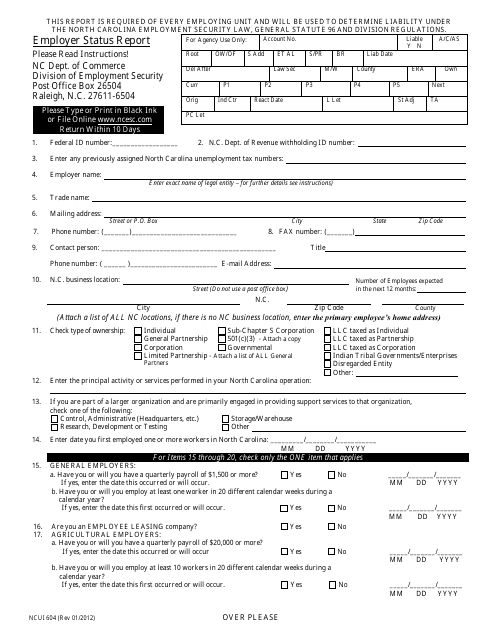

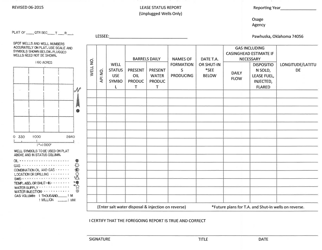

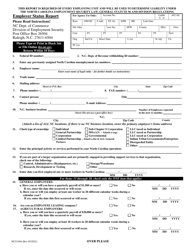

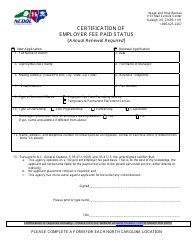

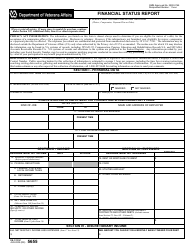

Form 604 Employer Status Report - North Carolina

What Is Form 604?

This is a legal form that was released by the North Carolina Department of Commerce - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 604 Employer Status Report?

A: Form 604 Employer Status Report is a document used in North Carolina to report employer status information.

Q: Who needs to file Form 604 in North Carolina?

A: Employers in North Carolina need to file Form 604.

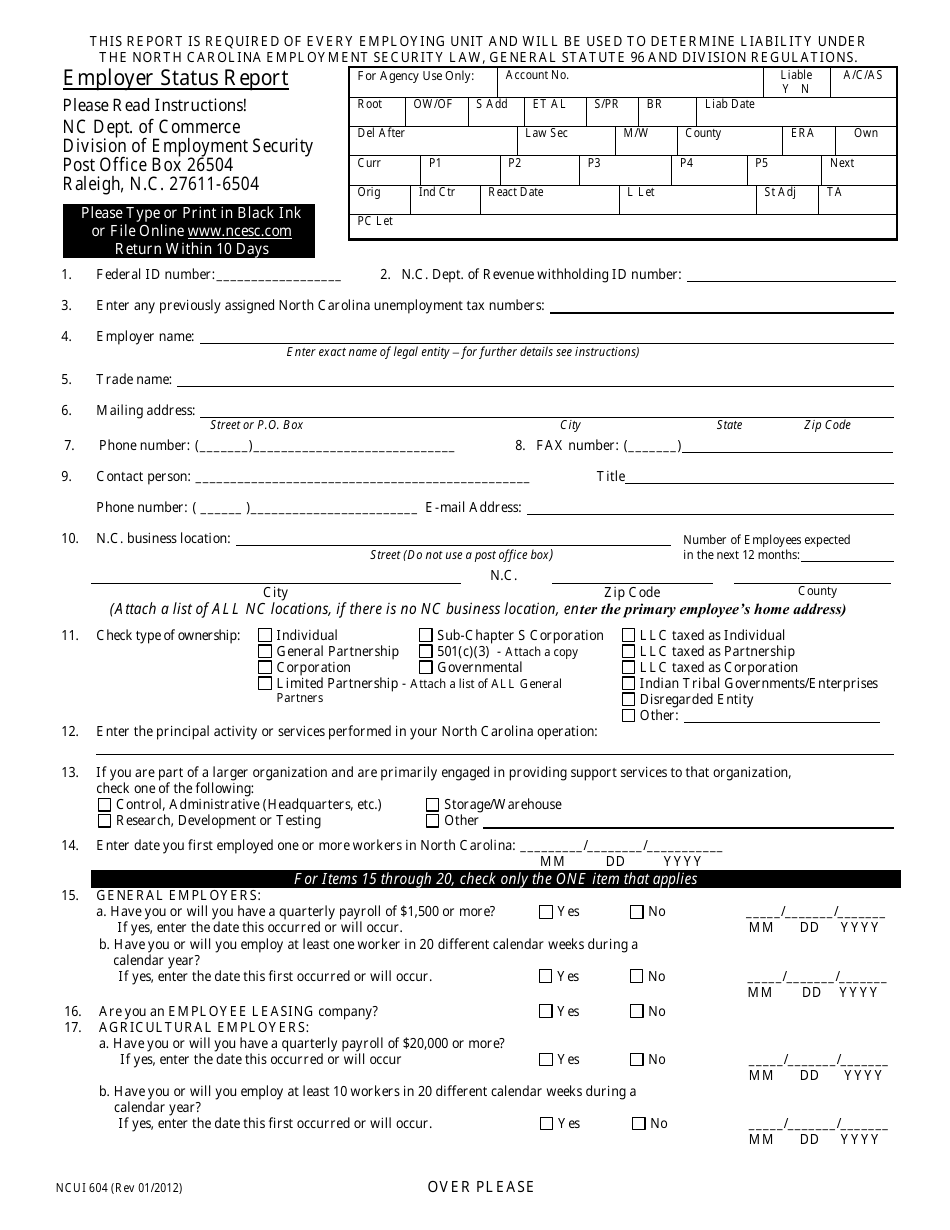

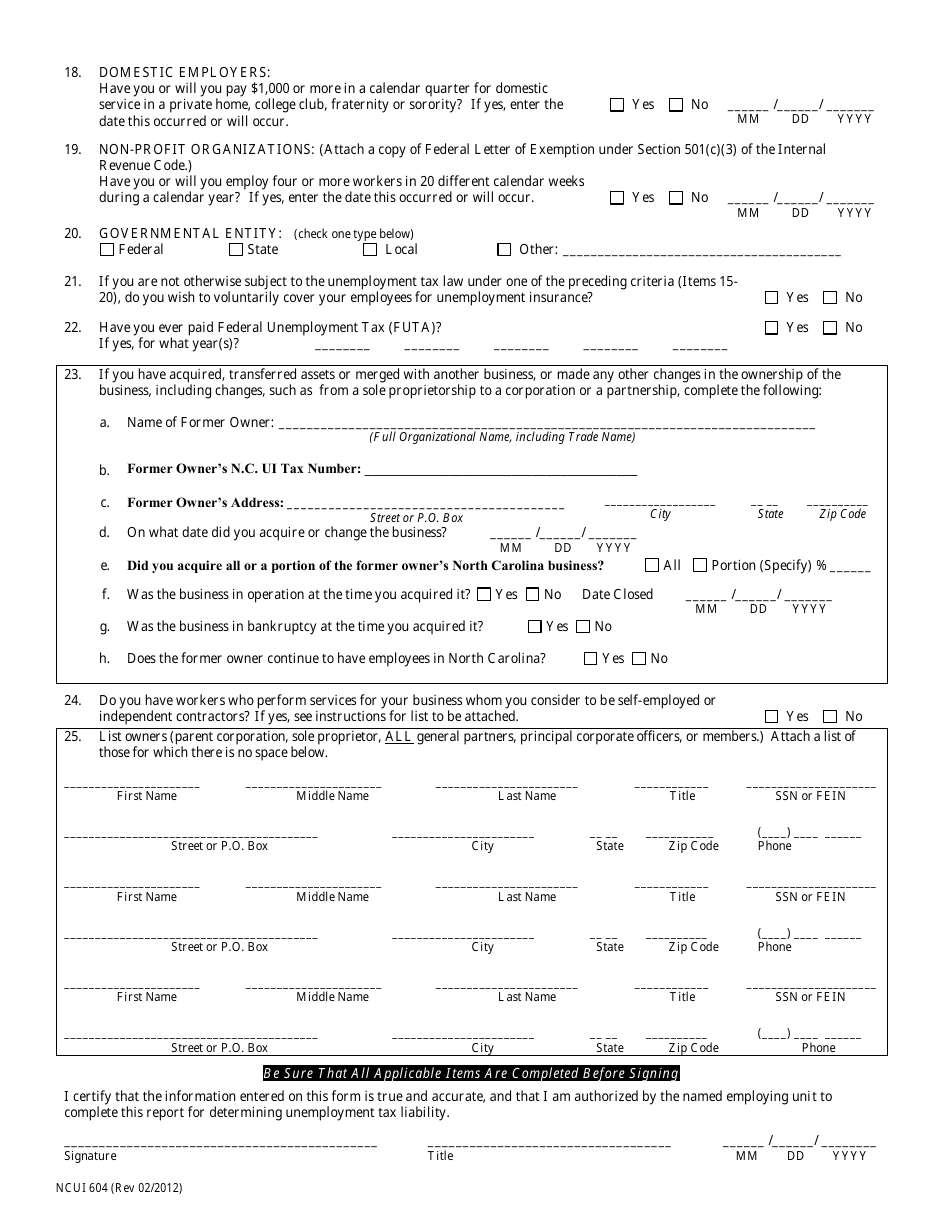

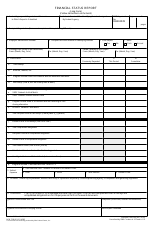

Q: What information is required on Form 604?

A: Form 604 requires employers to provide their business name, address, Federal Employer Identification Number (FEIN), North Carolina Secretary of State Identification Number (SOSID), and other relevant employer information.

Q: When is Form 604 due?

A: Form 604 is due within 15 days of becoming liable for unemployment insurance contributions or within 30 days of acquiring an existing business.

Q: What happens if I don't file Form 604?

A: Failure to file Form 604 may result in penalties or fines imposed by the North Carolina Department of Commerce.

Q: Is Form 604 only for new businesses?

A: No, Form 604 is not only for new businesses. Existing businesses that acquire another business may also need to file this form.

Q: Do I need to file Form 604 every year?

A: No, Form 604 does not need to be filed annually. It is only required when there is a change in employer status or when acquiring a new business.

Form Details:

- Released on January 1, 2012;

- The latest edition provided by the North Carolina Department of Commerce;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 604 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Commerce.