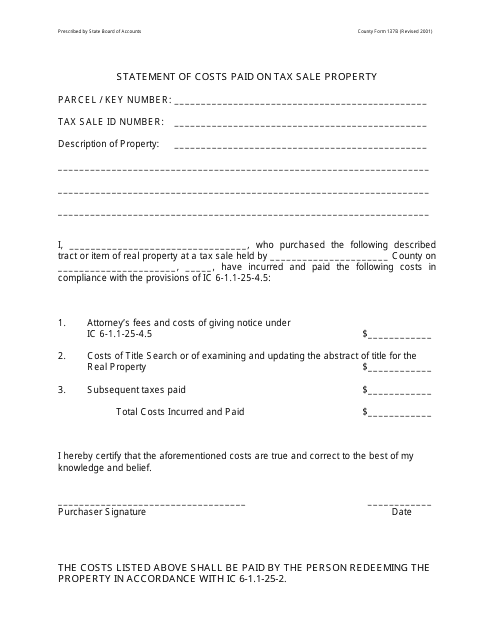

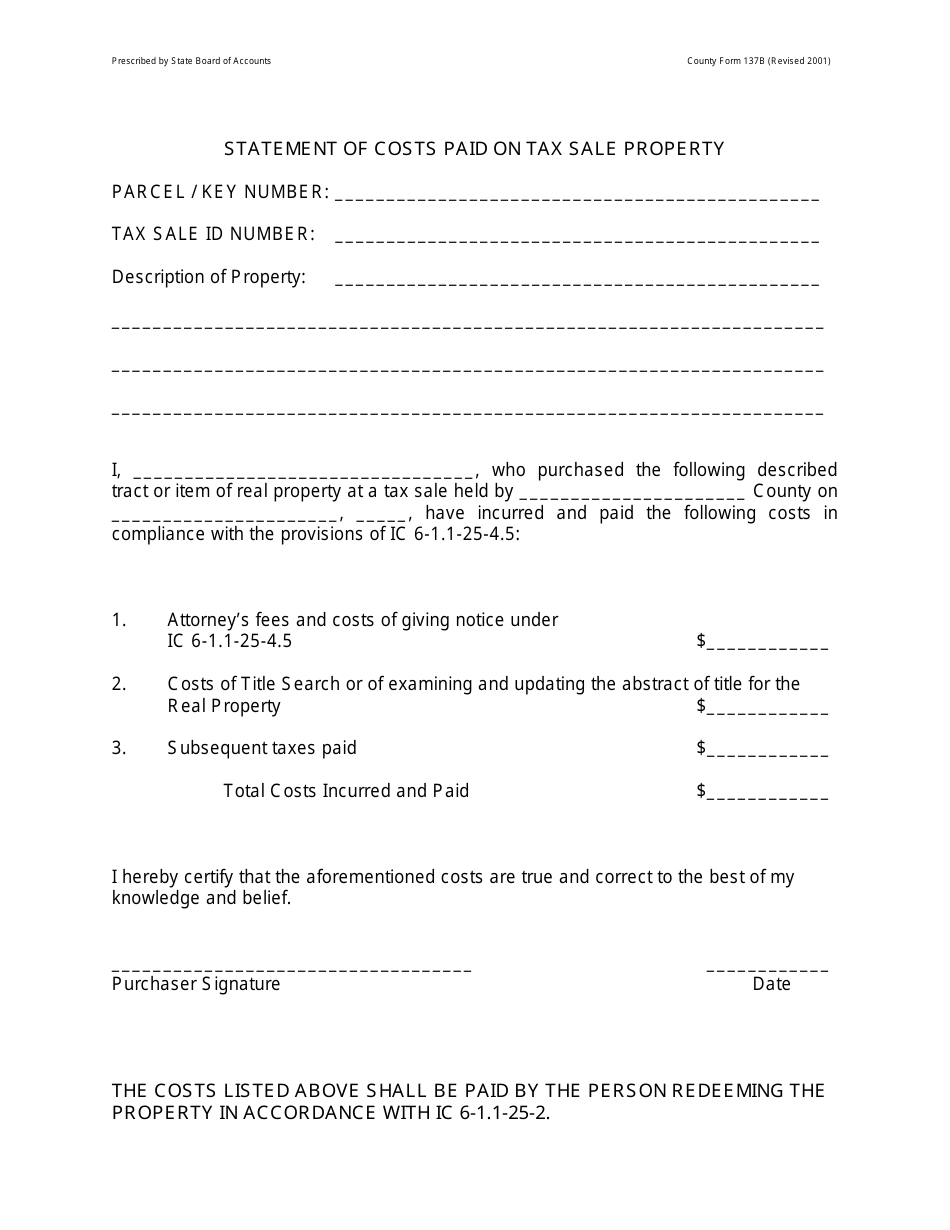

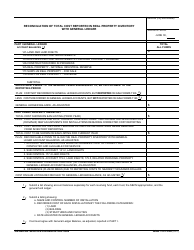

Form 137B Statement of Costs Paid on Tax Sale Property - Ripley County, Indiana

What Is Form 137B?

This is a legal form that was released by the Auditor's Office - Ripley County, Indiana - a government authority operating within Indiana. The form may be used strictly within Ripley County. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 137B?

A: Form 137B is a Statement of Costs Paid on Tax Sale Property.

Q: What is the purpose of Form 137B?

A: The purpose of Form 137B is to document the costs paid on a tax sale property.

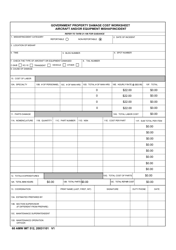

Q: What information is included in Form 137B?

A: Form 137B includes details about the costs paid on a tax sale property, such as the buyer's name, property address, amount paid, and the date of payment.

Q: Who is responsible for filling out Form 137B?

A: The person or entity who paid the costs on a tax sale property is responsible for filling out Form 137B.

Q: Is Form 137B specific only to Ripley County, Indiana?

A: Yes, Form 137B is specific to Ripley County, Indiana and may not be applicable in other locations.

Q: Are there any deadlines for submitting Form 137B?

A: It is recommended to check with the local authorities or the instructions on the form itself to determine any specific deadlines for submitting Form 137B.

Q: Do I need to include any supporting documents with Form 137B?

A: Depending on the requirements of Ripley County, Indiana, you may need to include supporting documents such as receipts or proof of payment with Form 137B.

Q: What should I do with the completed Form 137B?

A: Once you have completed Form 137B, you should submit it to the appropriate authority in Ripley County, Indiana as instructed.

Form Details:

- Released on January 1, 2001;

- The latest edition provided by the Auditor's Office - Ripley County, Indiana;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 137B by clicking the link below or browse more documents and templates provided by the Auditor's Office - Ripley County, Indiana.