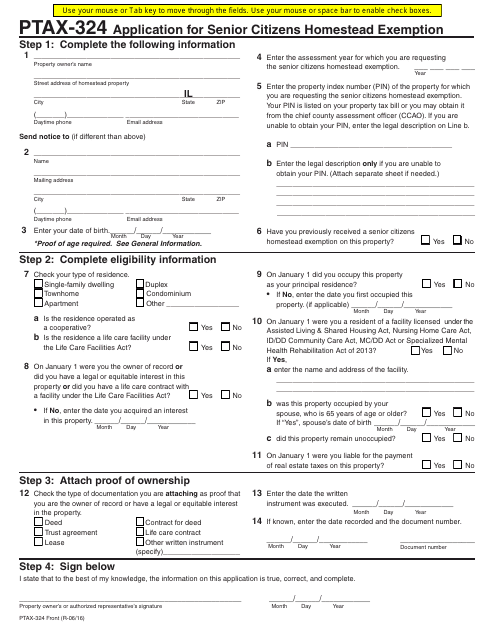

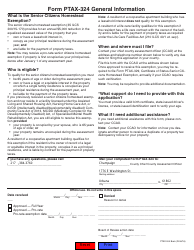

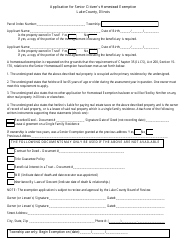

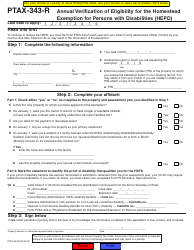

Form PTAX-324 Application for Senior Citizens Homestead Exemption - Illinois

What Is Form PTAX-324?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

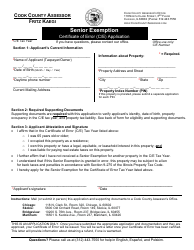

Q: What is the Form PTAX-324?

A: Form PTAX-324 is the Application for Senior Citizens Homestead Exemption in Illinois.

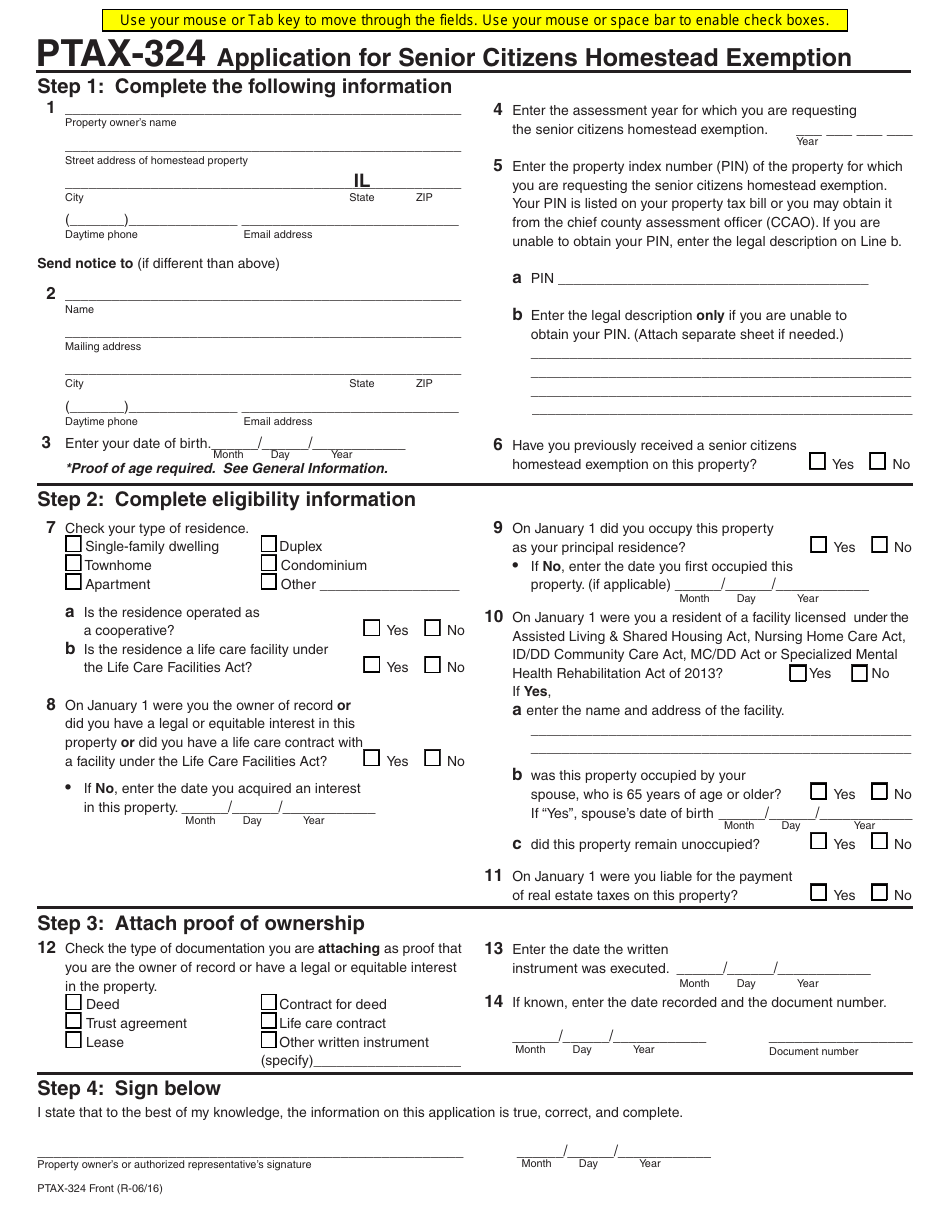

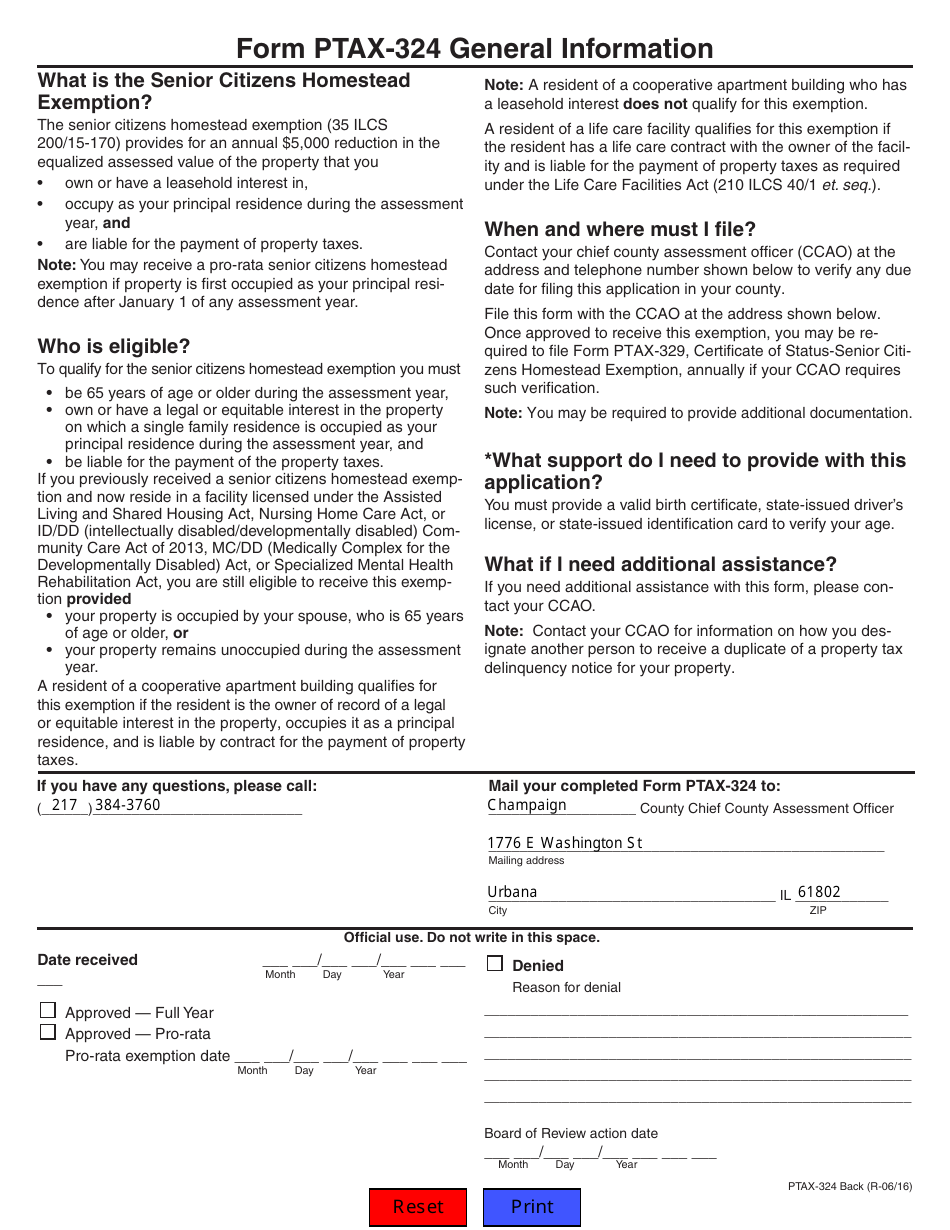

Q: Who is eligible for the Senior Citizens Homestead Exemption?

A: Senior citizens who meet certain age and income requirements may be eligible for this exemption.

Q: How can I apply for the Senior Citizens Homestead Exemption?

A: You can apply for the exemption by completing the Form PTAX-324 and submitting it to your local county assessor's office.

Q: What are the age and income requirements for the exemption?

A: The age requirement is typically 65 or older, and there are income limitations that vary by county.

Q: What is the purpose of the Senior Citizens Homestead Exemption?

A: The exemption is designed to provide property tax relief for eligible senior citizens in Illinois.

Q: Are there any deadlines for applying for the exemption?

A: Yes, there are specific deadlines for filing the application, so it's important to check with your local county assessor's office for the exact dates.

Q: Can I apply for the exemption if I rent a property?

A: No, the Senior Citizens Homestead Exemption is only available for eligible senior citizens who own their primary residence in Illinois.

Q: Is the exemption available in all counties of Illinois?

A: Yes, the exemption is available statewide, but some counties may have additional local requirements or limitations.

Form Details:

- Released on June 1, 2016;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PTAX-324 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.