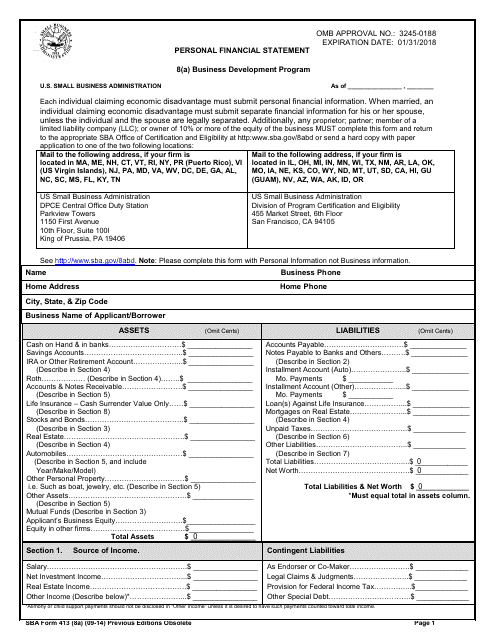

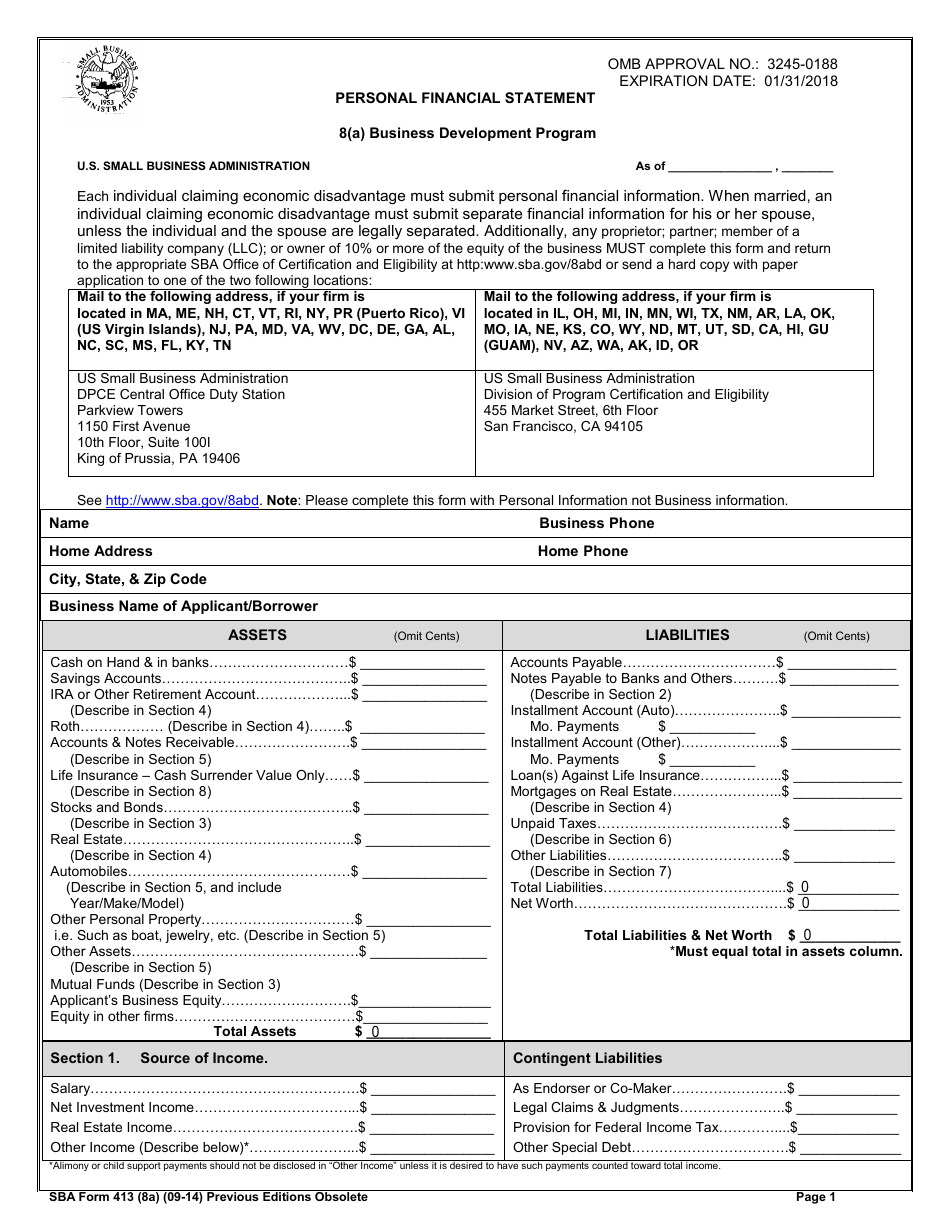

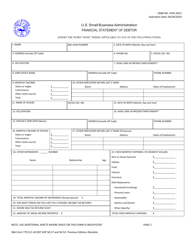

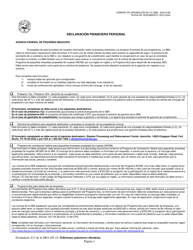

SBA Form 413 (8A) Personal Financial Statement

What Is SBA Form 413 (8A)?

This is a legal form that was released by the U.S. Small Business Administration on September 1, 2014 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SBA Form 413 (8A) Personal Financial Statement?

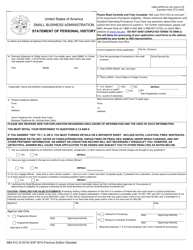

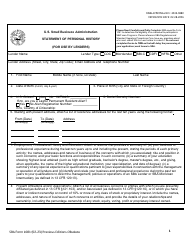

A: SBA Form 413 (8A) Personal Financial Statement is a document used by the U.S. Small Business Administration (SBA) to assess the personal financial status of individuals applying for loans or participating in the SBA 8(a) Business Development program.

Q: Why is SBA Form 413 (8A) Personal Financial Statement important?

A: SBA Form 413 (8A) Personal Financial Statement is important because it helps the SBA evaluate the eligibility of individuals for loans or the 8(a) program, and it provides a snapshot of their personal financial situation.

Q: Who needs to fill out SBA Form 413 (8A) Personal Financial Statement?

A: Individuals applying for loans or participating in the SBA 8(a) Business Development program need to fill out SBA Form 413 (8A) Personal Financial Statement.

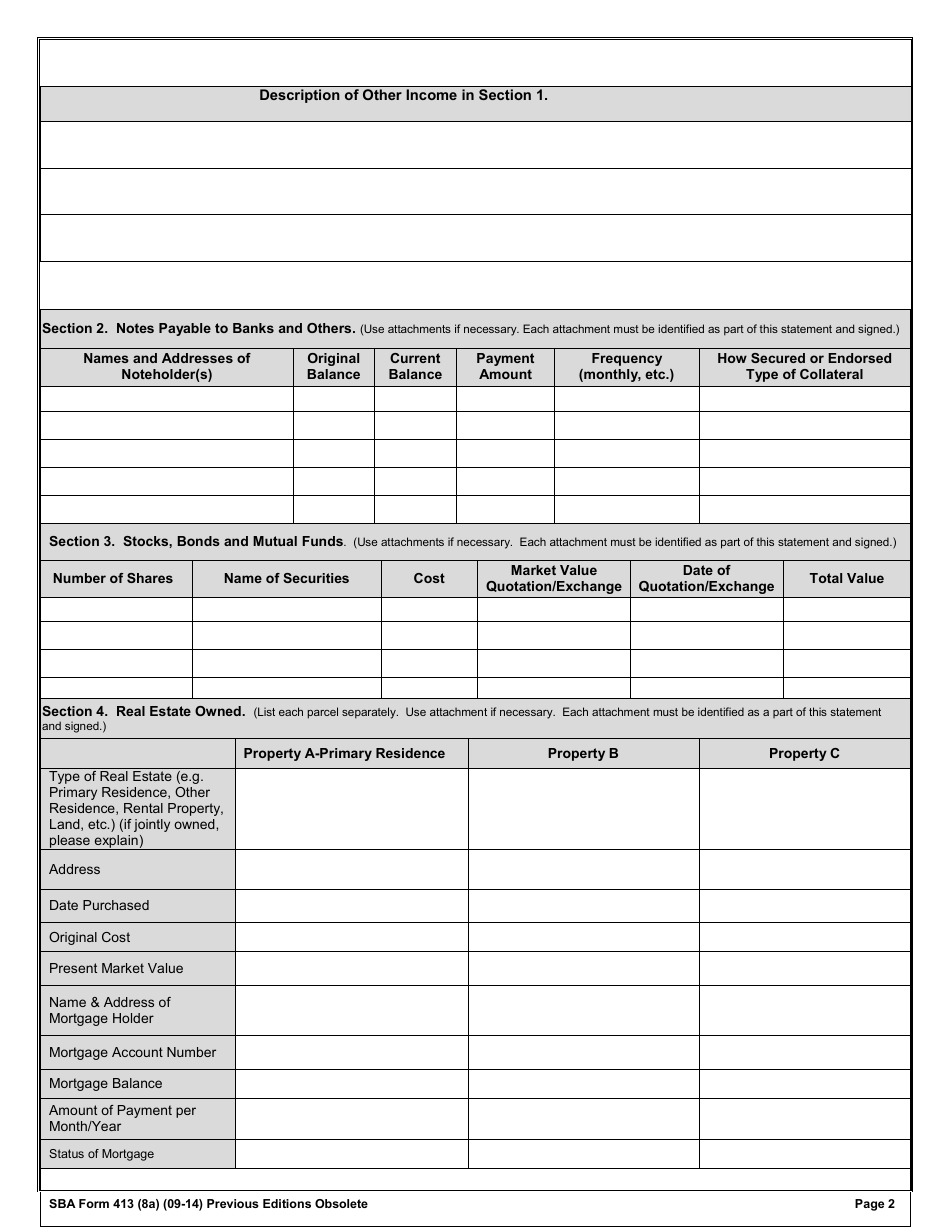

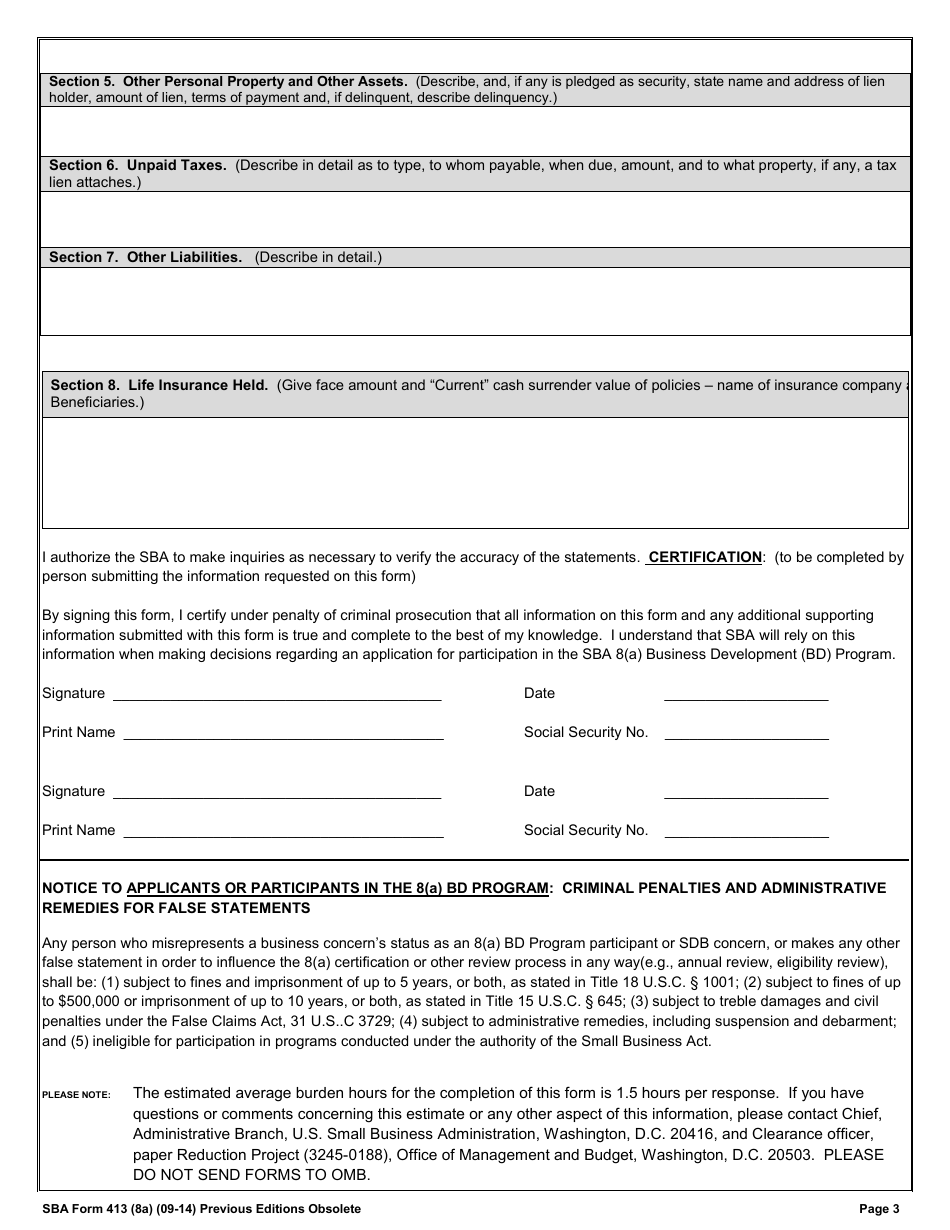

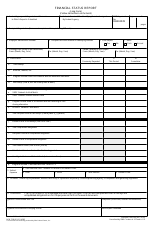

Q: What information is required in SBA Form 413 (8A) Personal Financial Statement?

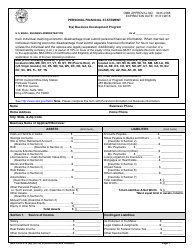

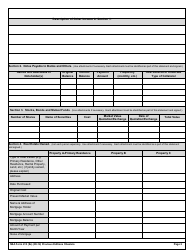

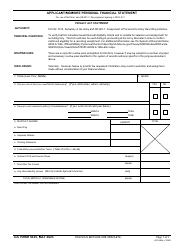

A: SBA Form 413 (8A) Personal Financial Statement requires information about personal assets, liabilities, income, expenses, and other financial details.

Q: How should I fill out SBA Form 413 (8A) Personal Financial Statement?

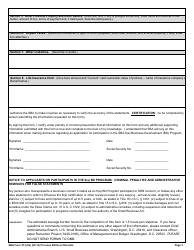

A: SBA Form 413 (8A) Personal Financial Statement should be filled out accurately, providing all the requested information and supporting documentation to the best of your knowledge.

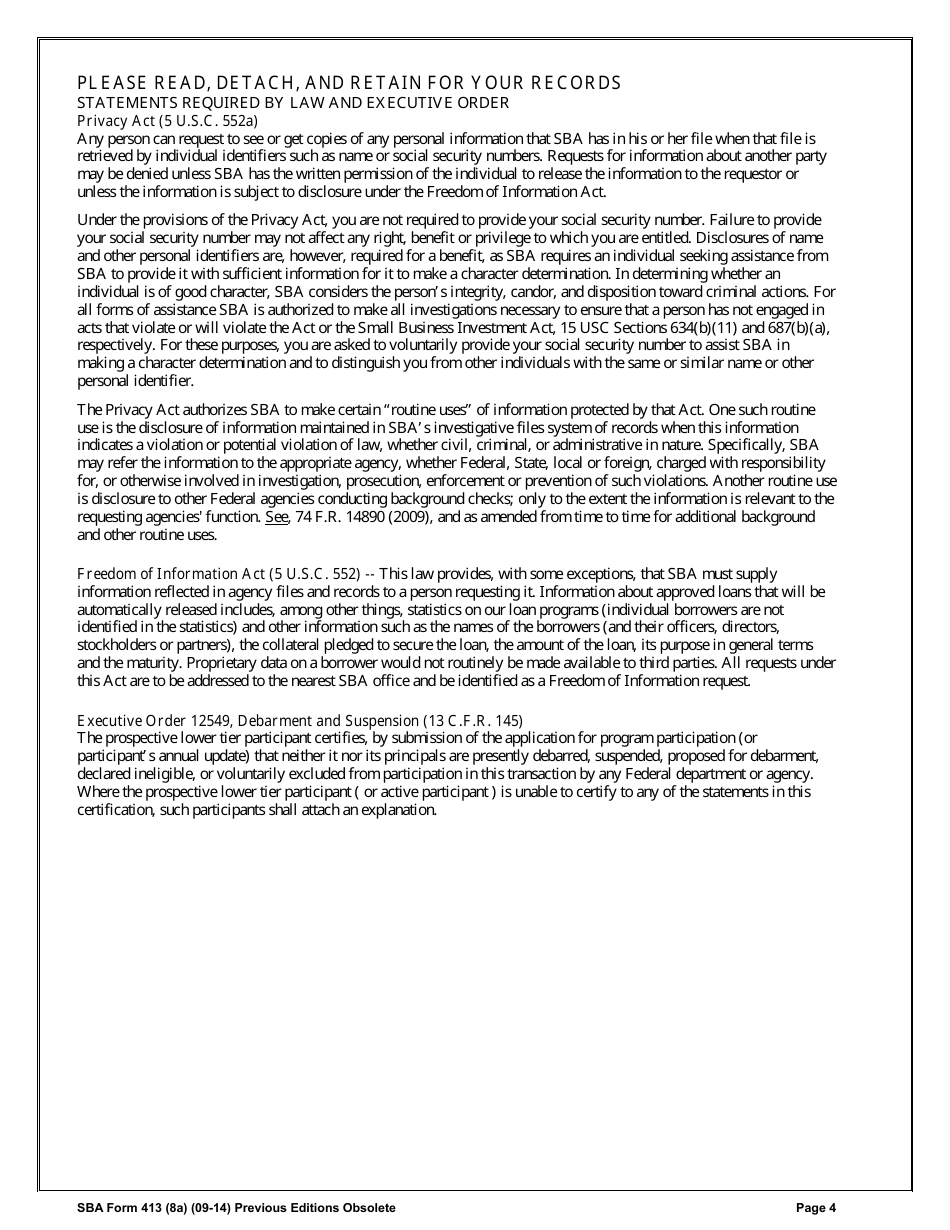

Q: Is SBA Form 413 (8A) Personal Financial Statement confidential?

A: Yes, SBA Form 413 (8A) Personal Financial Statement is confidential and is protected by privacy laws. It will only be used for the purpose of evaluating your eligibility for loans or the 8(a) program.

Form Details:

- Released on September 1, 2014;

- The latest available edition released by the U.S. Small Business Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of SBA Form 413 (8A) by clicking the link below or browse more documents and templates provided by the U.S. Small Business Administration.