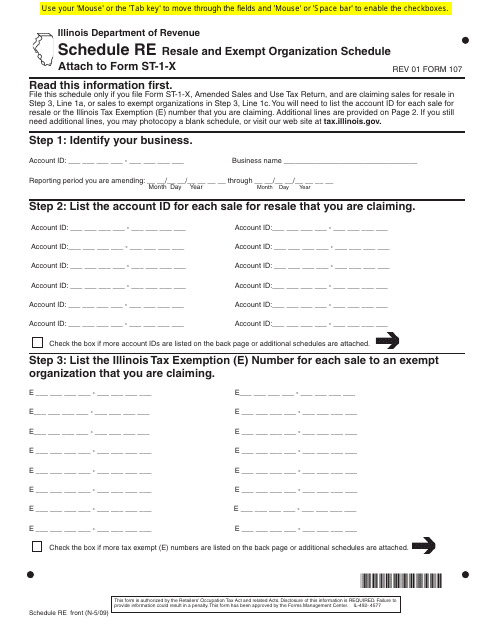

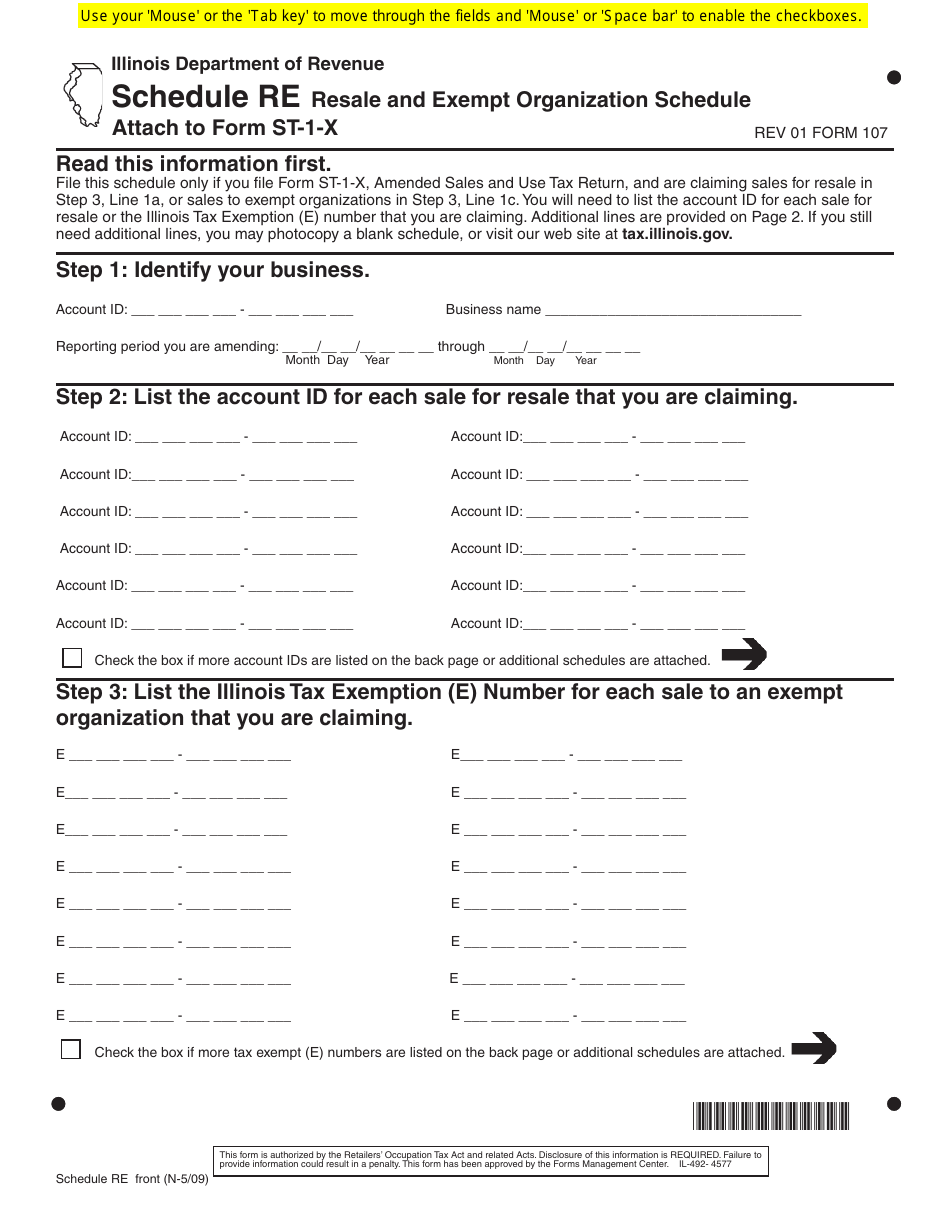

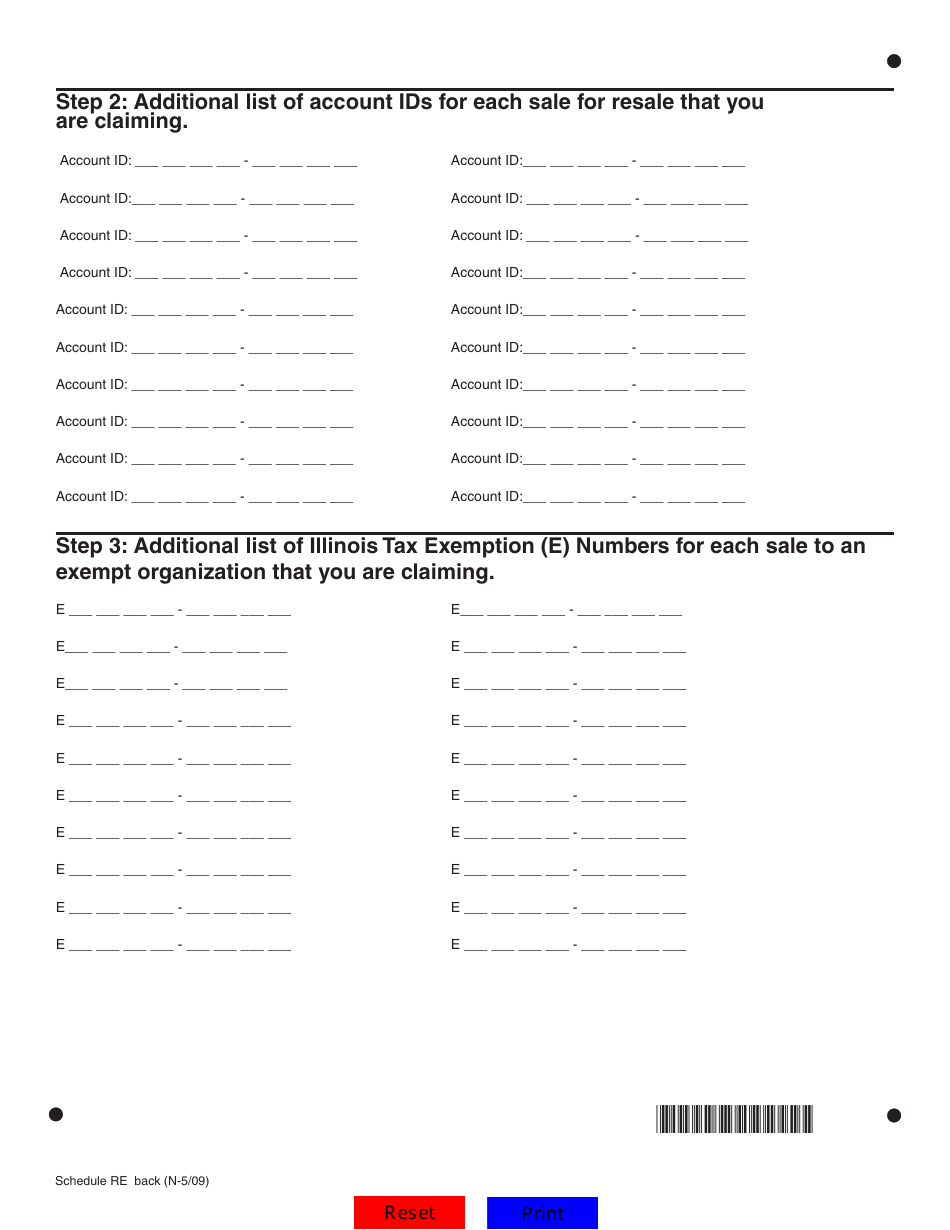

Form 107 Schedule RE Resale and Exempt Organization Schedule - Illinois

What Is Form 107 Schedule RE?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 107 Schedule RE?

A: Form 107 Schedule RE is a tax form used in Illinois to report resale and exempt organization transactions.

Q: Who needs to file Form 107 Schedule RE?

A: Businesses and organizations in Illinois that engage in resale or are exempt from sales tax may need to file Form 107 Schedule RE.

Q: What are resale transactions?

A: Resale transactions refer to the sale of goods or services that will be resold by the buyer.

Q: What are exempt organization transactions?

A: Exempt organization transactions refer to sales made by organizations that are exempt from paying sales tax, such as certain non-profit organizations.

Q: What information is required on Form 107 Schedule RE?

A: Form 107 Schedule RE requires information about the buyer, seller, and details of the transaction, including the amount of sales tax collected or exempted.

Q: When is Form 107 Schedule RE due?

A: The due date for filing Form 107 Schedule RE in Illinois varies depending on the reporting period, but it is generally due on a monthly or quarterly basis.

Q: Is there a fee for filing Form 107 Schedule RE?

A: No, there is no fee for filing Form 107 Schedule RE.

Q: What happens if I fail to file Form 107 Schedule RE?

A: Failure to file Form 107 Schedule RE or inaccurately reporting the information may result in penalties or fines.

Form Details:

- Released on May 1, 2009;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 107 Schedule RE by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.