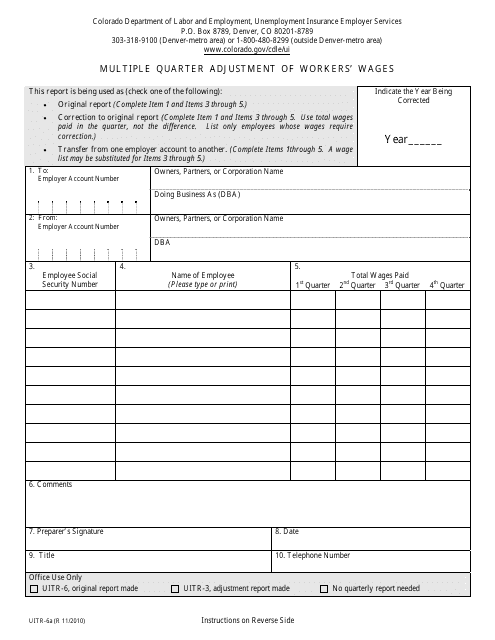

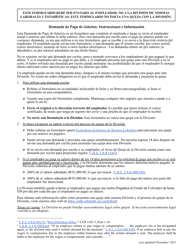

This version of the form is not currently in use and is provided for reference only. Download this version of

Form UITR-6a

for the current year.

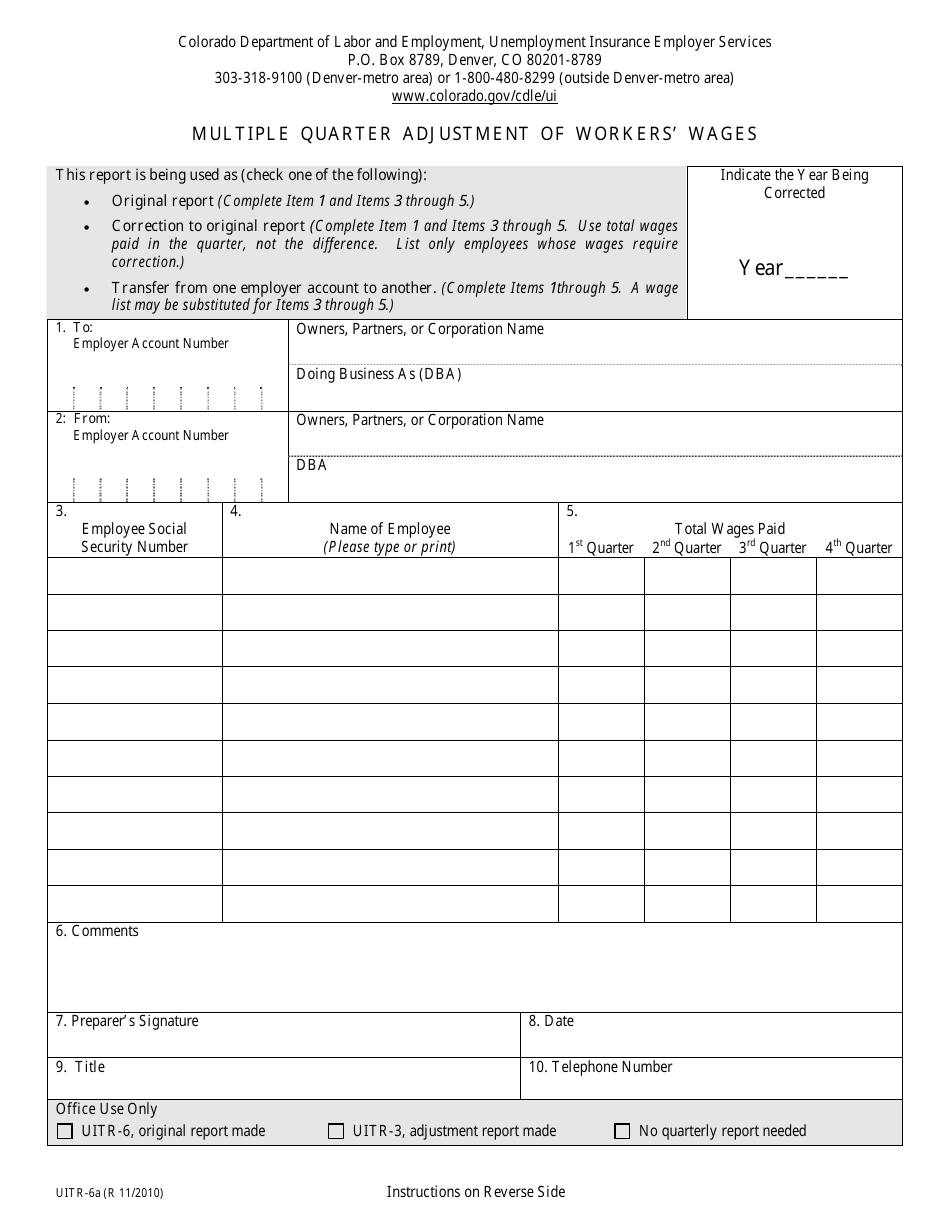

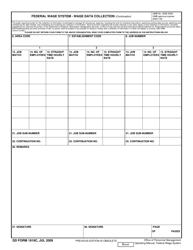

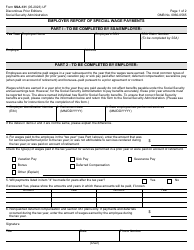

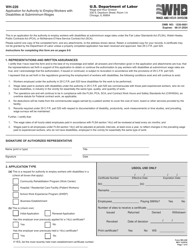

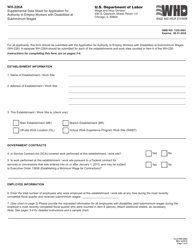

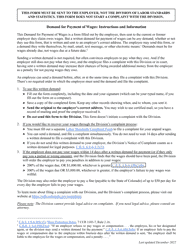

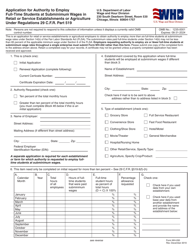

Form UITR-6a Multiple Quarter Adjustment of Workers' Wages - Colorado

What Is Form UITR-6a?

This is a legal form that was released by the Colorado Department of Labor and Employment - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is UITR-6a?

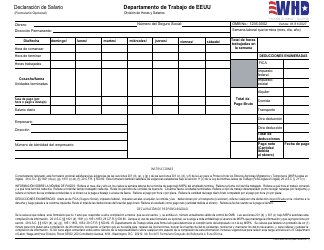

A: UITR-6a is a form used for making multiple quarter adjustments of workers' wages in Colorado.

Q: Who needs to file UITR-6a?

A: Employers in Colorado who need to report adjustments to workers' wages for multiple quarters.

Q: What is the purpose of filing UITR-6a?

A: The purpose of filing UITR-6a is to correct any errors or omissions in the original wage reports and ensure accurate payment of unemployment insurance taxes.

Q: Is UITR-6a specific to Colorado?

A: Yes, UITR-6a is specific to Colorado and is not used in other states.

Q: Are there any fees associated with filing UITR-6a?

A: No, there are no fees associated with filing UITR-6a.

Q: When is the deadline for filing UITR-6a?

A: The deadline for filing UITR-6a is the last day of the month following the end of the quarter for which adjustments are being made.

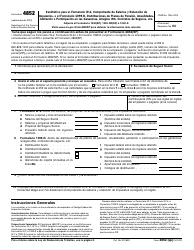

Q: What information is required to complete UITR-6a?

A: To complete UITR-6a, you will need to provide the employer's name, address, unemployment insurance account number, and details of the wage adjustments for each quarter.

Q: What should I do if I made a mistake on my UITR-6a?

A: If you made a mistake on your UITR-6a, you should contact the Colorado Department of Labor and Employment for guidance on how to correct the error.

Form Details:

- Released on November 1, 2010;

- The latest edition provided by the Colorado Department of Labor and Employment;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form UITR-6a by clicking the link below or browse more documents and templates provided by the Colorado Department of Labor and Employment.