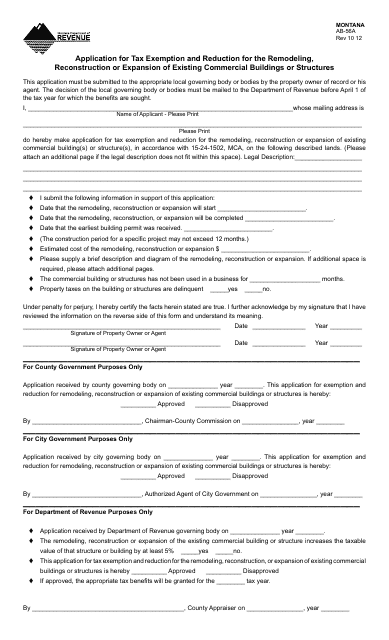

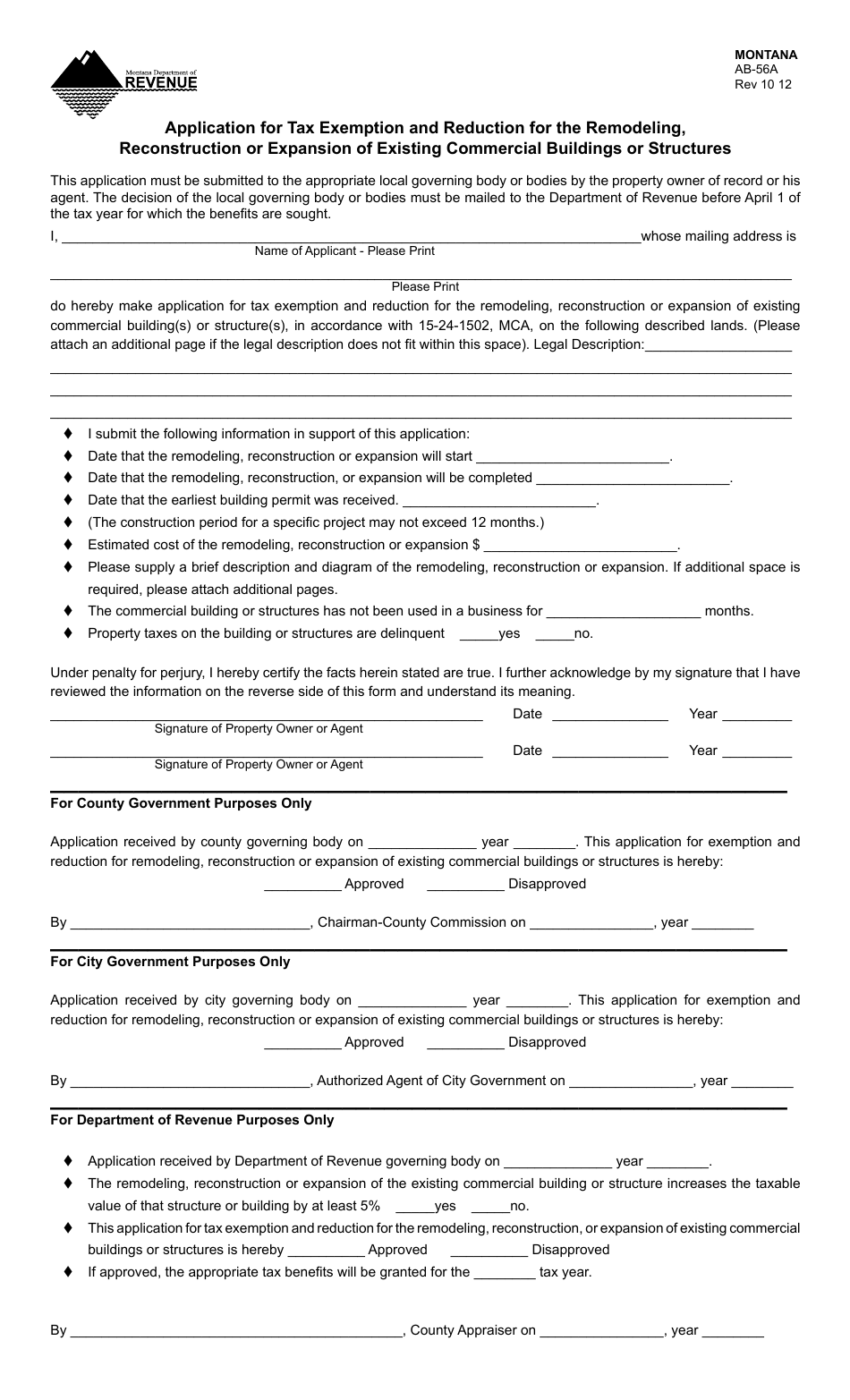

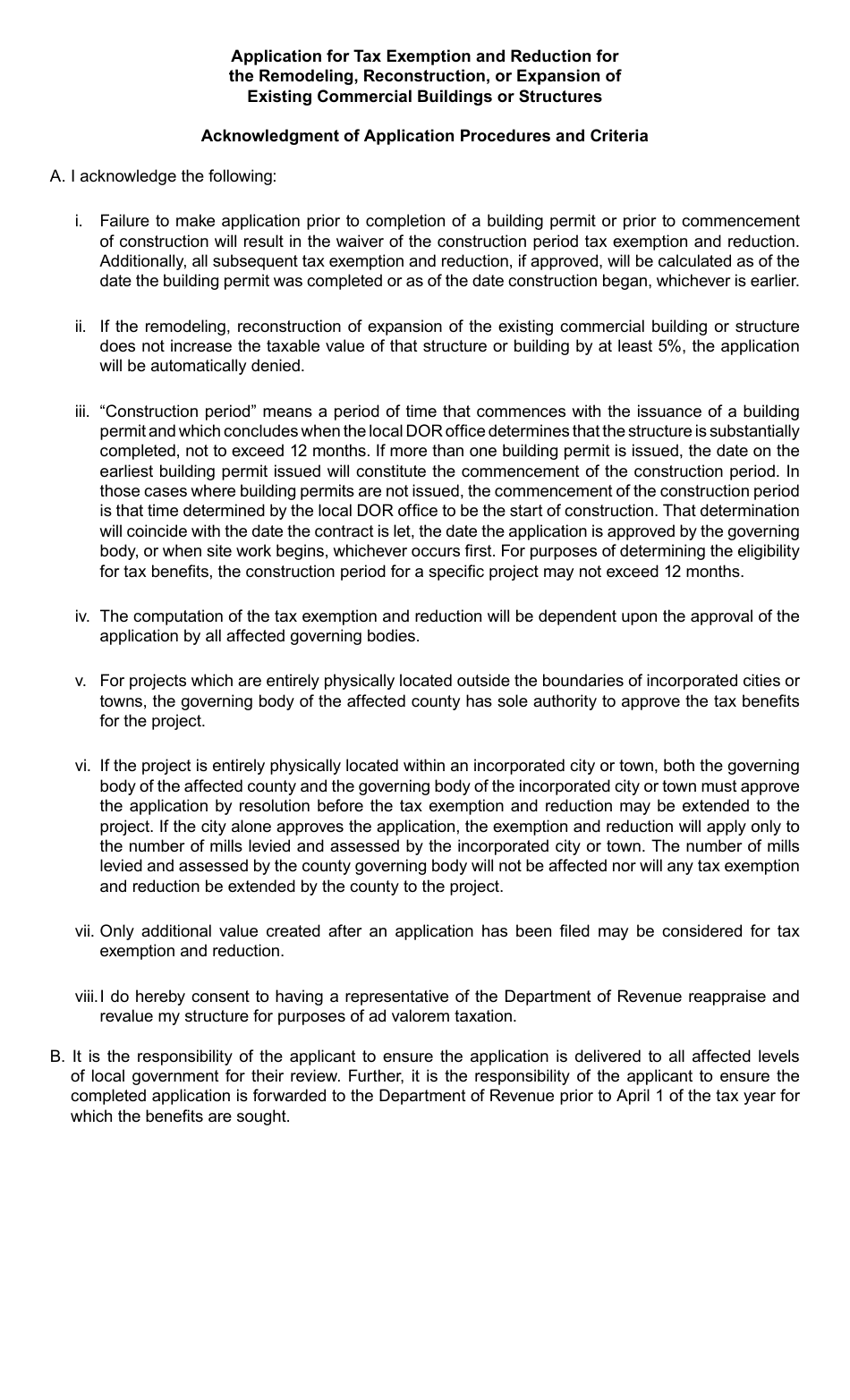

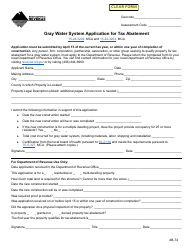

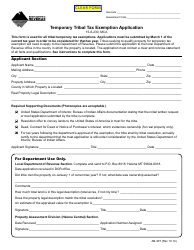

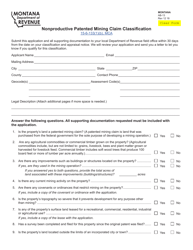

Form AB-56A Application for Tax Exemption and Reduction for the Remodeling, Reconstruction or Expansion of Existing Commercial Buildings or Structures - Montana

What Is Form AB-56A?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AB-56A?

A: Form AB-56A is an application for tax exemption and reduction for the remodeling, reconstruction, or expansion of existing commercial buildings or structures in Montana.

Q: What is the purpose of Form AB-56A?

A: The purpose of Form AB-56A is to apply for tax exemption and reduction for commercial building or structure renovations in Montana.

Q: Who can use Form AB-56A?

A: Anyone wishing to remodel, reconstruct or expand an existing commercial building or structure in Montana can use Form AB-56A.

Q: What is required to complete Form AB-56A?

A: To complete Form AB-56A, you will need to provide information about the property, the planned renovations, and any financial details or documentation.

Q: Is there a deadline for submitting Form AB-56A?

A: Yes, Form AB-56A must be submitted to the Montana Department of Revenue within 180 days of the completion of the renovations.

Q: What are the benefits of using Form AB-56A?

A: Using Form AB-56A can result in tax exemptions or reductions for the remodeling, reconstruction, or expansion of commercial buildings or structures in Montana.

Q: Are there any fees associated with filing Form AB-56A?

A: No, there are no fees associated with filing Form AB-56A.

Q: Can I apply for multiple tax exemptions using Form AB-56A?

A: Yes, you can apply for multiple tax exemptions for different projects using separate Form AB-56A applications.

Q: Who should I contact if I have questions about Form AB-56A?

A: If you have questions about Form AB-56A, you can contact the Montana Department of Revenue for assistance.

Form Details:

- Released on October 1, 2012;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form AB-56A by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.