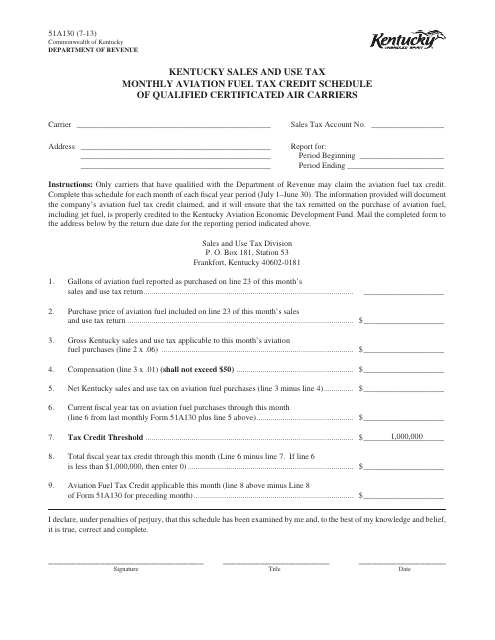

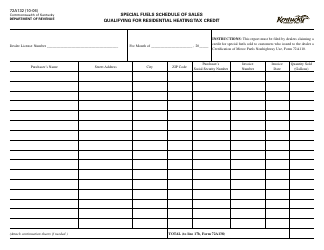

Form 51A130 Monthly Aviation Fuel Tax Credit Schedule of Qualified Certificated Air Carriers - Kentucky

What Is Form 51A130?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 51A130?

A: Form 51A130 is the Monthly Aviation FuelTax Credit Schedule of Qualified Certificated Air Carriers in Kentucky.

Q: Who needs to file Form 51A130?

A: Qualified Certificated Air Carriers in Kentucky need to file Form 51A130.

Q: What is the purpose of Form 51A130?

A: The purpose of Form 51A130 is to claim the aviation fuel tax credit available to Qualified Certificated Air Carriers in Kentucky.

Q: How often should Form 51A130 be filed?

A: Form 51A130 should be filed on a monthly basis.

Q: What information is required on Form 51A130?

A: Form 51A130 requires information such as the carrier's name, fuel purchases, and fuel sales for the reporting period.

Q: Is there a deadline for filing Form 51A130?

A: Yes, Form 51A130 must be filed by the last day of the month following the reporting period.

Form Details:

- Released on July 1, 2013;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 51A130 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.