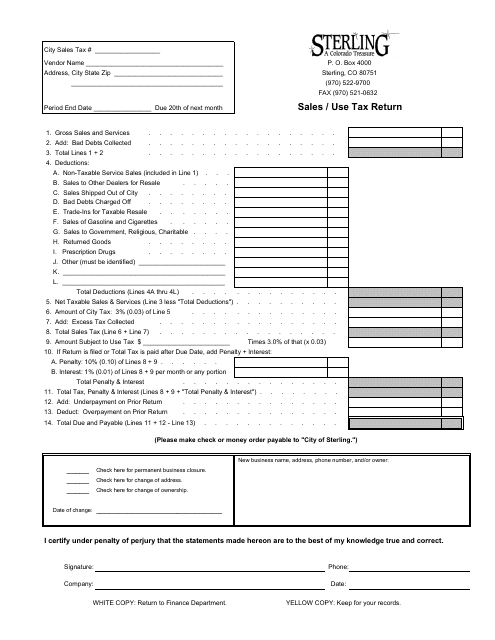

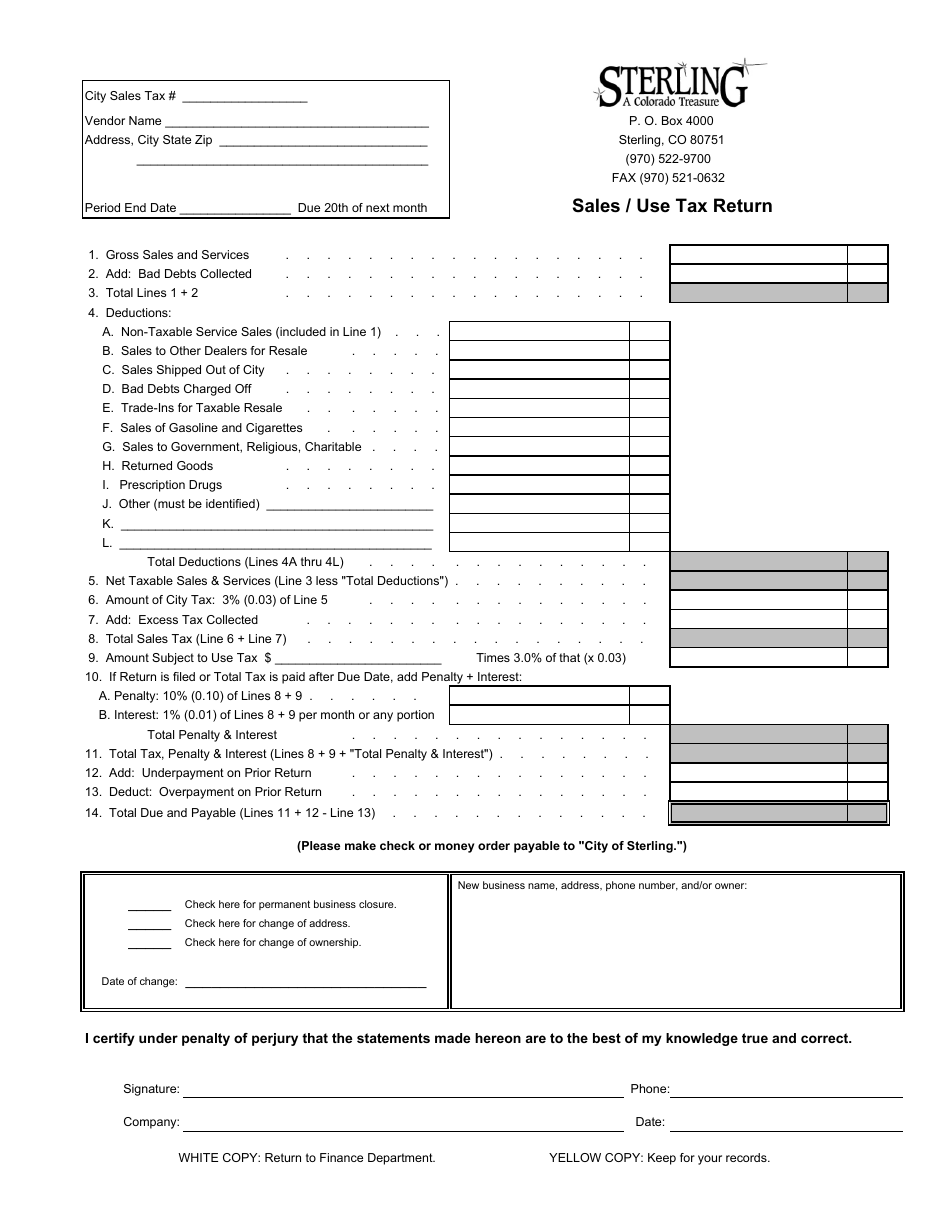

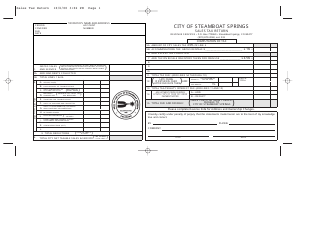

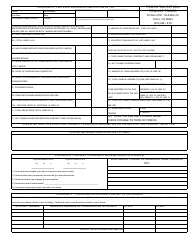

Sales / Use Tax Return Form - City of Sterling, Colorado

Sales / Use Tax Return Form is a legal document that was released by the Colorado Department of Revenue - a government authority operating within Colorado. The form may be used strictly within City of Sterling.

FAQ

Q: What is a Sales/Use Tax Return form?

A: A Sales/Use Tax Return form is a document used to report and pay the sales or use tax owed to the City of Sterling, Colorado.

Q: Who needs to fill out a Sales/Use Tax Return form?

A: Anyone engaged in business activities within the City of Sterling, Colorado may be required to fill out a Sales/Use Tax Return form.

Q: How often do I need to file a Sales/Use Tax Return form?

A: The frequency of filing a Sales/Use Tax Return form depends on the specific requirements set by the City of Sterling, Colorado. It may be filed monthly, quarterly, or annually.

Q: What is the purpose of a Sales/Use Tax Return form?

A: The purpose of a Sales/Use Tax Return form is to report and remit the sales or use tax collected from customers within the City of Sterling, Colorado.

Q: What happens if I don't file a Sales/Use Tax Return form?

A: Failure to file a Sales/Use Tax Return form may result in penalties and interest charges imposed by the City of Sterling, Colorado.

Form Details:

- The latest edition currently provided by the Colorado Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.