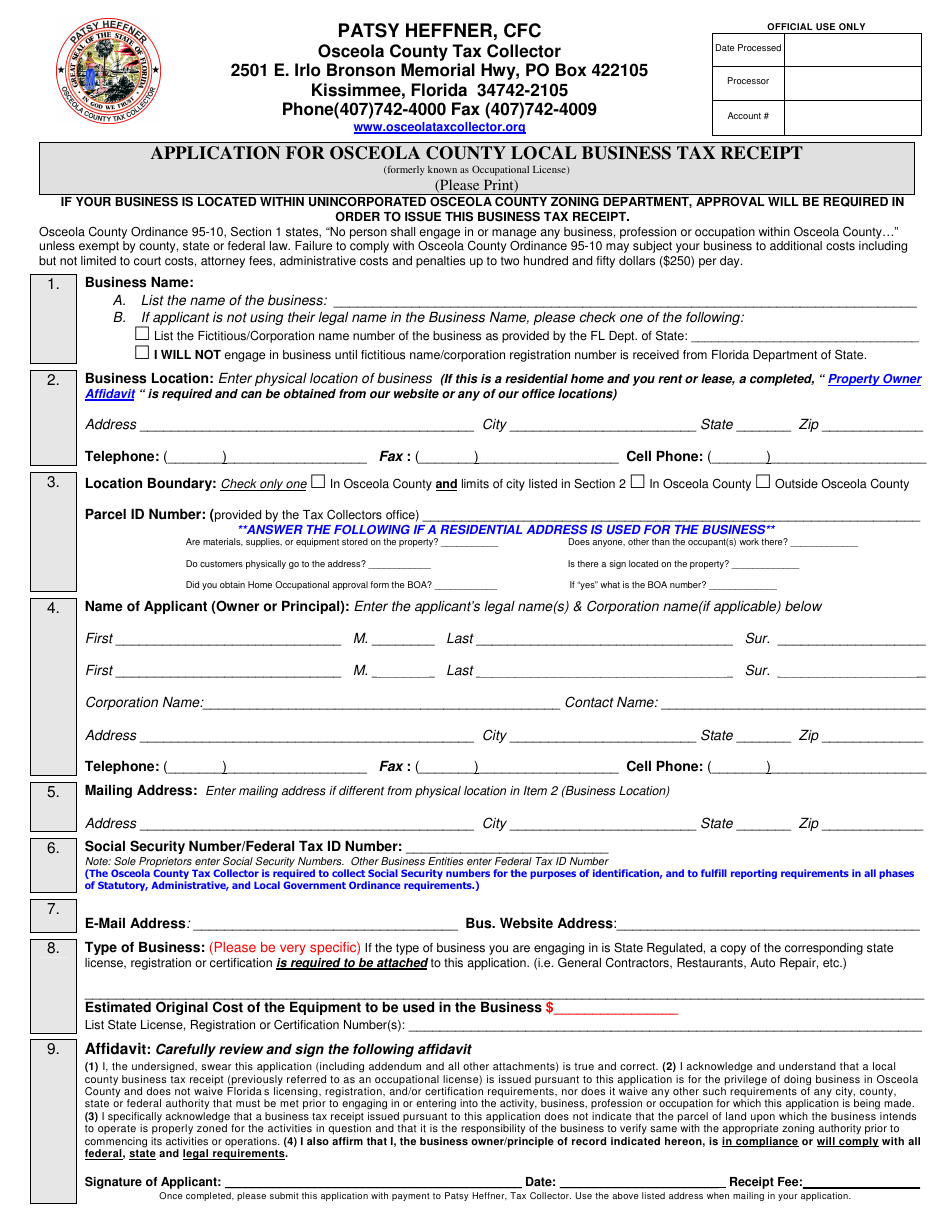

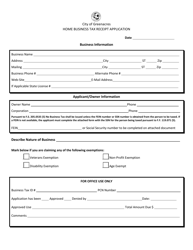

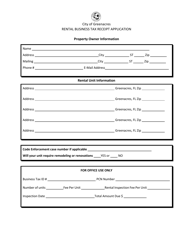

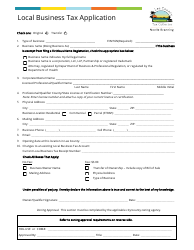

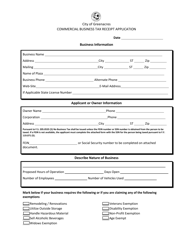

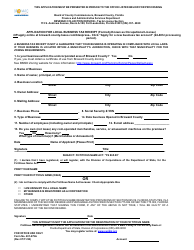

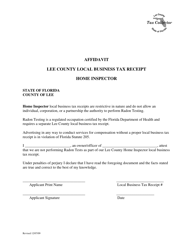

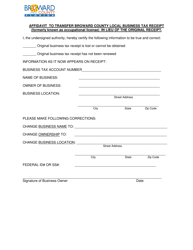

Application for Osceola County Local Business Tax Receipt Form - Osceola County, Florida

Application for Osceola County Tax Receipt Form is a legal document that was released by the Florida Department of Revenue - a government authority operating within Florida. The form may be used strictly within Osceola County.

FAQ

Q: What is an Osceola County Local Business Tax Receipt?

A: An Osceola County Local Business Tax Receipt is a license or permit required for operating a business in Osceola County, Florida.

Q: Who needs to apply for an Osceola County Local Business Tax Receipt?

A: Anyone planning to start a business in Osceola County, Florida needs to apply for an Osceola County Local Business Tax Receipt.

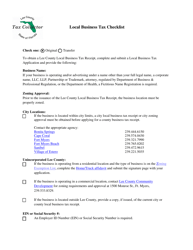

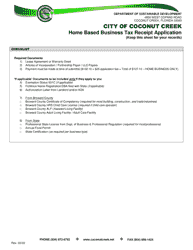

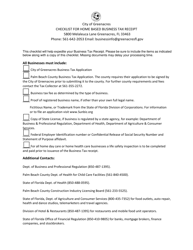

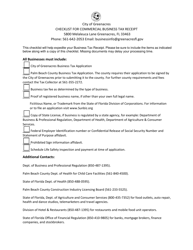

Q: What documents are required to apply for an Osceola County Local Business Tax Receipt?

A: The required documents for applying for an Osceola County Local Business Tax Receipt may include a completed application form, proof of business location, and the appropriate fee.

Q: What is the validity period of an Osceola County Local Business Tax Receipt?

A: The validity period of an Osceola County Local Business Tax Receipt is typically one year, but it may vary depending on the type of business or license.

Form Details:

- The latest edition currently provided by the Florida Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.