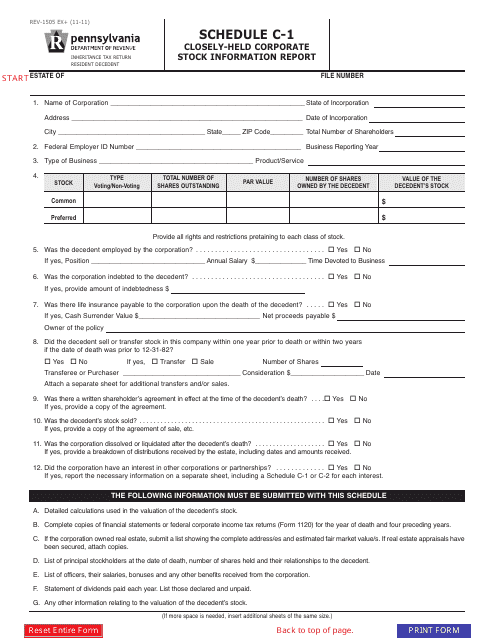

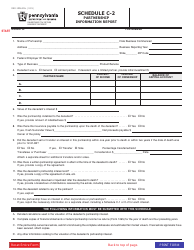

Form REV-1505 Schedule C-1 Closely-Held Corporate Stock Information Report - Pennsylvania

What Is Form REV-1505 Schedule C-1?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the REV-1505 Schedule C-1?

A: The REV-1505 Schedule C-1 is the Closely-Held Corporate Stock Information Report for Pennsylvania.

Q: Who needs to file the REV-1505 Schedule C-1?

A: Any closely-held corporation in Pennsylvania needs to file the REV-1505 Schedule C-1.

Q: What information is required on the REV-1505 Schedule C-1?

A: The REV-1505 Schedule C-1 requires information about the closely-held corporation's stockholders and their stock ownership.

Q: When is the deadline for filing the REV-1505 Schedule C-1?

A: The deadline for filing the REV-1505 Schedule C-1 is generally April 15th of each year.

Form Details:

- Released on November 1, 2011;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1505 Schedule C-1 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.