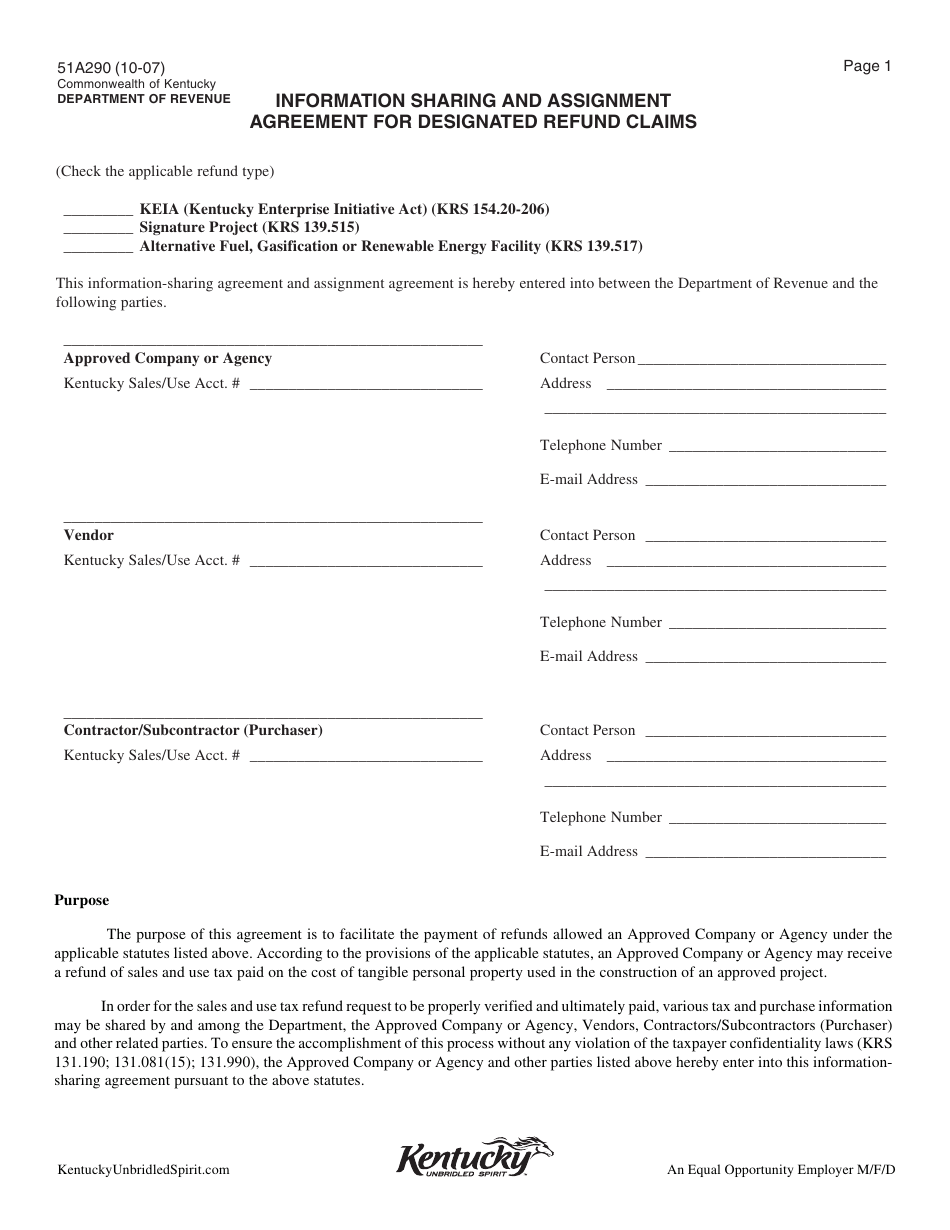

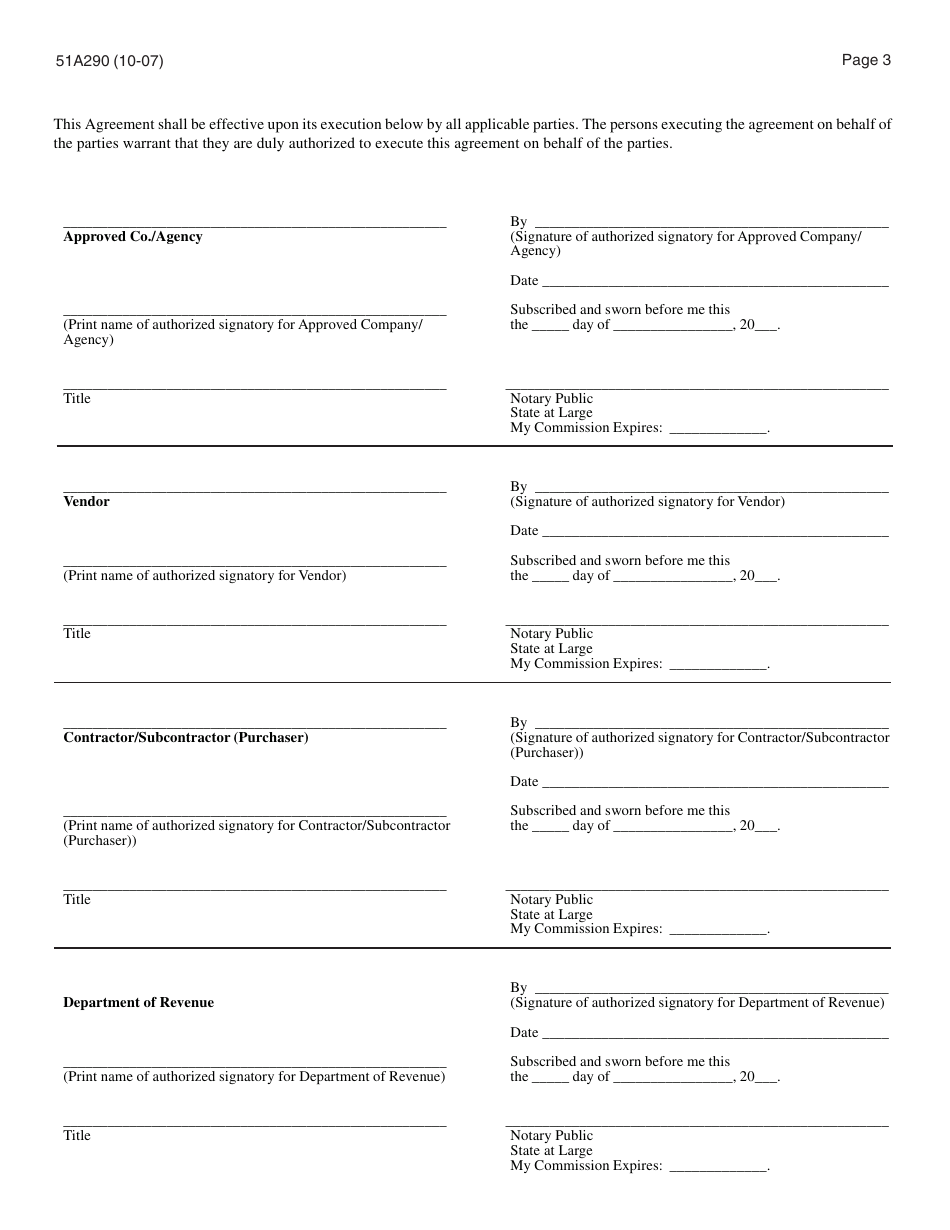

Form 51A290 Information Sharing and Assignment Agreement for Designated Refund Claims - Kentucky

What Is Form 51A290?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 51A290?

A: Form 51A290 is an Information Sharing and Assignment Agreement for Designated Refund Claims in Kentucky.

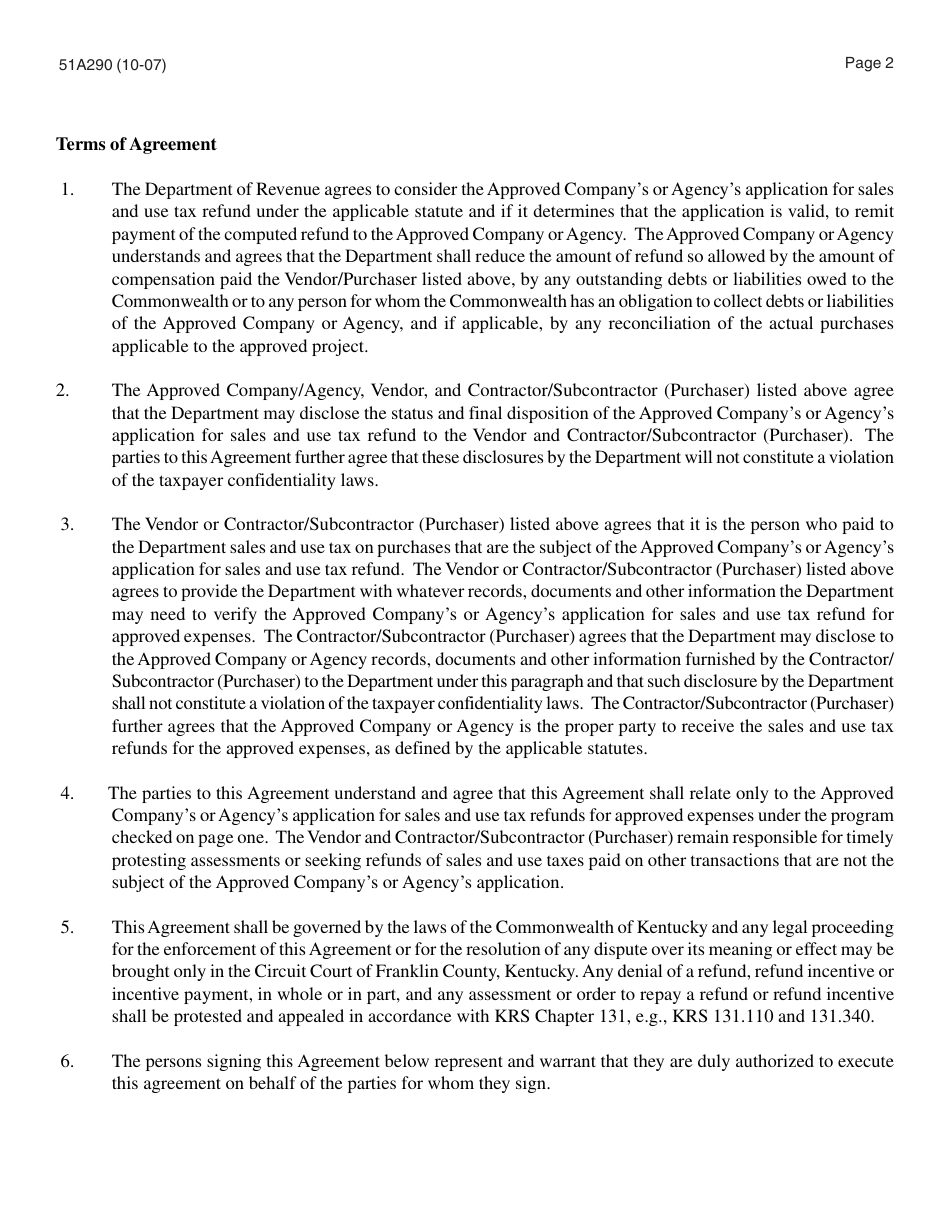

Q: What is the purpose of Form 51A290?

A: The purpose of Form 51A290 is to allow the sharing and assignment of refund claims in certain situations.

Q: Who should use Form 51A290?

A: Form 51A290 should be used by those who want to share or assign their refund claims in Kentucky.

Q: What information is required on Form 51A290?

A: Form 51A290 requires information such as the name of the claimant, the tax period, and the amount of the refund.

Q: Are there any fees associated with submitting Form 51A290?

A: There are no fees associated with submitting Form 51A290.

Q: Can Form 51A290 be submitted electronically?

A: Yes, Form 51A290 can be submitted electronically.

Q: Is there a deadline for submitting Form 51A290?

A: There is no specific deadline mentioned for submitting Form 51A290, but it is recommended to submit it as soon as possible.

Q: What happens after submitting Form 51A290?

A: After submitting Form 51A290, the Kentucky Department of Revenue will process the request and notify the claimant of the outcome.

Q: Can I revoke or modify a submitted Form 51A290?

A: Yes, you can revoke or modify a submitted Form 51A290 by submitting a written request to the Kentucky Department of Revenue.

Form Details:

- Released on October 1, 2007;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 51A290 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.