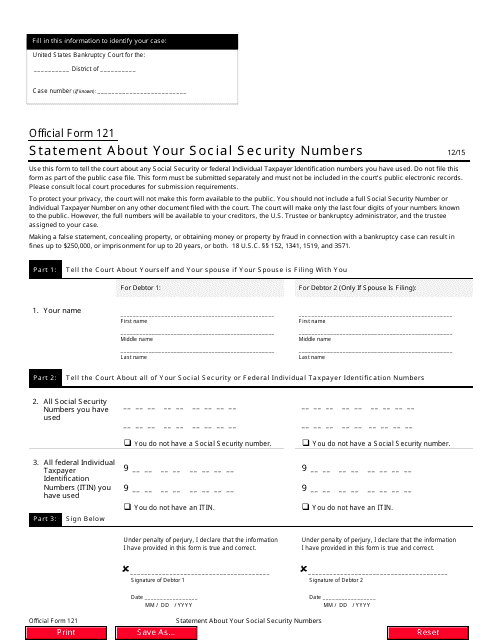

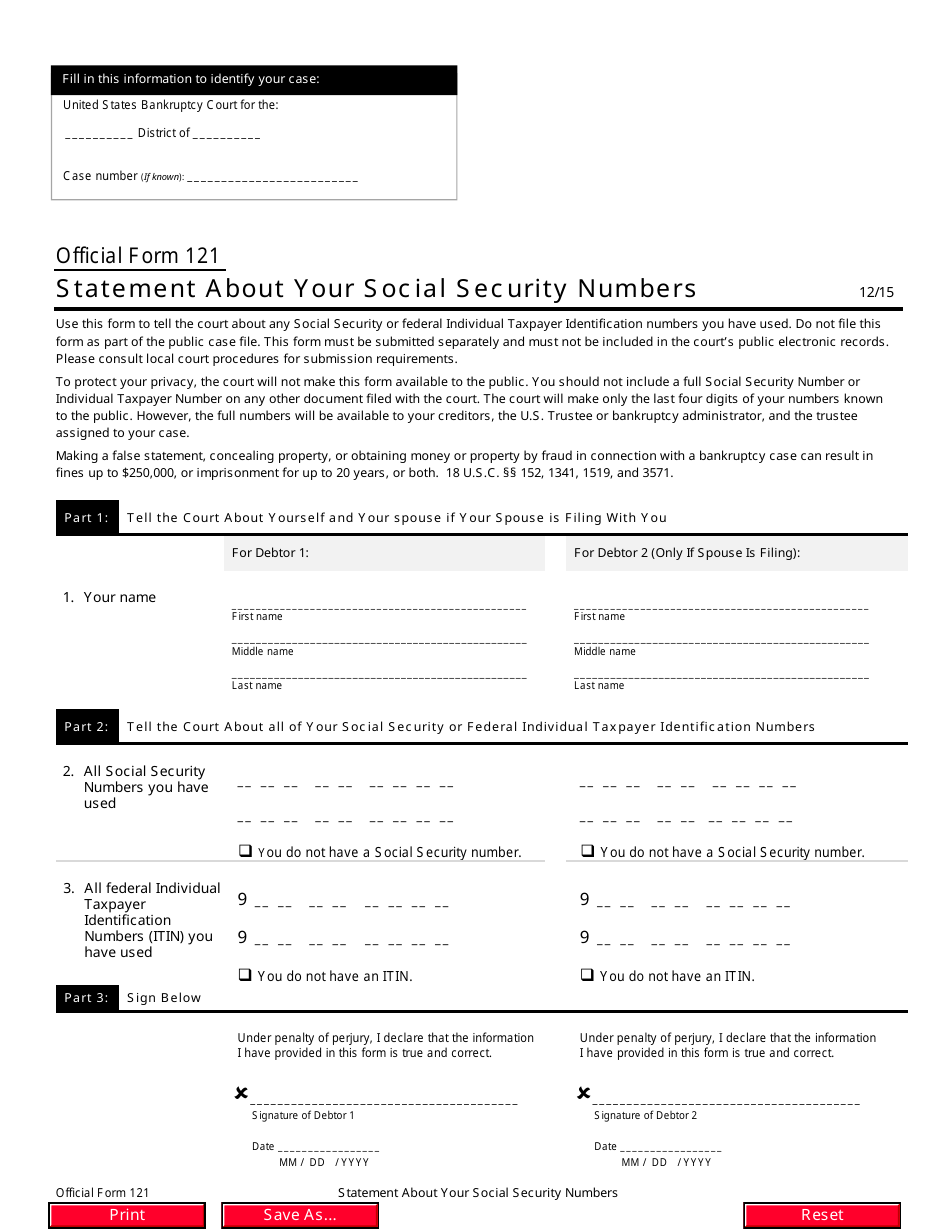

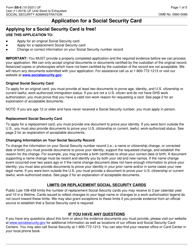

Official Form 121 Statement About Your Social Security Numbers

What Is Official Form 121?

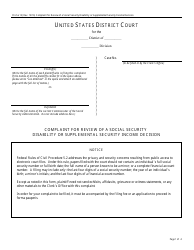

This is a legal form that was released by the United States Bankruptcy Court on December 1, 2015 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 121?

A: Form 121 is an official statement about your Social Security Numbers.

Q: Why do I need to complete Form 121?

A: You need to complete Form 121 to provide accurate information about your Social Security Numbers.

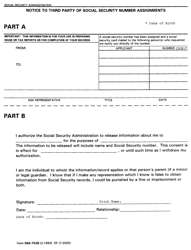

Q: Who should complete Form 121?

A: Any individual who is required to provide their Social Security Numbers may need to complete Form 121.

Q: Is Form 121 mandatory?

A: The requirement to complete Form 121 may vary depending on the specific circumstances. It is advisable to consult with the authorities or a legal professional to determine if it is mandatory for you.

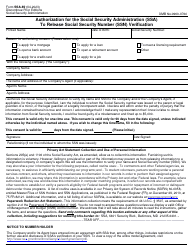

Q: What information is required on Form 121?

A: Form 121 typically requires you to provide accurate details about your Social Security Numbers, such as the number itself and other identifying information.

Q: What should I do if I make a mistake on Form 121?

A: If you make a mistake on Form 121, you should contact the relevant authorities or consult a legal professional for guidance on how to correct the error.

Q: How long does it take to process Form 121?

A: The processing time for Form 121 may vary depending on the specific circumstances and the efficiency of the authorities handling the form. Contact the relevant authorities for an estimate on processing times.

Q: Is there a fee for submitting Form 121?

A: The requirement of a fee for submitting Form 121 may vary depending on the specific circumstances. Contact the relevant authorities or refer to the instructions on the form for information about any applicable fees.

Form Details:

- Released on December 1, 2015;

- The latest available edition released by the United States Bankruptcy Court;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Official Form 121 by clicking the link below or browse more documents and templates provided by the United States Bankruptcy Court.