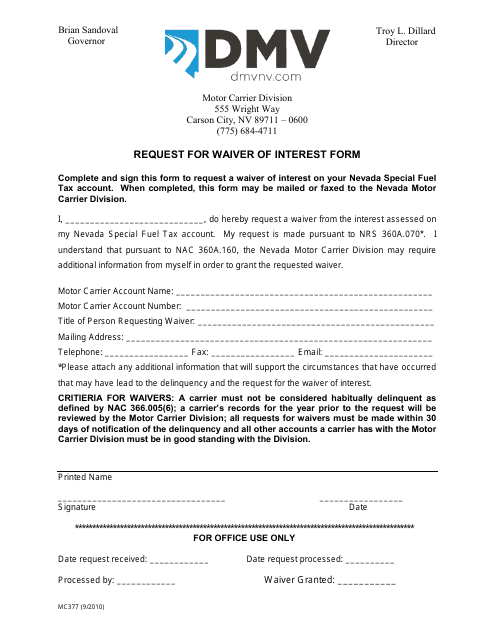

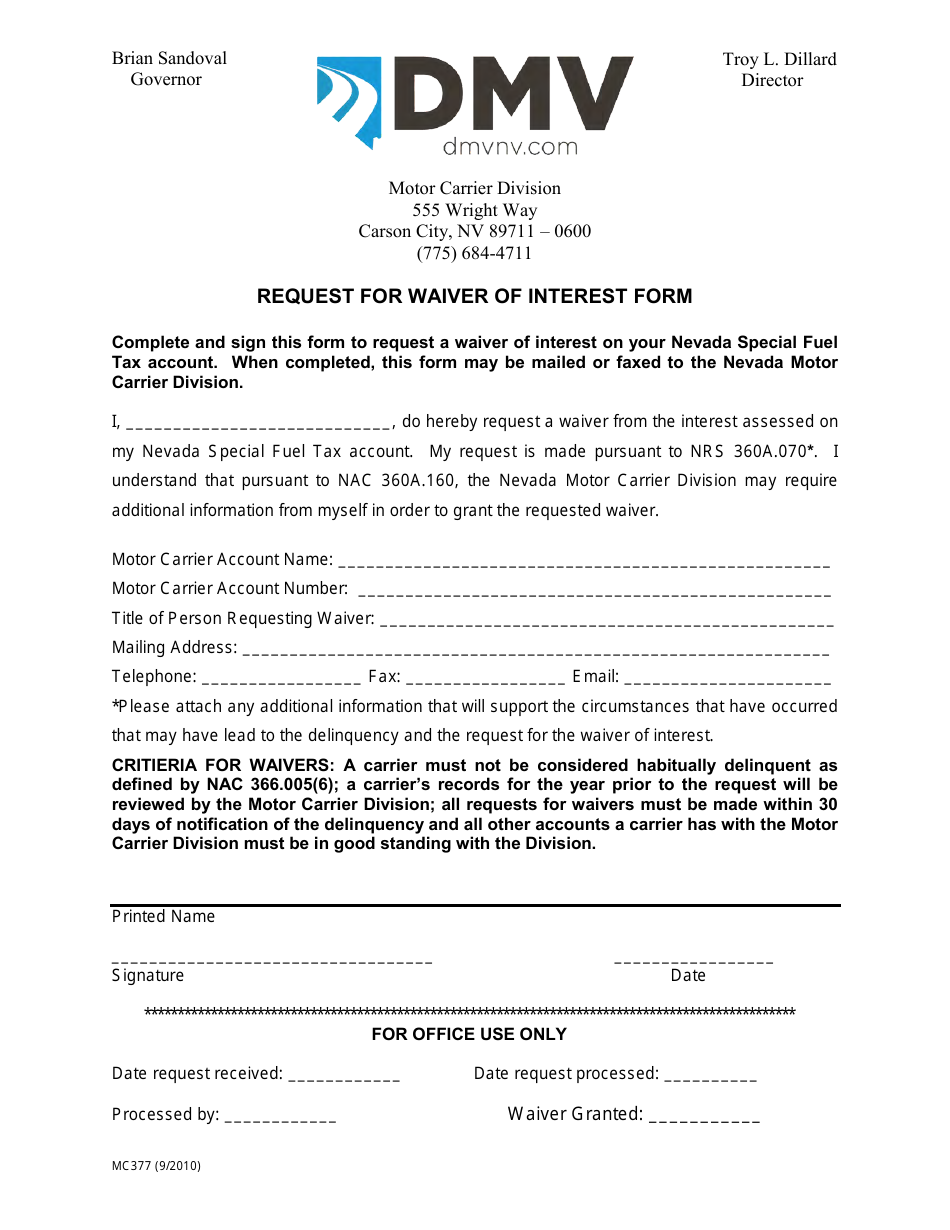

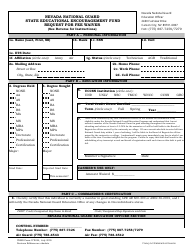

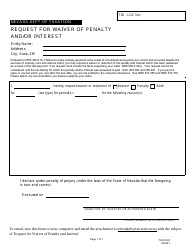

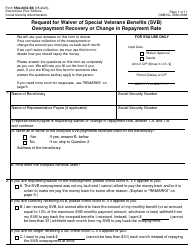

Form MC377 Request for Waiver of Interest Form - Nevada

What Is Form MC377?

This is a legal form that was released by the Nevada Department of Motor Vehicles - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MC377?

A: Form MC377 is a Request for Waiver of Interest form in Nevada.

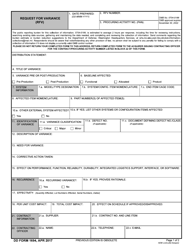

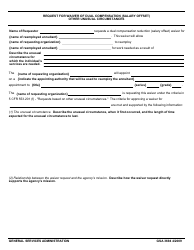

Q: What is the purpose of Form MC377?

A: The purpose of Form MC377 is to request a waiver of interest on certain taxes owed to the state of Nevada.

Q: Who can use Form MC377?

A: Form MC377 can be used by individuals, businesses, and other entities that owe taxes to the state of Nevada and are seeking a waiver of the interest on those taxes.

Q: What taxes can be included in Form MC377?

A: Form MC377 can be used to request a waiver of interest on a variety of taxes, including sales tax, use tax, modified business tax, and cigarette tax, among others.

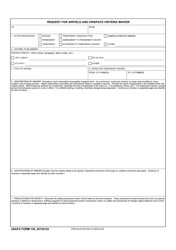

Q: What is the deadline for submitting Form MC377?

A: Form MC377 should be submitted within 60 days of the date on the Notice of Assessment or Notice of Delinquency.

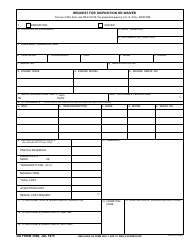

Q: Are there any fees associated with filing Form MC377?

A: No, there are no fees associated with filing Form MC377.

Q: How long does it take to process Form MC377?

A: The processing time for Form MC377 may vary, but it generally takes several weeks for a decision to be made on the waiver request.

Q: What supporting documentation should be included with Form MC377?

A: Supporting documentation that may be required includes copies of tax returns, payment receipts, and any other relevant documents.

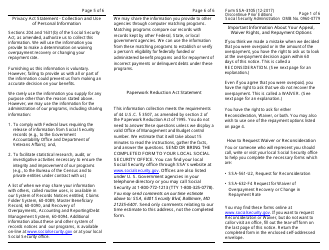

Q: Can I appeal if my request for a waiver of interest is denied?

A: Yes, if your request for a waiver of interest is denied, you have the right to appeal the decision by following the instructions provided in the denial letter.

Form Details:

- Released on September 1, 2010;

- The latest edition provided by the Nevada Department of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MC377 by clicking the link below or browse more documents and templates provided by the Nevada Department of Motor Vehicles.