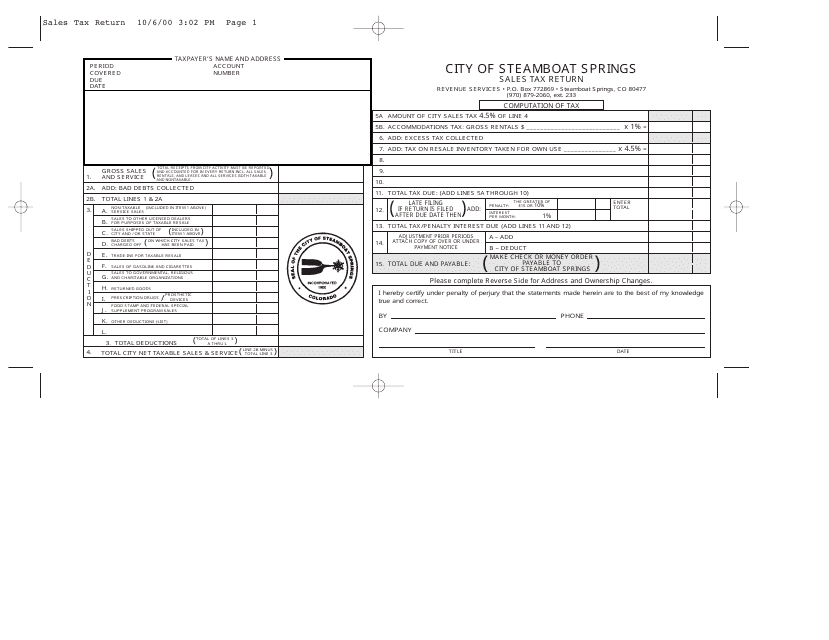

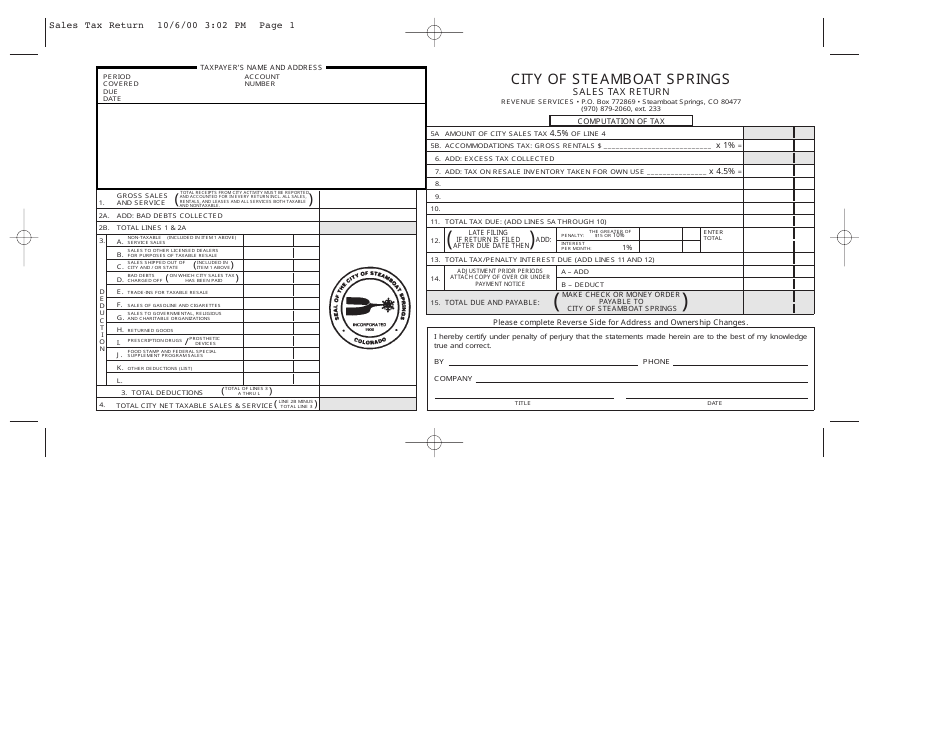

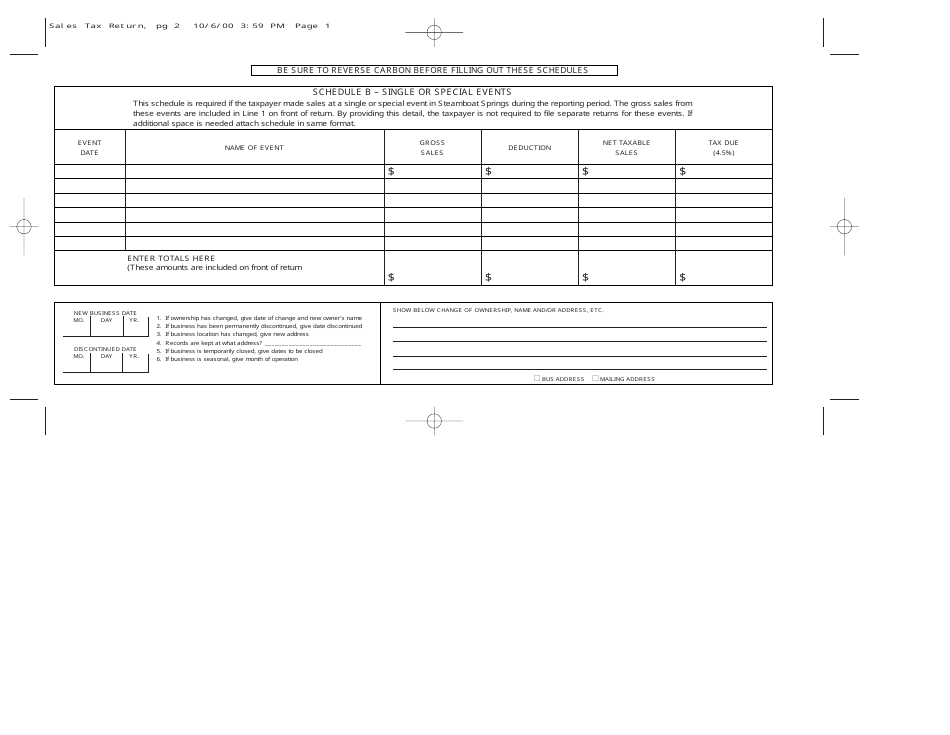

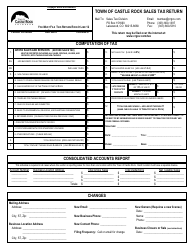

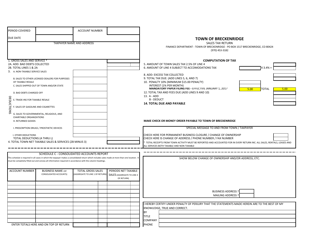

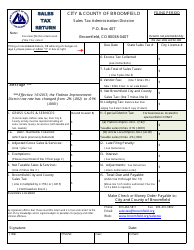

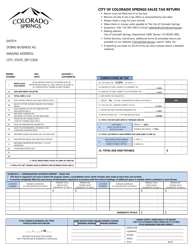

Sales Tax Return Form - City of Steamboat Springs, Colorado

Sales Tax Return Form is a legal document that was released by the Colorado Department of Revenue - a government authority operating within Colorado. The form may be used strictly within City of Steamboat Springs.

FAQ

Q: What is the sales tax return form for the City of Steamboat Springs, Colorado?

A: The sales tax return form for the City of Steamboat Springs, Colorado is the CTR-126 form.

Q: What is the purpose of the sales tax return form?

A: The sales tax return form is used to report and remit the sales tax collected by businesses in the City of Steamboat Springs, Colorado.

Q: Who needs to file the sales tax return form?

A: Businesses that are registered for sales tax in the City of Steamboat Springs, Colorado need to file the sales tax return form.

Q: When is the sales tax return form due?

A: The sales tax return form is due on the 20th day of the month following the end of the reporting period.

Q: Are there any penalties for late filing or non-compliance?

A: Yes, there may be penalties for late filing or non-compliance with sales tax regulations in the City of Steamboat Springs, Colorado. It is important to file the form and remit the tax on time to avoid penalties.

Q: Is there a minimum threshold for sales tax filing?

A: Yes, businesses with an annual taxable sales below $300 are not required to file the sales tax return form in the City of Steamboat Springs, Colorado.

Q: What is the current sales tax rate in the City of Steamboat Springs, Colorado?

A: The current sales tax rate in the City of Steamboat Springs, Colorado is 4% (as of 2021). However, additional taxes may apply depending on the specific items and services being sold.

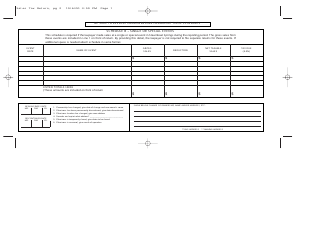

Form Details:

- The latest edition currently provided by the Colorado Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.