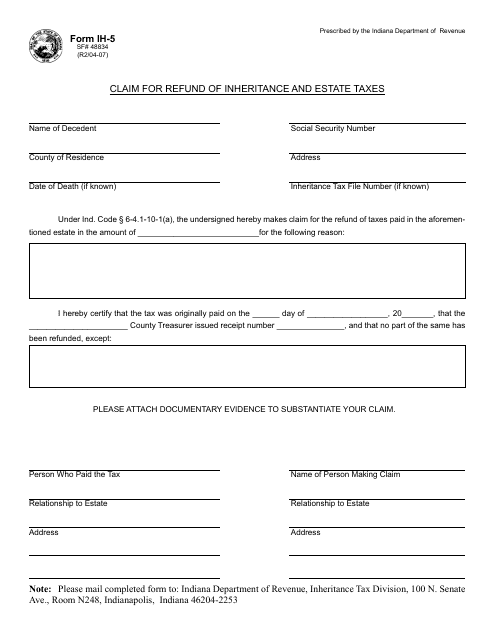

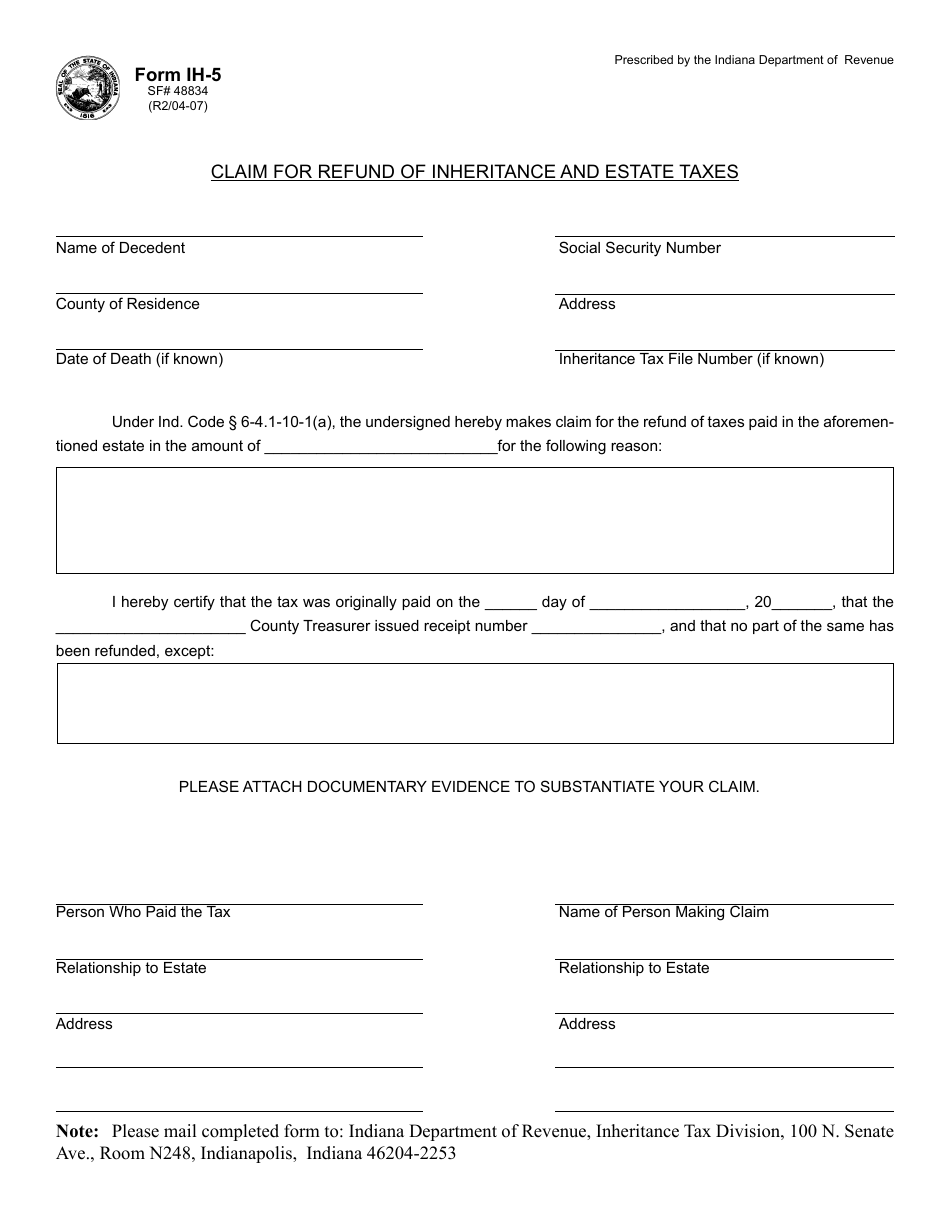

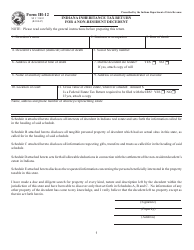

Form IH-5 Claim for Refund of Inheritance and Estate Taxes - Indiana

What Is Form IH-5?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IH-5?

A: Form IH-5 is the Claim for Refund of Inheritance and Estate Taxes in the state of Indiana.

Q: Who can use Form IH-5?

A: Form IH-5 can be used by individuals or representatives of estates who want to claim a refund of inheritance and estate taxes paid in Indiana.

Q: What is the purpose of Form IH-5?

A: The purpose of Form IH-5 is to request a refund of inheritance and estate taxes that were overpaid or otherwise eligible for a refund in Indiana.

Q: Is there a deadline to file Form IH-5?

A: Yes, Form IH-5 must be filed within three years from the date of payment of the tax or within one year from the date of a final court order determining the inheritance tax liability, whichever is later.

Q: Are there any supporting documents required with Form IH-5?

A: Yes, you will need to provide supporting documents such as copies of the federal estate tax return, Indiana inheritance tax return, and evidence of payment of taxes.

Q: Can I file Form IH-5 electronically?

A: No, Form IH-5 cannot be filed electronically. It must be filed by mail or in person.

Form Details:

- Released on April 2, 2007;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IH-5 by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.