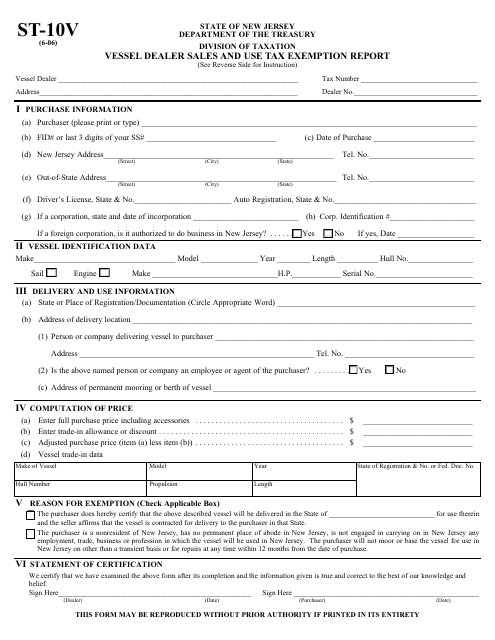

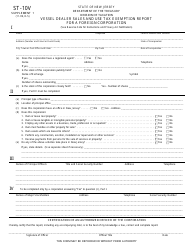

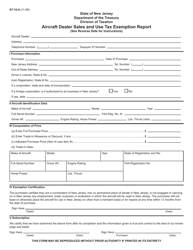

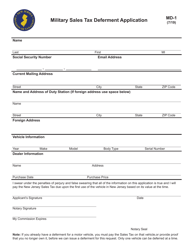

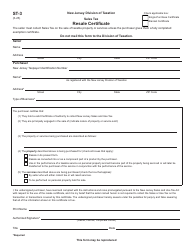

Form ST-10V Vessel Dealer Sales and Use Tax Exemption Report - New Jersey

What Is Form ST-10V?

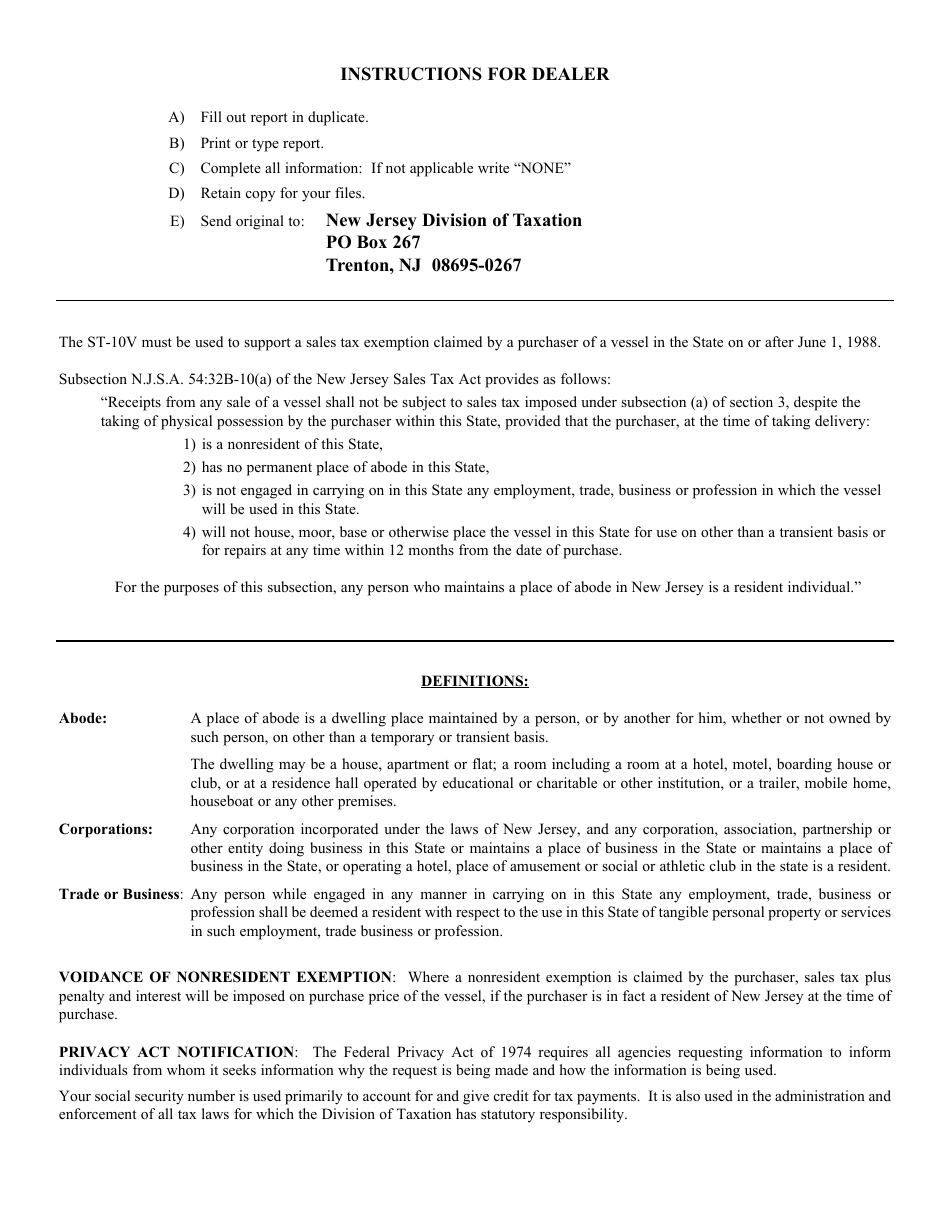

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-10V?

A: Form ST-10V is the Vessel Dealer Sales and Use TaxExemption Report in New Jersey.

Q: Who is required to file Form ST-10V?

A: Vessel dealers in New Jersey are required to file Form ST-10V.

Q: What is the purpose of Form ST-10V?

A: The purpose of Form ST-10V is to claim sales and use tax exemption for vessels sold by dealers.

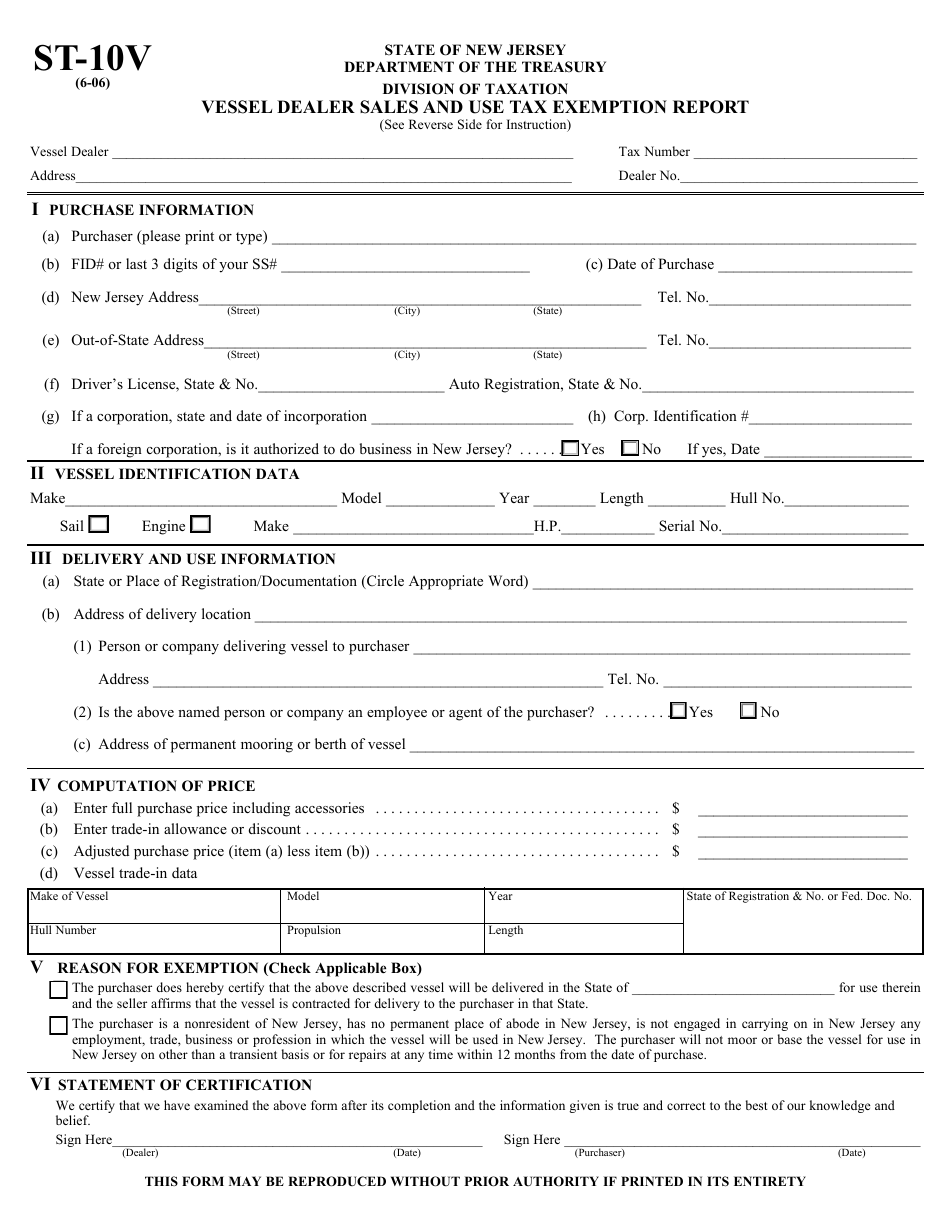

Q: What information is required on Form ST-10V?

A: Form ST-10V requires information such as the dealer's name, address, vessel details, and buyer information.

Q: When is Form ST-10V due?

A: Form ST-10V is due on a quarterly basis, with the due date falling on the last day of the month following the end of the quarter.

Form Details:

- Released on June 1, 2006;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-10V by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.