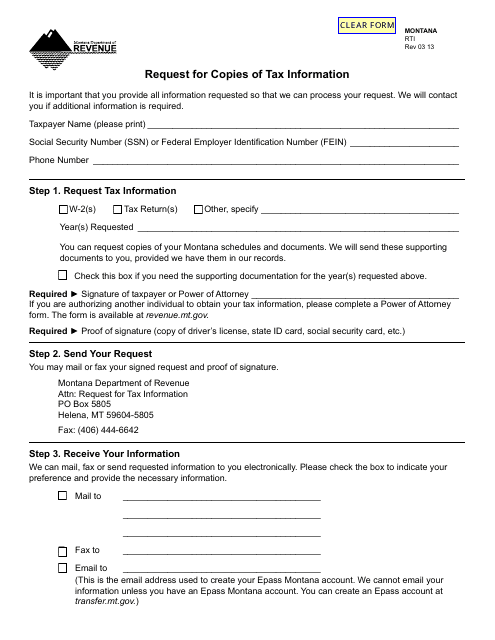

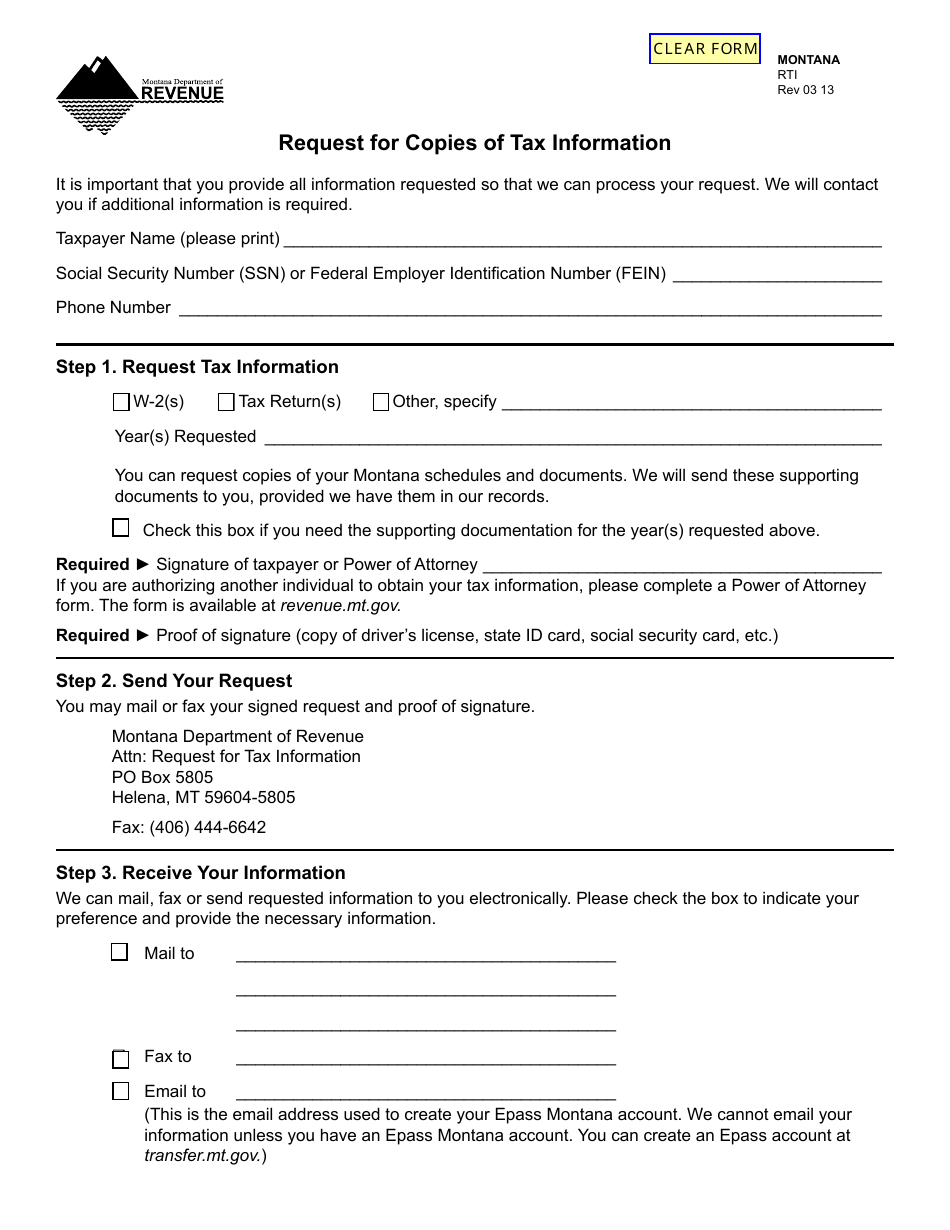

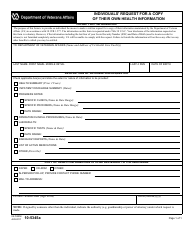

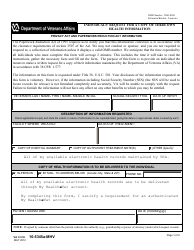

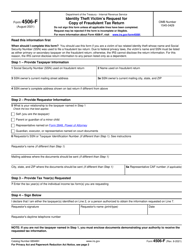

Form RTI Request for Copies of Tax Information - Montana

What Is Form RTI?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is an RTI request?

A: RTI stands for Right to Information. It is a legal process that allows individuals to request copies of specific information held by government entities.

Q: How can I make an RTI request for tax information in Montana?

A: To make an RTI request for tax information in Montana, you can submit a written request to the Montana Department of Revenue. Be sure to include your name, contact information, and specific details about the tax information you are requesting.

Q: What should I include in my RTI request for tax information?

A: In your RTI request for tax information, make sure to include your name, contact information, and a clear description of the specific tax information you are requesting, such as the tax year and any relevant tax forms or documents.

Q: Is there a fee for requesting tax information through RTI?

A: The Montana Department of Revenue may charge a fee for copying and providing the requested tax information. The fee will vary depending on the type and amount of information requested.

Q: How long does it take to receive the requested tax information through RTI?

A: The timeframe for receiving requested tax information through RTI can vary. The Montana Department of Revenue typically processes RTI requests as quickly as possible, but the exact processing time will depend on the nature and complexity of the request.

Form Details:

- Released on March 1, 2013;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RTI by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.